- Bitcoin posted sturdy charges post-halving.

- BTC remained in a bear development regardless of an over 1.7% improve.

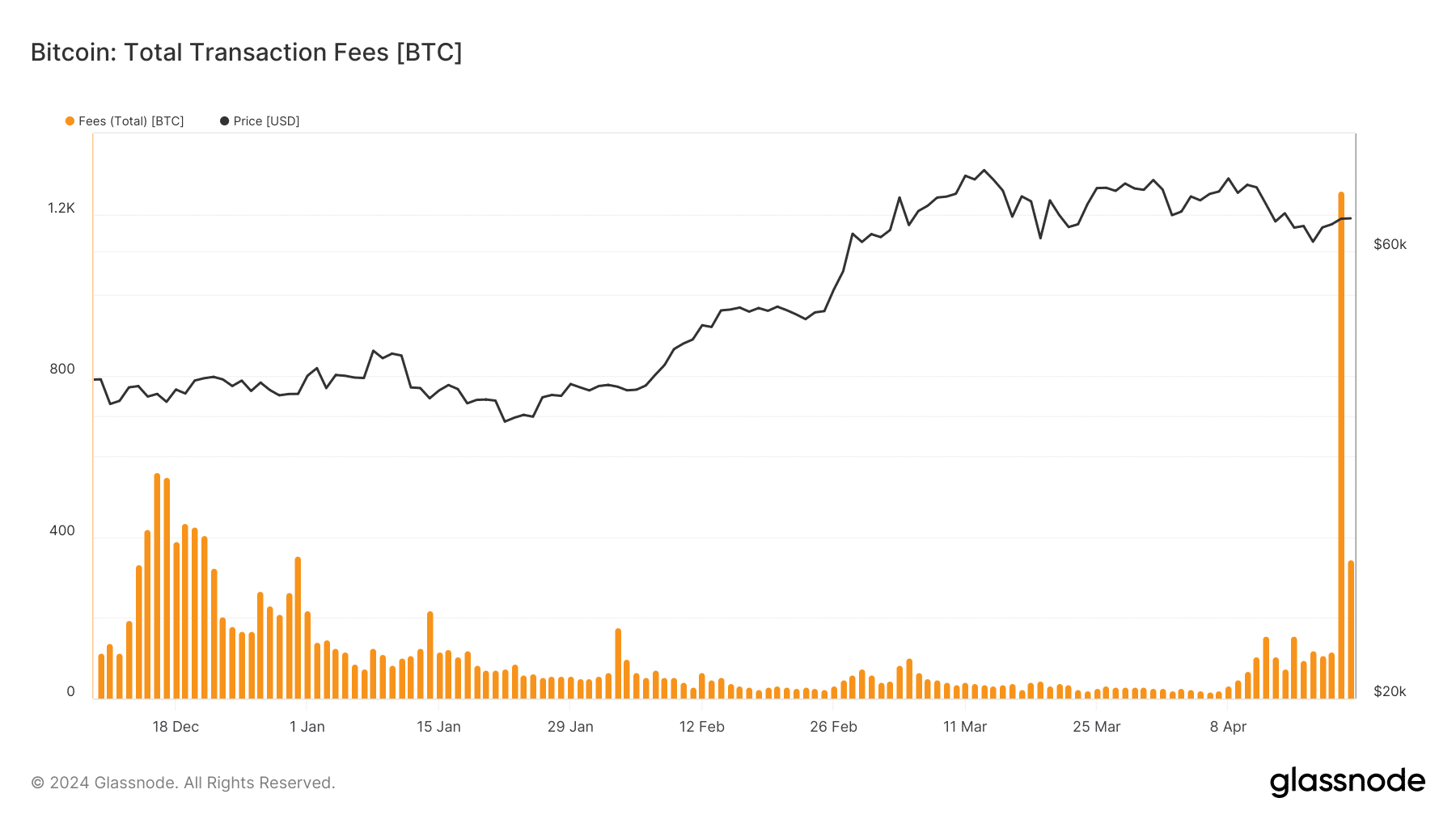

The Bitcoin [BTC] halving, anticipated to decrease miner charges, has occurred. Opposite to expectations, charges hit a file excessive post-halving. Nevertheless, indications recommend it could be non permanent.

Bitcoin data highest common transaction price

The Bitcoin halving occurred within the early hours of Saturday, the twentieth of April. Nevertheless, by the top of that day, community charges had soared to a file excessive, opposite to expectations from the halving.

Evaluation from Glassnode revealed that on the twentieth of April, charges spiked to over 1,257 BTC, equal to over $81 million on the time.

