Coinspeaker

DAI Hit Document $240B in On-chain Transaction Quantity Final Week

Stablecoins recorded vital traction final week as losses and volatility compounded within the crypto market. However MakerDAO’s DAI stablecoin benefited probably the most throughout final week’s massacre.

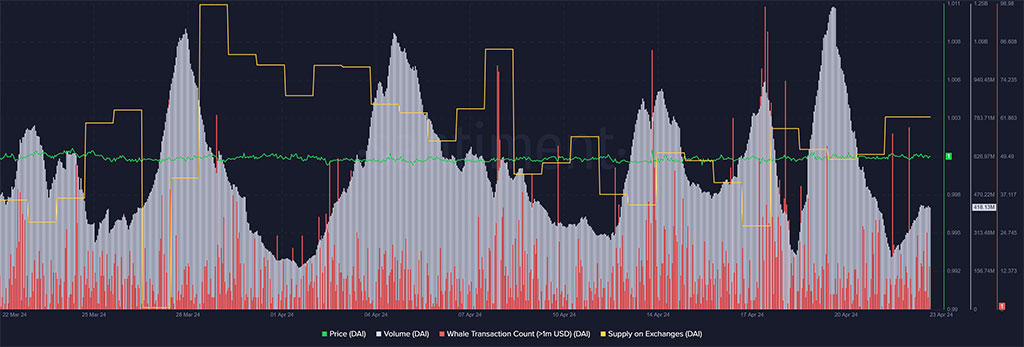

Based on information from the on-chain clever platform IntoTheBlock, DAI hit a file $240B in on-chain transaction quantity. This file weekly excessive eclipsed the remainder of the stablecoins mixed.

$DAI noticed $240B in on-chain transaction quantity final week.

Not solely is that this a brand new weekly excessive for $DAI, it's additionally greater than all different stablecoins mixed! pic.twitter.com/pgm3pv7M5M

— IntoTheBlock (@intotheblock) April 23, 2024

Usually, a surge in stablecoin quantity or provide held by addresses can sign a flight from volatility since stablecoins can provide “stability” in comparison with different cryptocurrencies.

It may additionally imply a surge in shopping for strain as traders and merchants ship cash to exchanges to purchase the dips.

DeFiLlama information revealed that final week’s DAI quantity was largely focused on Ethereum (ETH) and Polygon (MATIC).

Additional analysis of DAI motion within the Ethereum community confirmed that final week’s surge in quantity additionally marked a slight dip within the Provide on Exchanges metric (orange). It reveals that extra DAI stablecoins have been moved out from exchanges, which was in all probability a flight to security from volatility.

Photograph: Santiment

Nevertheless, on the time of writing, the Provide on Change metric began to development larger, denoting that extra DAI was being moved to exchanges, in all probability to seize discounted crypto property amidst market restoration.

Notably, the spikes in purple point out that whales transacting over $1M have been actively concerned within the DAI transactions.

MakerDAO and USDe $1B DAI partnership

MakerDAO’s DAI stablecoin is primarily utilized in DeFi actions like lending and borrowing. On 8 April, MakerDAO introduced a $1B DAI allocation to Ethena’s yield-bearing “synthetic dollar” USDe pool.

The deal sparked outrage throughout the market as others noticed it as reckless and aggressive. In reality, the transfer prompted the lending protocol Aave to replace its danger parameters and cut back publicity to DAI.

However MakerDAO pushed via with the huge deal. As of writing, DAI was amongst the highest three stablecoins, boasting over $5B in market cap.

Tether’s USDT and Circle’s USDC held the primary and second spots, respectively. Moreover, USDe’s explosive development has seen it soar into the highest 5 stablecoins inside a brief time period.

Because of this, MakerDAO’s latest super partnership and heightened volatility may partly clarify the file surge in DAI volumes throughout final week’s market drawdowns.

DAI Hit Document $240B in On-chain Transaction Quantity Final Week