- Some Bitcoin miners are contemplating strategic options like asset gross sales post-halving

- Miners “extremely underpaid,” revenues now at lowest ranges since late 2022

The much-anticipated Bitcoin [BTC] halving got here and went final month. Nevertheless, whereas it’s but to have its meant impression on the worth entrance, its miners have definitely been affected by the identical.

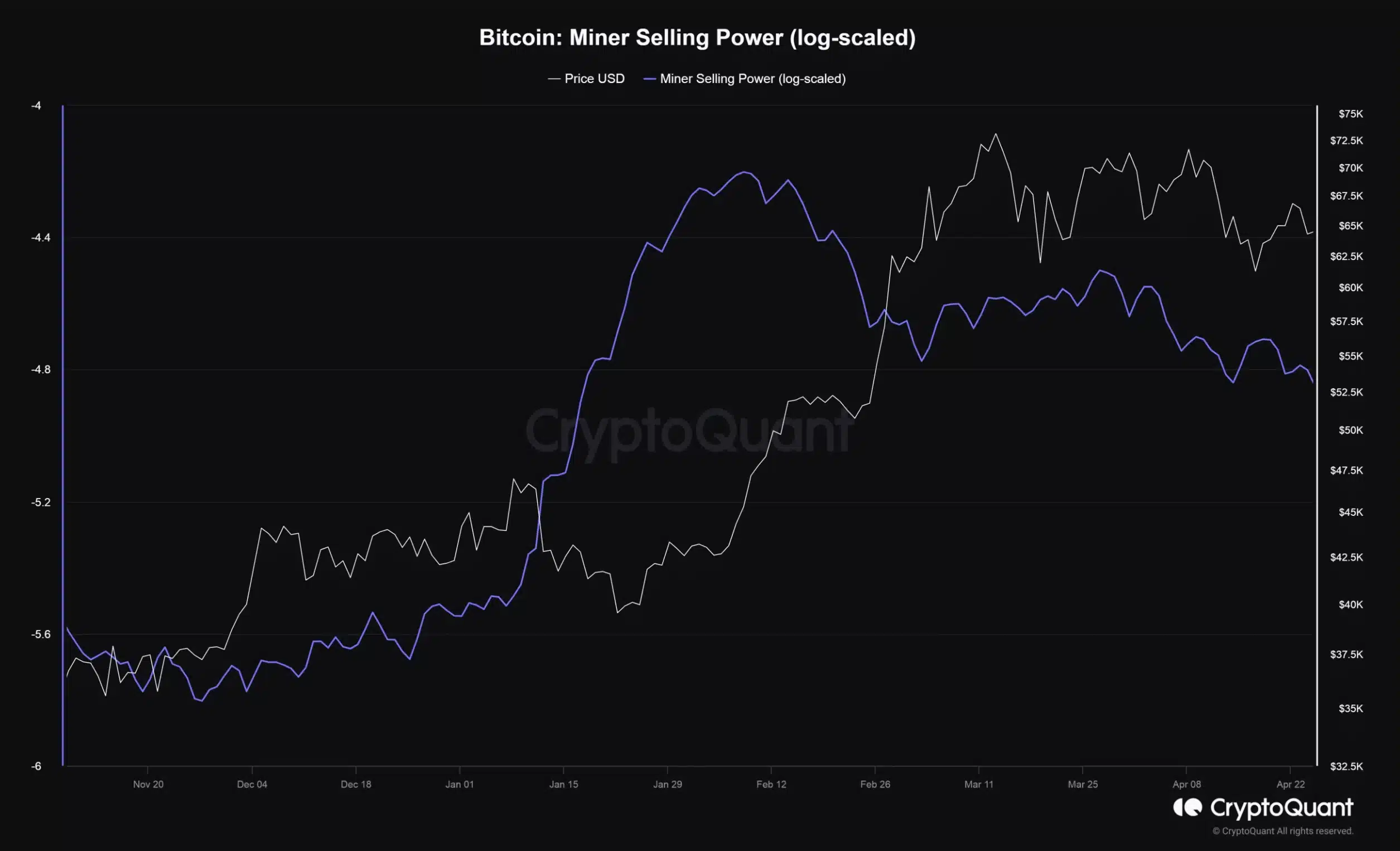

In reality, AMBCrypto’s evaluation of CryptoQuant information revealed a notable decline in promoting stress from miners post-halving.

Stronghold’s strategic choices

With BTC falling on the worth charts, many miners are involved. Stronghold Digital Mining, a number one Bitcoin mining firm, is one in all them. And, it’s within the information in the present day after it introduced its monetary and operational outcomes for the primary quarter of 2024.

Right here, it’s value remembering that mining rewards are slashed after every halving occasion, an element that might have performed a task in influencing Stronghold’s strategic choices.

As per a press launch report launched on 2 Could,

“The company is considering a wide range of alternatives to maximize shareholder value, including, but not limited to, the sale of all or part of the Company, or another strategic transaction involving some, or all of, the assets of the Company.”

This announcement has drawn lots of consideration, particularly contemplating the potential implications of miner capitulation following the Bitcoin halving occasion.

Miner capitulation happens when many miners within the cryptocurrency business stop or reduce their mining actions attributable to numerous components like a protracted drop within the cryptocurrency’s worth or rising operational bills.

