- Bitcoin whales accrued enormous sums of BTC because the crypto’s worth surged

- Then again, general exercise throughout the Bitcoin ecosystem fell

After Bitcoin [BTC] fell beneath the $60,000-level, panic was the norm throughout the market, with FUD settling in too. Nonetheless, as anticipated, the cryptocurrency’s whales noticed this dip as a possibility to purchase BTC at a reduction. And, they did.

Whales get an urge for food for BTC

In response to latest information, Bitcoin whales accrued 47,000 BTCs in simply 24 hours. Whale accumulation on a big scale often tends to have constructive results on the worth of any cryptocurrency.

Bitcoin was no completely different, with the crypto mountain climbing by 6.36% over the aforementioned interval. On the time of writing, it was buying and selling near $64,200 on the charts.

Now, despite the fact that whale curiosity will help transfer costs north, there are some drawbacks to whale curiosity as effectively. Excessive curiosity from whales may end up in a lot of the BTC being within the palms of some. These wallets can then manipulate the crypto’s costs, adversely affecting weak retail buyers.

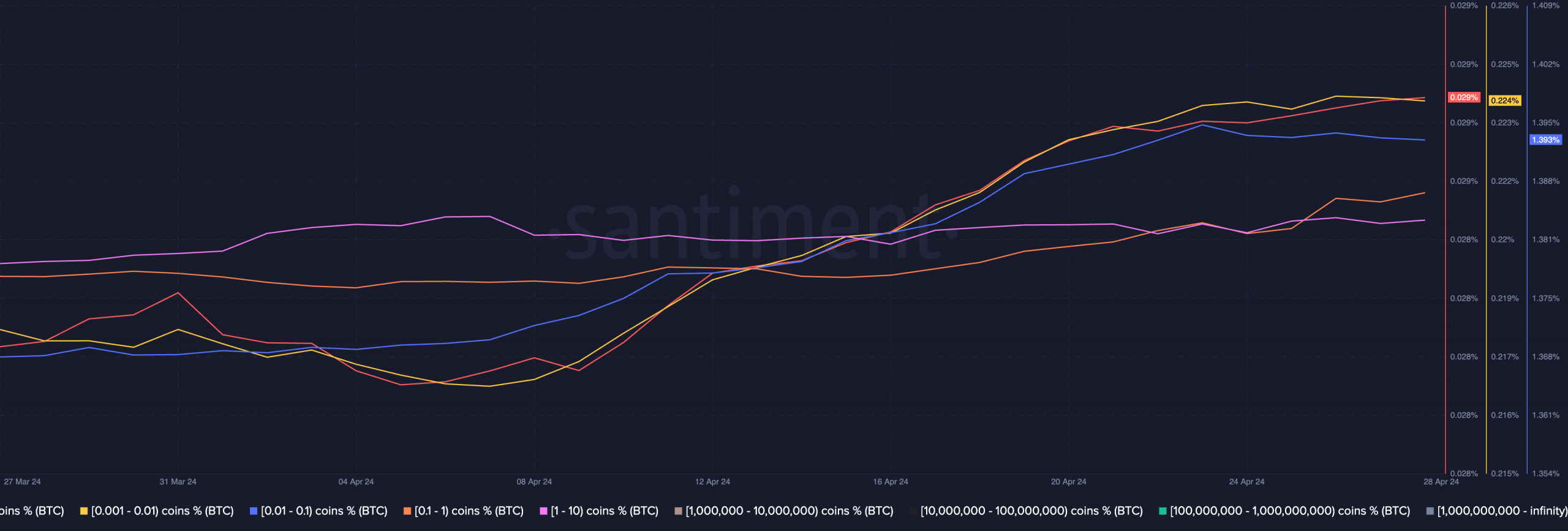

Apparently, it was seen that it wasn’t simply whales which were accumulating BTC. As a substitute, addresses holding anyplace between 0.001 to 1 BTC additionally began to point out curiosity in shopping for the king coin.

Wanting on the information

If the sentiment round BTC stays constructive for each retail and whale buyers, Bitcoin’s worth may rally even additional. By doing so, it would climb again to $65k once more.

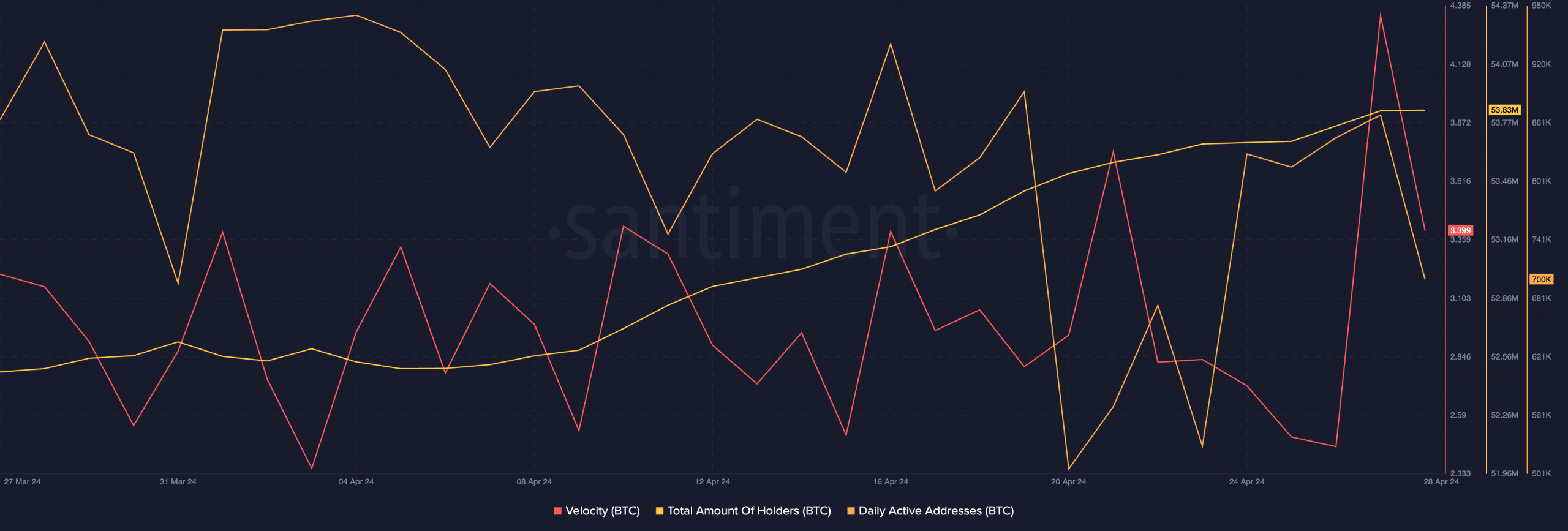

Furthermore, the speed round BTC additionally grew considerably over the previous couple of days. This indicated that the frequency with which BTC was being traded at had grown considerably over the previous couple of days. Furthermore, the the entire variety of addresses holding BTC additionally grew.

A mix of those components may show to be useful for BTC’s worth trajectory in the long term.

One other issue that might play an element is the state of Bitcoin’s community. Over the previous couple of days, the variety of every day energetic addresses on the community has declined materially. If exercise on the community continues to fall, the income generated by miners could be affected, inflicting a surge in promoting stress on the charts.

Even within the NFT sector, there appeared to be indicators of waning curiosity. In truth, the quantity of NFTs being offered on the Bitcoin community fell considerably.

Is your portfolio inexperienced? Try the BTC Revenue Calculator