- Historic developments recommend that Bitcoin’s worth may rise within the coming months

- Metrics and technical indicators turned purple after main worth correction

The final 12 hours noticed Bitcoin [BTC] report main worth corrections on the worth charts. Even so, it’s not too far off its current all-time excessive. Nevertheless, BTC’s worth wasn’t the one metric to hit an ATH not too long ago. In reality, its demand additionally elevated sharply.

The newfound curiosity in Bitcoin amongst buyers might play a pivotal function in propelling additional progress. Let’s have a better take a look at what’s happening.

New buyers are demanding Bitcoin

Bitcoin is anticipating its subsequent halving in only a week. Within the meantime, nonetheless, its demand has skyrocketed. Elja, a preferred crypto-investor and influencer, not too long ago shared a tweet highlighting the truth that demand for BTC from accumulation addresses has been exceeding provide from miners. That is the primary time this has occurred in BTC’s historical past.

In reality, CryptoQuant not too long ago posted an evaluation mentioning how new buyers are coming into the market. CryptoDan, an analyst and creator at CryptoQuant, talked about in an evaluation that Bitcoins held for greater than 6 months imply that the variety of Bitcoins traded for lower than 6 months has elevated, indicating an inflow of latest buyers. Comparable incidents have occurred earlier than, every of which was adopted by bull rallies.

“In 2017, after a large influx of new investors began, Bitcoin reached its peak 9 months later, and in 2021, Bitcoin reached its peak 7 months later.”

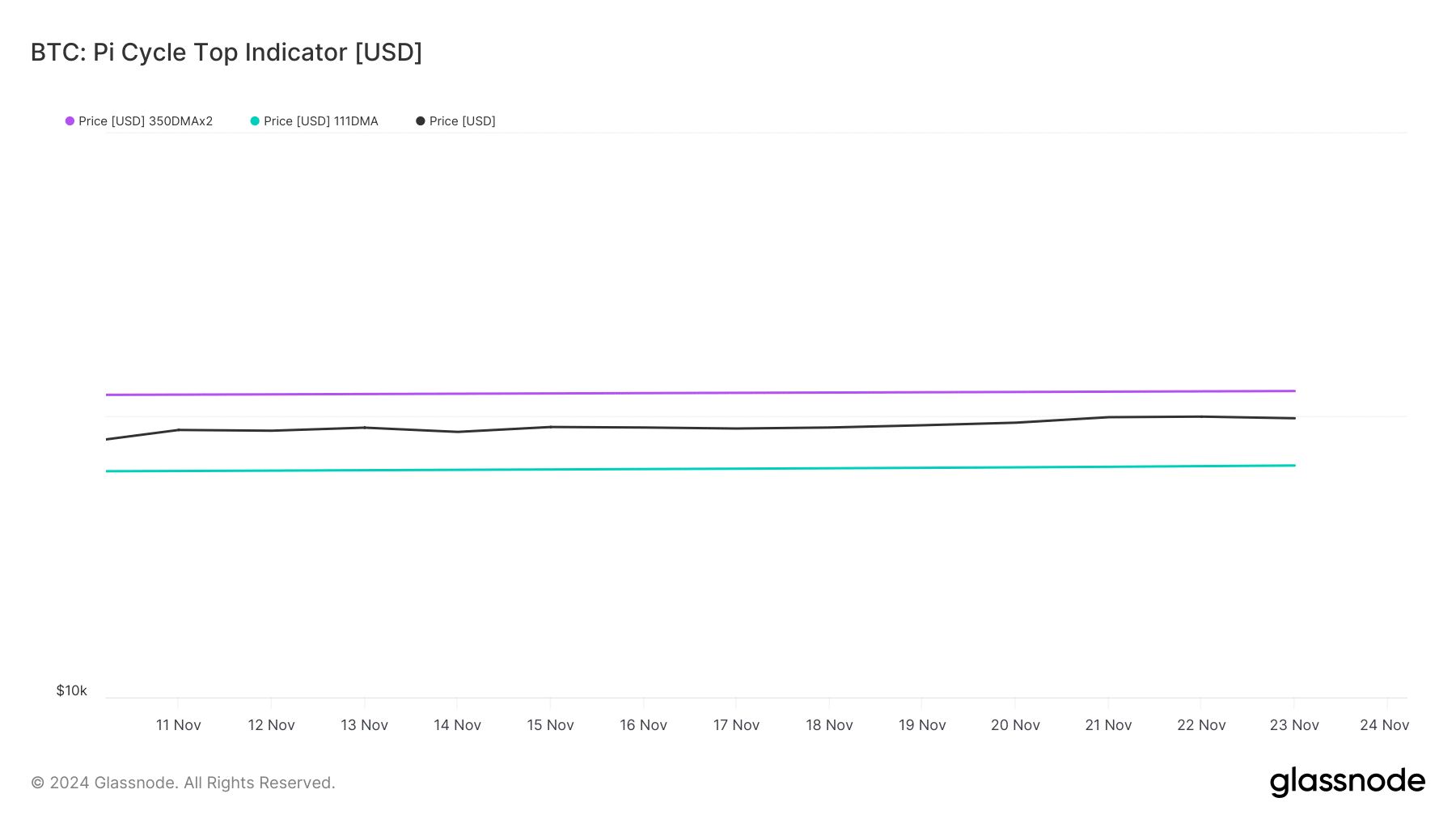

On this event, about 3 months have handed since new buyers started to circulation in. This can be a signal that there are nonetheless just a few extra months left earlier than BTC hits a brand new peak. Ergo, individuals who have been making $100k and $150k worth predictions might not be flawed actually.

This peak, nonetheless, could also be somewhat late, particularly in mild of the cryptocurrency’s most up-to-date worth correction. In line with CoinMarketCap, BTC was down by over 5% in 24 hours, at press time. Owing to Bitcoin’s fall, different cryptos had adopted go well with too.

Is Bitcoin preparing for a brand new rally?

Because the possibilities of new buyers fueling a bull rally appeared excessive, AMBCrypto then checked BTC’s metrics to search out whether or not they supported this risk. We discovered that not solely new buyers, but additionally long-term holders are actually in a temper to carry their belongings. The identical was evidenced by the inexperienced binary CDD.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

On the worth charts, nonetheless, BTC’s indicators had been seeing purple, on the time of writing. As an example, each the CMF and MFI dipped dramatically, with the previous near 0 on the charts now.