Stronghold’s potential for progress

Emphasizing Stronghold’s strong place available in the market and its potential for additional progress and diversification, Greg Beard, Chairman and Chief Government Officer of Stronghold, added,

“We have observed what we believe to be valuation dislocation when comparing Stronghold’s market value to valuations of public Bitcoin mining peers, merchant power companies, and data center and power generation assets trading in the market.”

Following the identical, the corporate noticed a major uptick in income, marking a sequential enhance of 27% and a year-over-year surge of 59%, culminating in a complete income of $27.5 million within the first quarter of 2024.

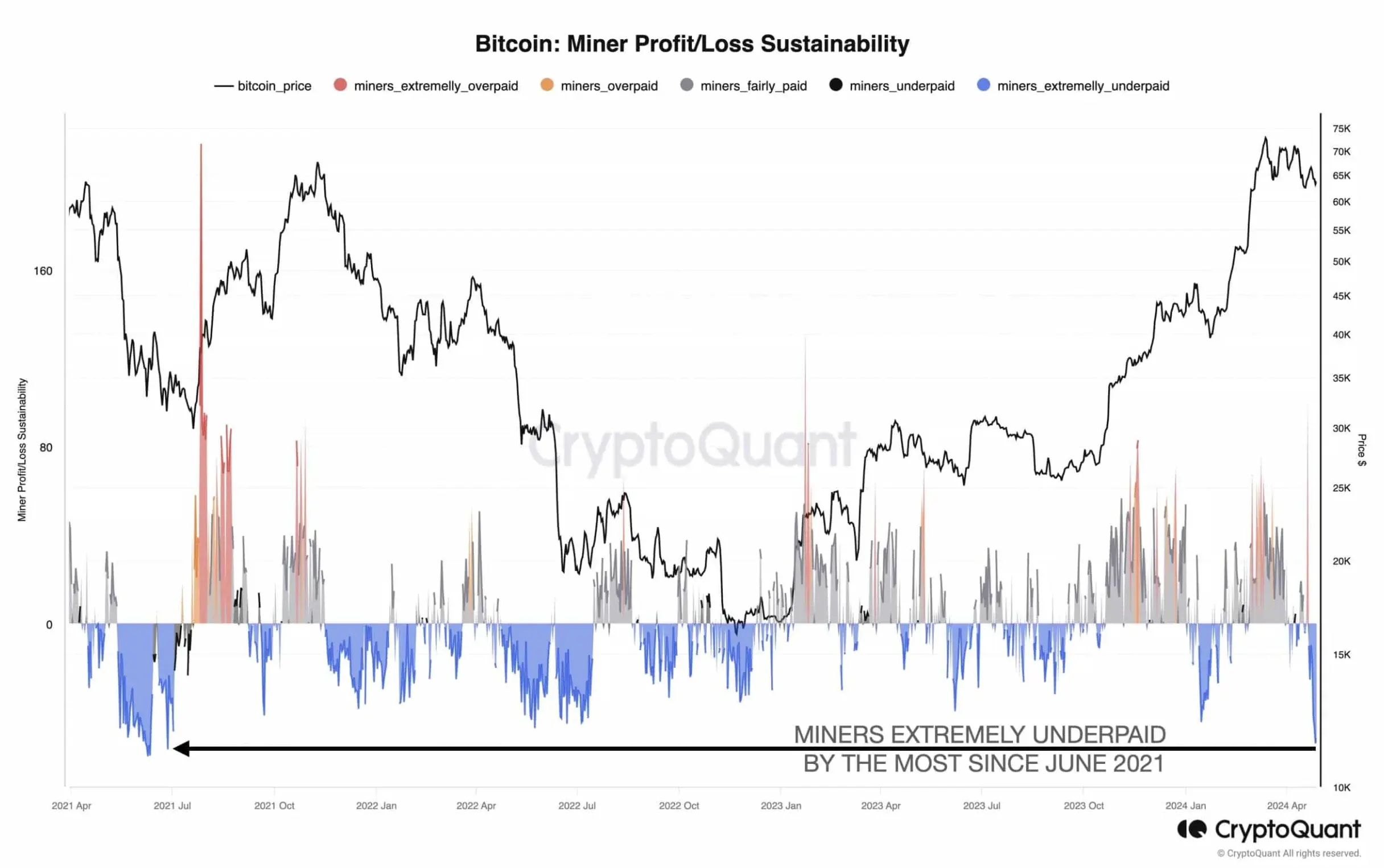

Curiously, drawing parallels with historic information, Julio Moreno, Head of Analysis at on-chain analytics agency CryptoQuant, stated,

“Bitcoin miners are extremely underpaid right now as daily revenues have plummeted to the lowest since Nov 2022. The miner profit/loss sustainability reached the lowest since June 2021.”

The aforementioned metric compares block rewards to mining issue, displaying that miners have been underpaid. Moreover, day by day revenues had been down on the charts too.

This occurred as a result of the halving reduce miners’ block rewards in half, forcing miners to double their investments to interrupt even, leading to small miners struggling to outlive.

Means ahead

This raises an important query – How will miners change their enterprise plans and mining actions to maintain supporting Bitcoin with fewer rewards?

Whereas it’s robust proper now, the halving might result in miners turning into extra environment friendly and stronger. As main gamers like Stronghold discover strategic options, all eyes are on how the mining panorama will evolve to fulfill this new actuality.