- Bitcoin holders had been nonetheless worthwhile, which threatened extra promoting strain ought to the market uncertainty proceed.

- The MVRV ratio’s predicted dip may take Bitcoin costs under the important thing $59k help degree

Bitcoin [BTC] noticed its demand decelerate in April. Demand development and ETF inflows had been down, though on a month-to-date foundation, the BTC ETF inflows stood at a formidable $555 million.

The shortage of motion in BTC introduced doubt to buyers’ minds.

Final week’s dip noticed $84 million circulation out of U.S. spot Bitcoin ETFs. This noticed a 22% drop in belongings beneath administration (AUM) of Bitcoin-linked funds.

Two on-chain metrics indicated that we could possibly be in for a significant correction.

The speculation of imply reversion and Bitcoin’s have to reset

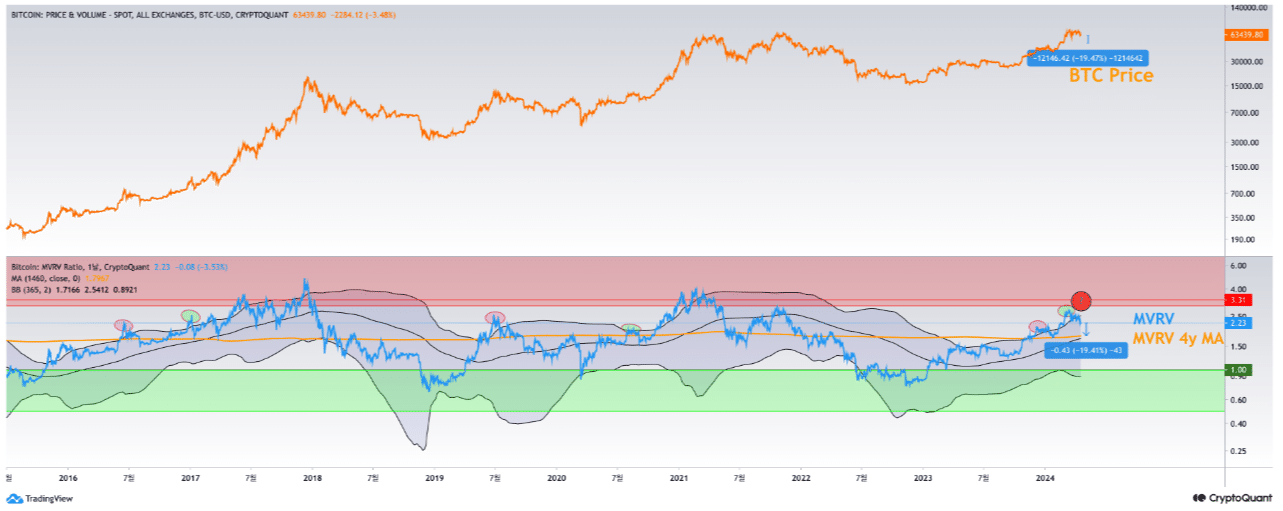

A CryptoQuant Insights submit used the MVRV and Bollinger bands to theorize {that a} 20% correction was inbound for Bitcoin. The consumer mixed the MVRV ratio on CryptoQuant with Bollinger Bands.

The bands are a imply reversion indicator. When the band’s extremes are breached, normally (however not each time) there’s a motion towards the imply.

Supply: CryptoQuant Insights

The analyst identified on the chart that the higher band was breached not too long ago, however that the MVRV ratio was again with the bands. This steered that it could transfer decrease to the 365-period shifting common.

Such a reversion would imply a 20% drop in costs for Bitcoin. The MVRV ratio, which is at 2.23, can be nearer to 1.7 and such a retracement can be fully regular.

It could possibly be the form of reset that BTC has seen a number of occasions throughout bull markets.