This marked the very best every day price recorded in years, a major improve for the platform and its miners.

Additional examination of the typical charges paid on the community indicated a rise to roughly $128 per transaction on the twentieth of April.

Additionally, trying on the price chart on Crypto Charges, Bitcoin exhibited the very best charges up to now seven days. The typical price was over $20.2 million, in comparison with Ethereum’s [ETH] closest common of virtually $5 million.

Nevertheless, as of the time of writing, every day charges had declined. In keeping with Glassnode, charges dropped to 344 BTC, equal to round $22.3 million.

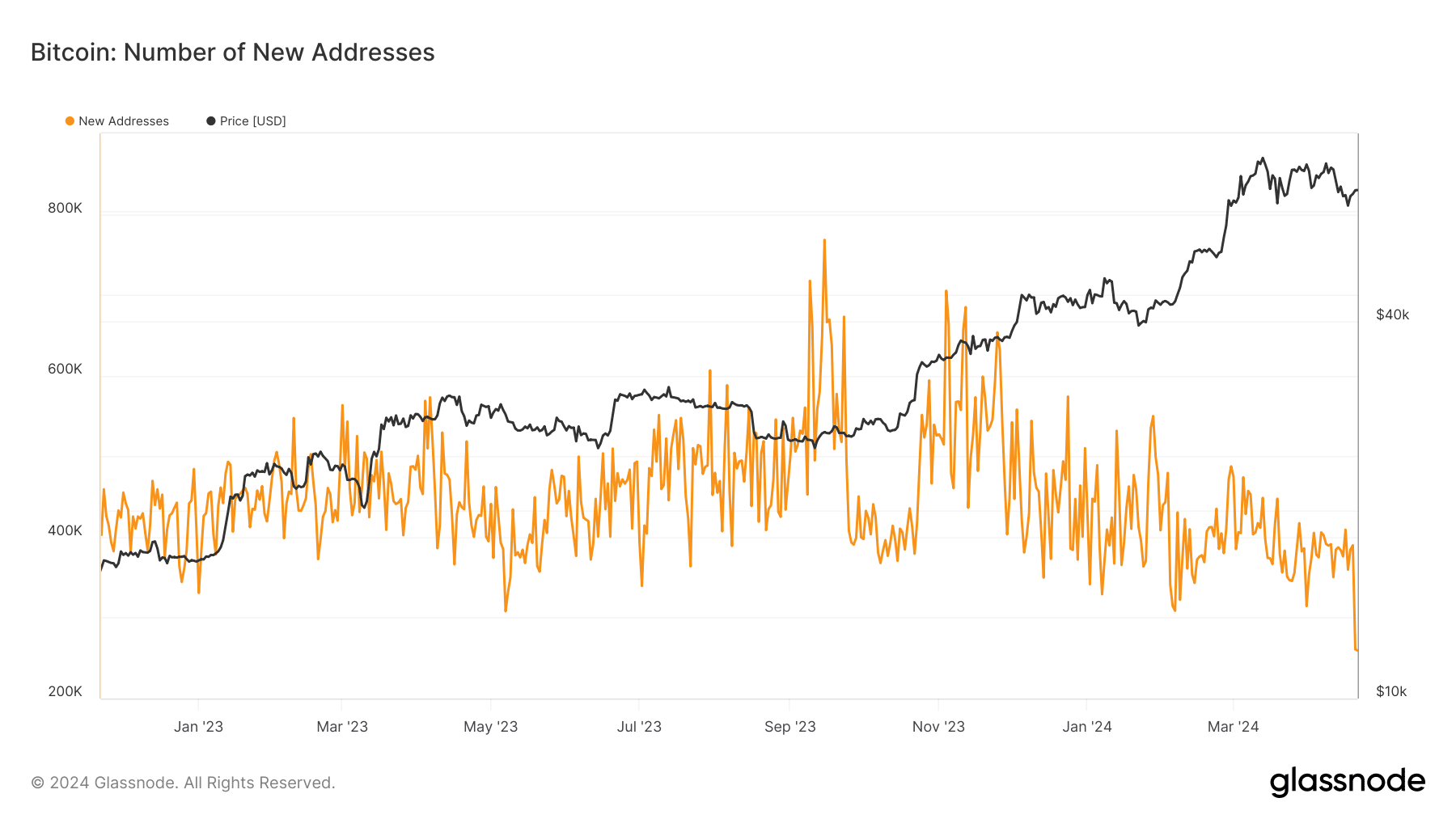

This substantial fluctuation in charges coincided with a lower within the variety of every day new customers.

