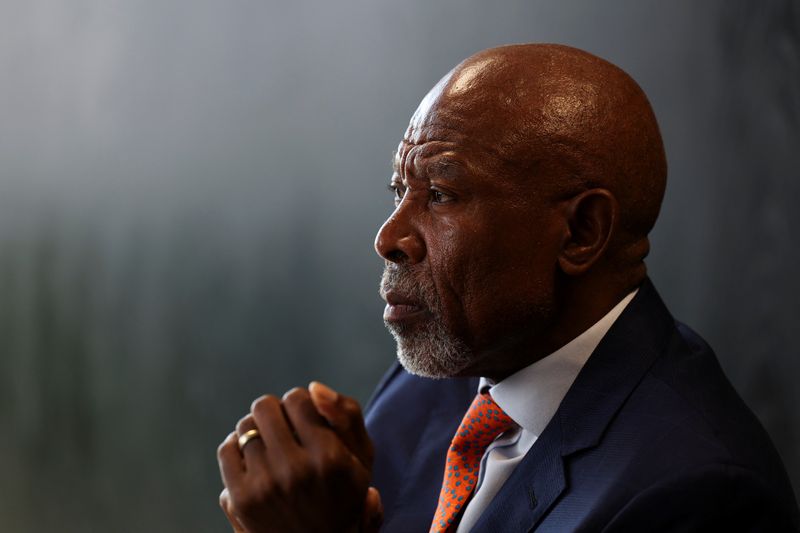

By Karin Strohecker

WASHINGTON (Reuters) – South Africa faces upside dangers to its inflation outlook, Central Financial institution Governor Lesetja Kganyago stated, however the newest information has not proven proof of worth pressures from meals regardless of antagonistic El Nino climate wreaking havoc throughout Africa.

Knowledge out on Wednesday had proven headline inflation fell to five.3% year-on-year, down from 5.6% in February and coming in a contact beneath analyst expectations.

In its March determination, the South African Reserve Financial institution (SARB) stated headline inflation was anticipated to achieve 4.5% – the midpoint of its goal vary – solely on the finish of 2025, later than beforehand forecast.

“There are upside risks to the inflation outlook,” Kganyago informed Reuters on the sidelines of the Worldwide Financial Fund and World Financial institution spring conferences in Washington.

These dangers stemmed from larger oil costs on the again of heightened tensions within the Center East, but in addition the prospect of tight world monetary situations amid the prospect of rates of interest on the U.S. Federal Reserve staying larger for longer.

This might seemingly suck capital out of rising markets and into superior economies, which might result in a realignment of alternate charges, he stated.

“And we are in that category,” stated Kganyago.

has weakened greater than 4% towards the greenback because the begin of the 12 months.

Value pressures from meals stuffs has been in focus throughout the continent, with droughts and antagonistic climate in a lot of the area wreaking havoc. Nonetheless, Kganyago stated the newest inflation information had not proven indicators of these pressures in South Africa.

“There are El Nino conditions… but the El Nino effect has not been felt yet.”

Africa’s most industrialised nation is grappling with an ailing financial system and excessive debt forward of a common election on Might 29 that would see the governing African Nationwide Congress occasion lose its parliamentary majority for the primary time because the finish of apartheid 30 years in the past.

Requested in regards to the election uncertainty, Kganyago stated this was a worldwide phenomenon with a file variety of nations across the globe holding elections.

“That is what you face – that uncertainty manifests itself in the foreign exchange market, it manifests itself in the bond market, in the equities market.”