The SOPR underlined long-term holders had been shifting

Supply: CryptoQuant

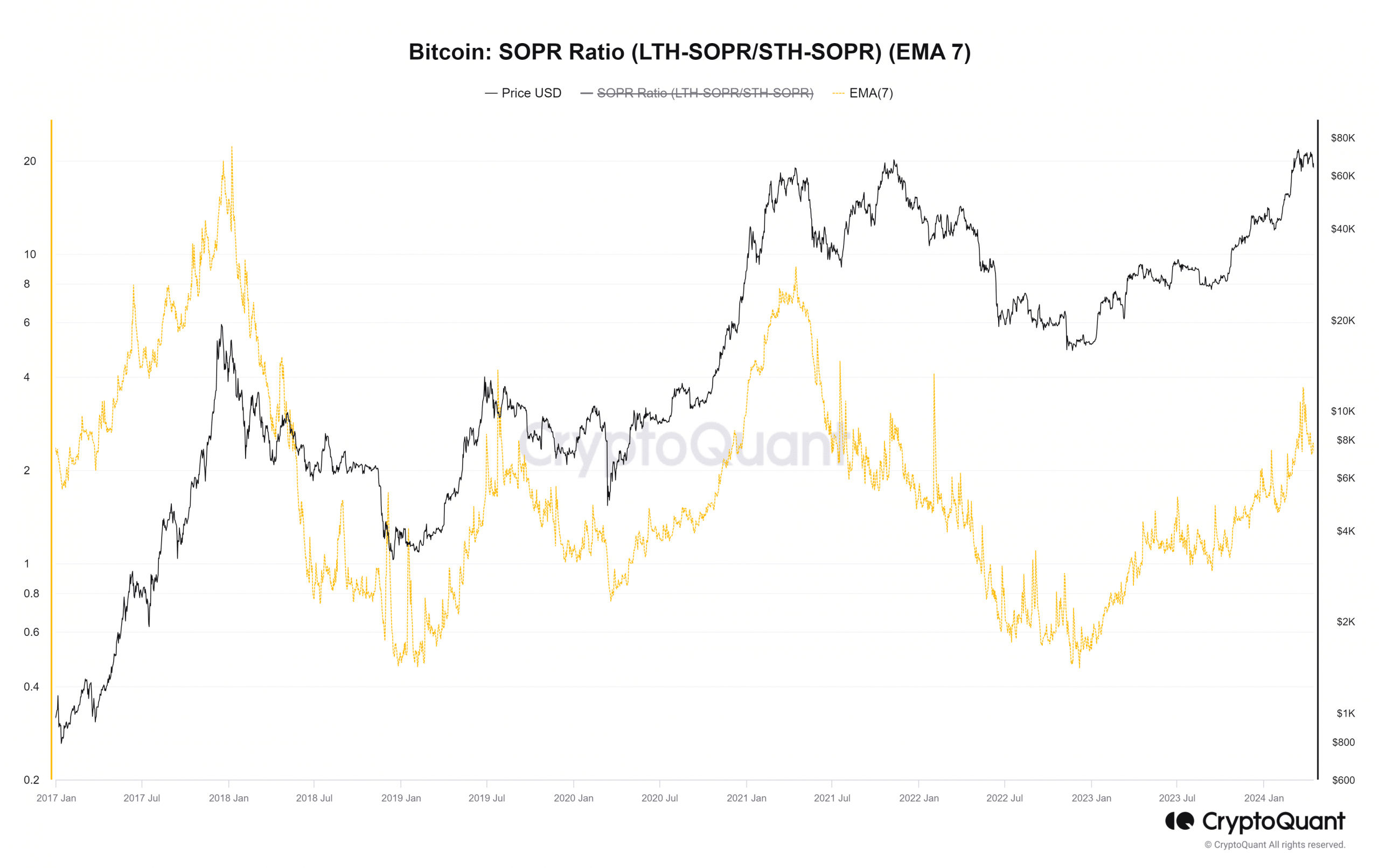

The spent output revenue ratio (SOPR) signifies how worthwhile the market individuals are. The 7-day EMA peaked at 3.7 on the twenty third of March and has dipped sharply since then.

This confirmed that BTC holders had been at a tidy revenue, even after the latest promoting strain.

By way of worth, the present state of affairs was much like the SOPR peak again in 2019 July, when the market rejected from a studying of 4.2. However now, the circumstances are totally different.

Again then, a bear market rally had ended, whereas now we’re witnessing a bull market starting.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Alternatively, the SOPR drop may additionally counsel a short lived prime for Bitcoin. The market would wish time to consolidate and take up the promoting strain from fearful individuals and profit-takers.

This situation, if it performs out, would go hand-in-hand with what the MVRV Bollinger bands sign.