Bitcoin addresses fall to lowest in over a 12 months

Whereas charges had been reaching file highs, the variety of every day new Bitcoin addresses was transferring in the wrong way.

AMBCrypto’s evaluation of Glassnode revealed a notable lower in handle creation. As of press time, the quantity stood at 259,431, a drop from the 300-400,000 vary seen days earlier.

This development recommended {that a} important inflow of latest customers didn’t drive the price surge. As an alternative, the Runestone improvement doubtless performed a task, with the next price drop supporting this speculation.

A rise in charges and new customers signifies heightened exercise, doubtlessly impacting BTC worth positively.

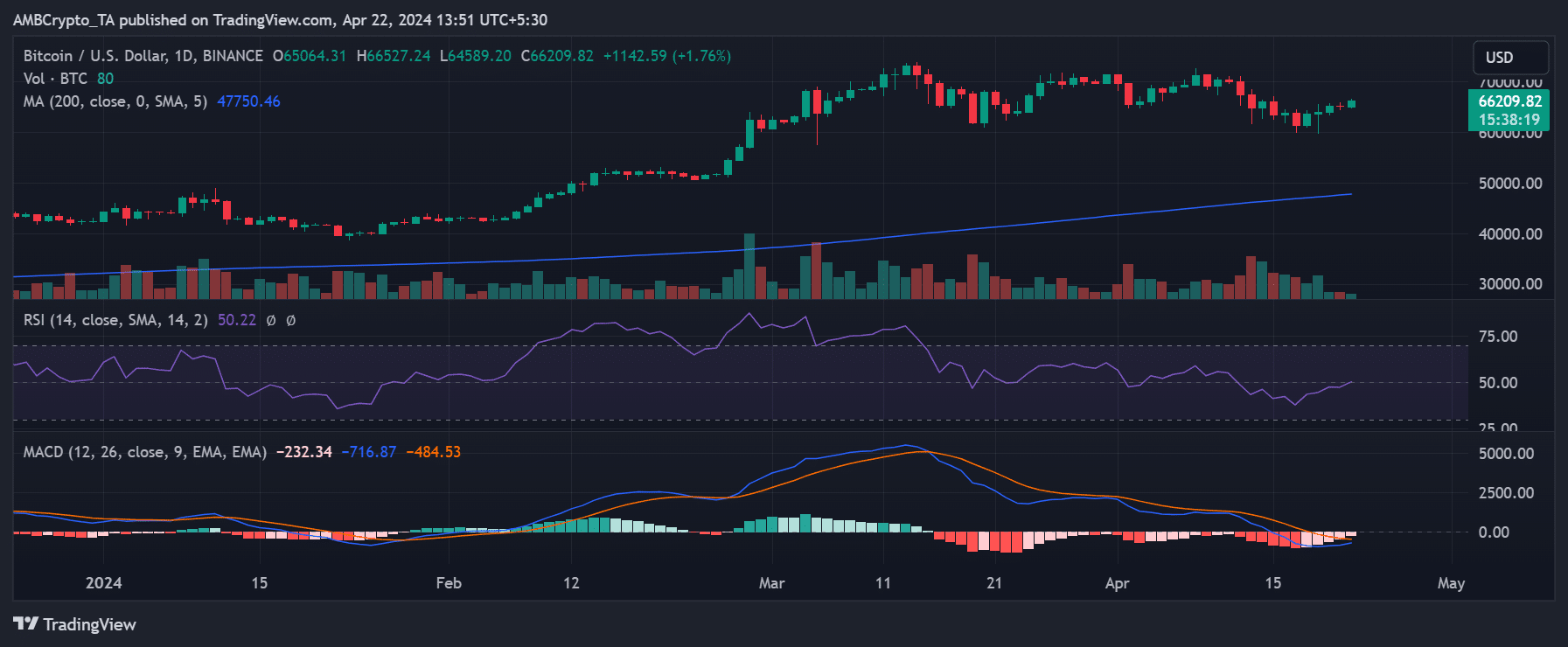

BTC goes again to $66,000

On the twenty first of April, Bitcoin skilled a slight dip however rapidly rebounded, as indicated by its every day timeframe worth chart.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

AMBCrypto’s take a look at the chart revealed that on the time of writing, BTC was buying and selling at roughly $66,200, reflecting a 1.7% improve.

Nevertheless, its rally was not but full, because it nonetheless maintained a bearish development. Breaking above this worth vary would signify a shift again right into a bullish development.