Coinspeaker

Bitcoin Dominance Peaked, Says Analyst, Altcoins to Take Cost?

The world’s largest cryptocurrency Bitcoin has come underneath sturdy promoting stress extending its weekly losses to greater than 10%. Quickly after the FOMC assembly on Wednesday, Might 1, Bitcoin (BTC) value tanked one other 5% dropping to the lows of $56,500, earlier than bouncing again partially. Standard crypto analyst Michaël van de Poppe just lately said that the “Bitcoin dominance has already peaked” whereas it’s time for altcoins to shine. “Altcoins start to wake up in their Bitcoin pairs, which means that the rotation is started,” he added.

Normally, a drop within the Bitcoin market dominance alerts market contributors that an altcoin market rally is across the nook since buyers shift their capital from BTC to altcoins. Contemplating the massive dimension of the Bitcoin market cap, the BTC dominance at present out there stands at round 53.9%. That is after the 1.75% drop in dominance registered over the past week. Regardless of this, the BTC dominance within the broader crypto market is up over 4.6% for the reason that starting of 2024.

A number of market analysts have identified the drop in BTC dominance just lately. Crypto dealer Matthew Hyland famous a major lack of assist in Bitcoin dominance and expressed the intention to await the weekly shut earlier than confirming or negating ‘the breakdown’.

In the meantime, buying and selling group IncomeSharks noticed on Might 1 by way of a submit on X that Bitcoin dominance is declining, suggesting potential for altcoins to capitalize if value fluctuations persist for a number of months. In addition they highlighted the surprising resilience of many altcoins on that day.”

#Bitcoin – Dominance dropping. If value continues to cut for a number of months alts might take benefit. Numerous alts holding up surprisingly effectively right now. pic.twitter.com/VQiG2zxJlq

— IncomeSharks (@IncomeSharks) Might 1, 2024

On-chain Information Hints at Weak spot in Bitcoin, $50,000 Coming?

As mentioned Bitcoin value has confronted a extreme correction underneath $60,000 as on-chain knowledge reveals weak point in Bitcoin demand progress together with the surge briefly positions. This reveals that one can’t rule out any additional draw back within the Bitcoin value from right here.

In keeping with CryptoQuant’s report, BTC’s latest decline may be attributed to a discount in demand, marked by a slowdown within the progress of Bitcoin balances amongst long-term holders, decreased curiosity in spot Bitcoin ETFs, and an increase briefly positions within the futures market.

