- Historical past known as consideration to a associated decline as volatility elevated

- A better variety of BTC is being spent, indicating a possible slip under $60,000

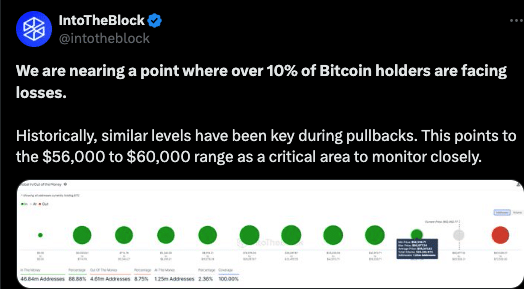

Bitcoin [BTC] finds itself at a vital juncture now with just a few hours left for the much-anticipated 4th halving. Nevertheless, based on information from IntoTheBlock, virtually 10% of BTC holders are at a loss proper now.

This improve in quantity could possibly be linked to Bitcoin’s current decline which was the value drop from over $70,000 to $62,324, at press time. That being stated, this didn’t appear to be the one menace to BTC.

Can bulls defend BTC?

As per the stated information, Bitcoin’s worth could possibly be set to plunge additional and will settle between $56,000 and $60,000. This might occur if profitability declines, and the variety of holders at a loss exceeds 10%.

Right here, it’s price noting that AMBCrypto isn’t presenting this prediction with out concrete reference to historical past. As an example, in January 2021, Bitcoin’s worth fell from $40,000 to $31,000 after holders not within the cash went larger than the aforementioned ratio.

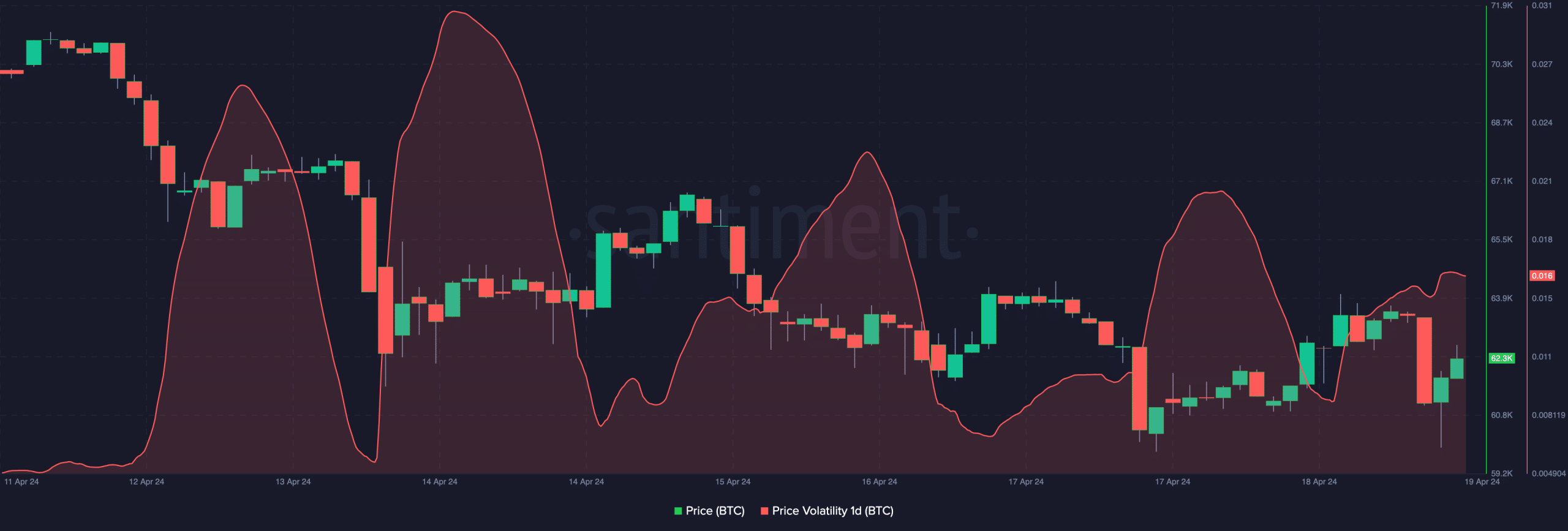

To determine this chance, we checked the coin’s volatility utilizing the on-chain analytics platform Santiment. At press time, the one-day volatility had risen to 0.016.

