Coinspeaker

MKR Worth Evaluation: MakerDAO Dangers $1,500 amid Community Milestones

As Bitcoin

BTC

$93 427

24h volatility:

0.4%

Market cap:

$1.86 T

Vol. 24h:

$48.67 B

has damaged beneath the $94,000 mark, Ethereum

ETH

$3 377

24h volatility:

0.7%

Market cap:

$407.52 B

Vol. 24h:

$22.98 B

has lingered beneath the $3,400 barrier. Amid such bearish circumstances, MakerDAO holds tight to the $1,500 psychological mark.

Nevertheless, with the 18.94% drop over the previous 30 days and the rising bearish affect within the crypto market, the rising volatility within the MKR worth

MKR

$1 507

24h volatility:

0.1%

Market cap:

$1.34 B

Vol. 24h:

$118.57 M

pattern warns of a bearish continuation.

Regardless of the market circumstances succumbing to bearish powers, the MakerDAO community creates new milestones in December.

MakerDAO Hits New Data This December

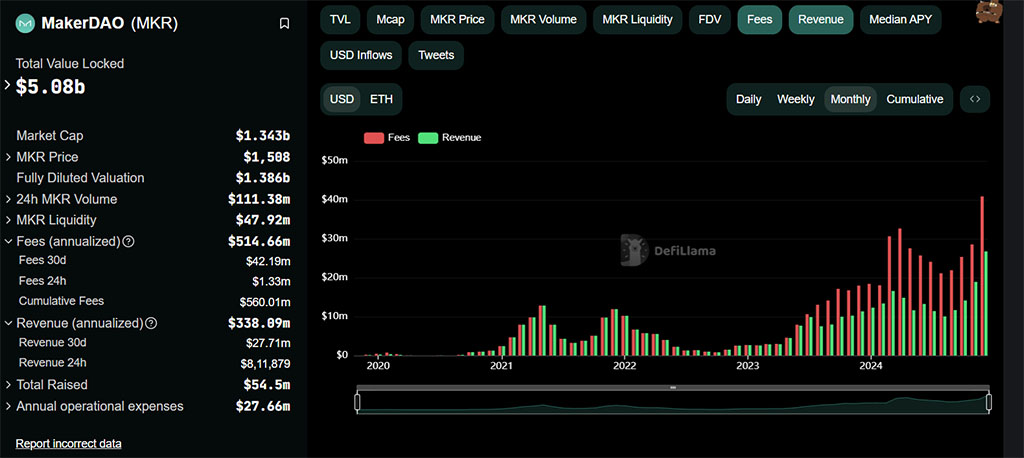

Amid the short-term enhance in worth volatility, the MakerDAO community registered a brand new file in December. Based mostly on the information from DeFi Llama, the month-to-month charges on the community have crossed the $40 million threshold. At the moment, it’s at $42.19M.

Moreover, the month-to-month revenues have crossed the $27 million milestone to achieve $27.71M. This marks a brand new file for the community.

With revenues of $811,879 over the previous 24 hours, the all-time charges stand at $560.01 million. Amid the rising probabilities of a bullish yr in 2025, the MakerDAO community development suggests a bull run forward.

MKR Token Worth Evaluation

Within the each day chart, MakerDAO’s MKR token worth alternate showcases a falling wedge sample. Since December, the MKR worth has dropped from $2425 to $1521.

The continued pullback part places the $1500 psychological market in danger. The downfall has damaged beneath the 200-day, 50-day, and 100-day EMA traces.

Moreover, it will increase the probabilities of a bearish crossover between the 50-day and 100-day EMA traces. In the course of the pullback, the RSI line dropped under the midway degree and consolidated barely at 40%.

Therefore, the technical indicators are giving a bearish outlook of the short-term MKR worth pattern.

Based mostly on the Fibonacci degree, the downfall has damaged beneath the 38.20% Fibonacci degree at $1,680. If the bearish pattern continues, the downfall is more likely to proceed beneath the 23.60% Fibonacci degree.

Within the case of the falling wedge breakdown rally, the speedy essential help at $1,054 is a possible downtrend. Nevertheless, within the case of a bullish reversal, the breakout of the overhead resistance trendline might propel the MKR worth again to the $2,000 vital mark.

On-Chain Reveals Demand and Provide Quantity Disparity

Because the pullback part continues, the worldwide in-and-out-of-the-money indicator highlights an important resistance forward. As MakerDAO struggles to begin an uphill journey, the speedy provide zone extends from $1,602 to $1,772.

The value band holds 138.09K MKR token provide inside 3.61K addresses. Nevertheless, the speedy help is relatively weaker with simply 1.16K addresses holding 2.75K MKR tokens.

The help zone extends from $1,413 to $1,434. The numerous distinction between demand and provide is highlighting a possible downtrend.

At the moment, the cash zone for the MKR token extends from $1,435 to $1,602 with 120.18K MKR tokens held inside 6.7K addresses. Whereas these addresses maintain the destiny of the upcoming worth pattern, the speedy ranges trace at a bearish continuation.

In such a case, the MKR token is more likely to check the $1,400 psychological mark.

MKR Worth Evaluation: MakerDAO Dangers $1,500 amid Community Milestones