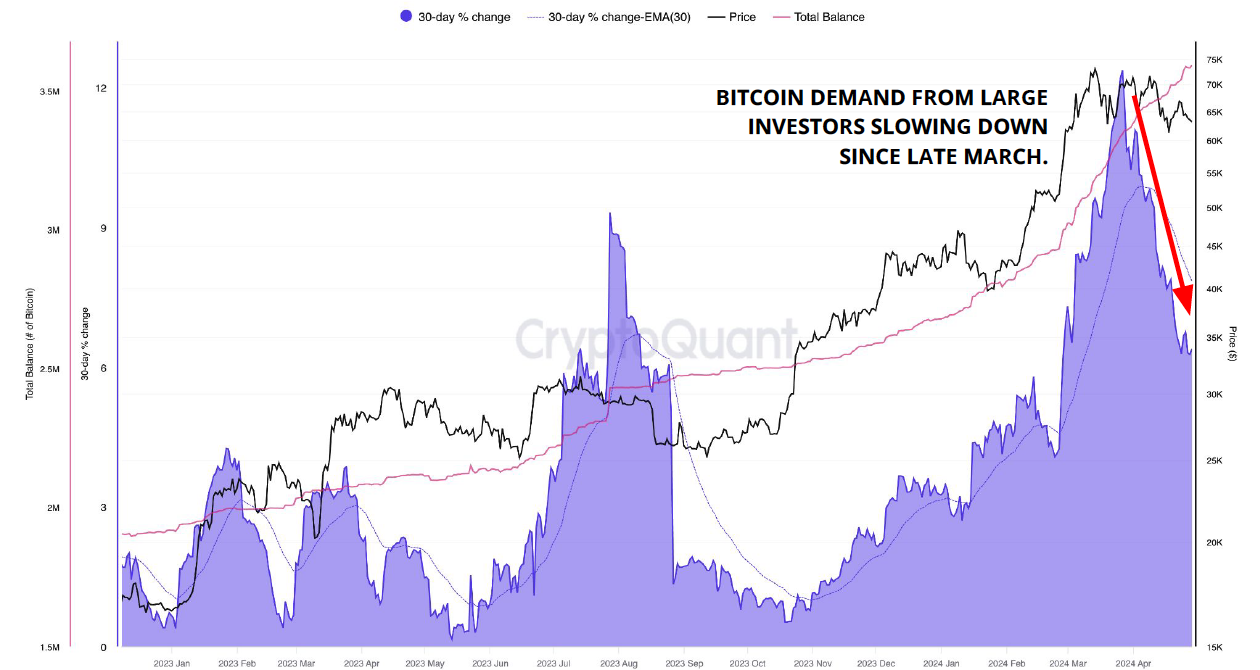

Information from CryptoQuant signifies that demand from long-term holders, outlined as buyers who constantly accumulate Bitcoin with out promoting, decreased by 50% in April. Balances went from over 200,000 BTC in late March to roughly 90,000 BTC.

Photograph: CryptoQuant

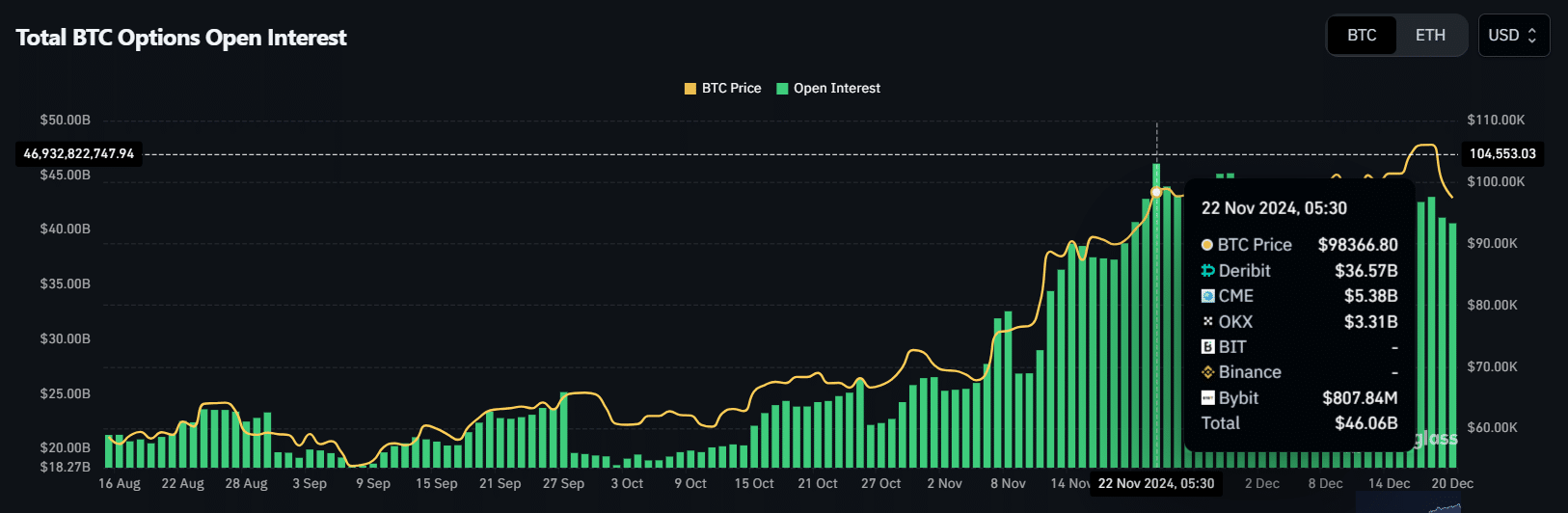

However, the demand from Bitcoin whales has additionally been on a decline since March. CryptoQuant notes: “Bitcoin whale demand growth (purple area) peaked at a monthly growth rate of 12% in late March and has now slowed down to 6%.”

Photograph: CryptoQuant

In keeping with famend analyst Scott Melker, the BTC value is unlikely to drop beneath $52,000 within the quick time period. Melker famous that regardless of the correction, which he considers comparatively minor for a bull market, the each day Relative Power Index (RSI) has not but reached oversold ranges.

“That is nonetheless solely a 23% correction, very shallow for a bull market and in line with different corrections on this run. We’re but to see a 30-40% pullback throughout this bull market, like these of the previous,” he mentioned.subsequent

Bitcoin Dominance Peaked, Says Analyst, Altcoins to Take Cost?