The upper the volatility, the upper the doable returns. Additionally, the hike within the metric has the potential to set off a big downward transfer on the charts.

At press time, Bitcoin’s volatility was not as excessive because it was on 14 and 16 April although. Ergo, if the metric hits any of these factors, then the coin would possibly report huge worth swings on the charts.

If promoting stress will increase, then a decline to $56,000 can be doable. Nevertheless, a surge in shopping for stress might change the forecast, and place BTC on a trajectory north.

Hassle forward? Merchants take cowl

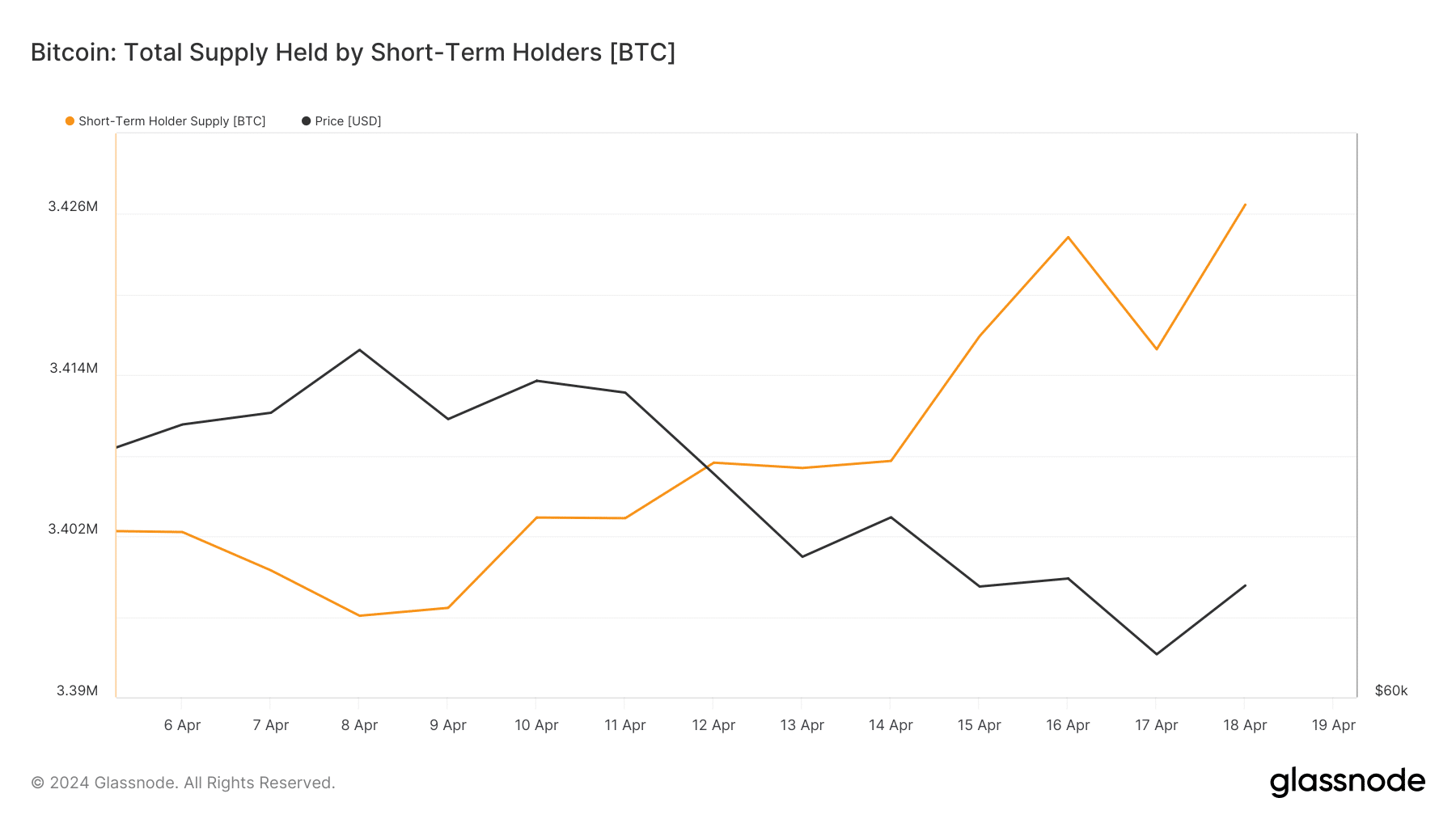

Within the meantime, we discovered that Quick Time period Holder (STH) provide has been rising. In response to Glassnode, Bitcoin’s STH provide has jumped from 3.40 million to three.42 million since 14 April.

The metric is the entire quantity of circulation provide held by short-term buyers. If the metric tightens, it implies a lower within the provide out there to be spent or actively traded. Usually, this means a bullish situation.

Nevertheless, this was not the case with BTC because the potential implication might spell hazard for the crypto’s worth. Ought to the STH provide stall, the value of the coin would possibly maintain above $62,000.

On the flip facet, a rise within the provide might set off a downturn, which might drive the worth to as little as $56,000.

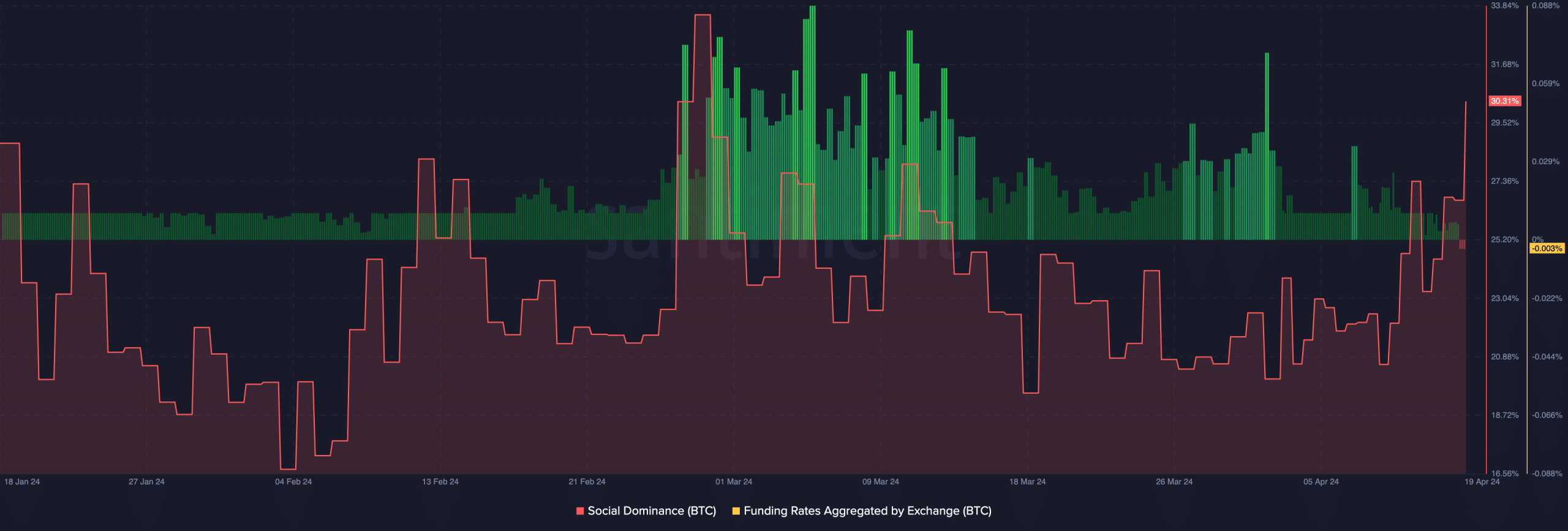

Regardless of the bearish bias, nonetheless, social dominance had elevated to 30.31%. The surge could possibly be linked to the nearing halving occasion which many imagine will change the sport for BTC this cycle. Quite the opposite, the aggregated Funding Charge went decrease, indicating that merchants are slowing down their bullish bets.

Is your portfolio inexperienced? Verify the Bitcoin Revenue Calculator

With the value shifting decrease and perp patrons lowering aggression, Bitcoin won’t have the energy it must invalidate the doable decline. If this stays the case when the halving takes place, then a fall on the charts will be anticipated.