- BTC’s value has appreciated by over 6% because it approached $63k on the charts

- Most metrics and indicators flashed inexperienced too

Bitcoin’s [BTC] value motion as soon as once more turned unstable because it swiftly approached $63k on the charts. Within the meantime, nonetheless, a sample gave the impression to be forming on the cryptocurrency’s value chart – An indication that BTC’s value may hit $75k within the coming weeks.

Bitcoin’s value motion appears to be like promising

Based on CoinMarketCap, BTC has gained by greater than 6% over the previous week, with it appreciating by 3% within the final 24 hours alone. On the time of writing, BTC was buying and selling at $62,998.95 with a market capitalization of over $1.24 trillion.

Regardless of its fall from its ATH, nonetheless, most market analysts stay optimistic concerning the crypto’s value motion. The truth is, AMBCrypto had beforehand reported that Ki Younger Ju, CEO of analytics agency CryptoQuant, claimed that Bitcoin’s community fundamentals may assist a market valuation “three times its current size.”

Whereas BTC’s value motion turned bullish, Titan of Cryptos, a well-liked crypto-analyst, identified in a tweet that an inverse head-and-shoulder sample was forming on BTC’s value chart. As per the tweet, the sample urged that BTC’s value may quickly cross its all-time excessive (ATH) and hit $75k within the coming weeks.

Nonetheless, the tweet additionally talked about the antagonistic state of affairs. If the whole lot doesn’t fall into place, then BTC may drop all the way down to $56k once more. Therefore, it’s value taking a better take a look at the cryptocurrency’s state to see which final result is extra probably.

What to anticipate from Bitcoin?

AMBCrypto’s evaluation of CryptoQuant’s information revealed that Bitcoin’s trade reserves have been dropping. This clearly meant that purchasing stress was excessive, which will be inferred as a bullish sign.

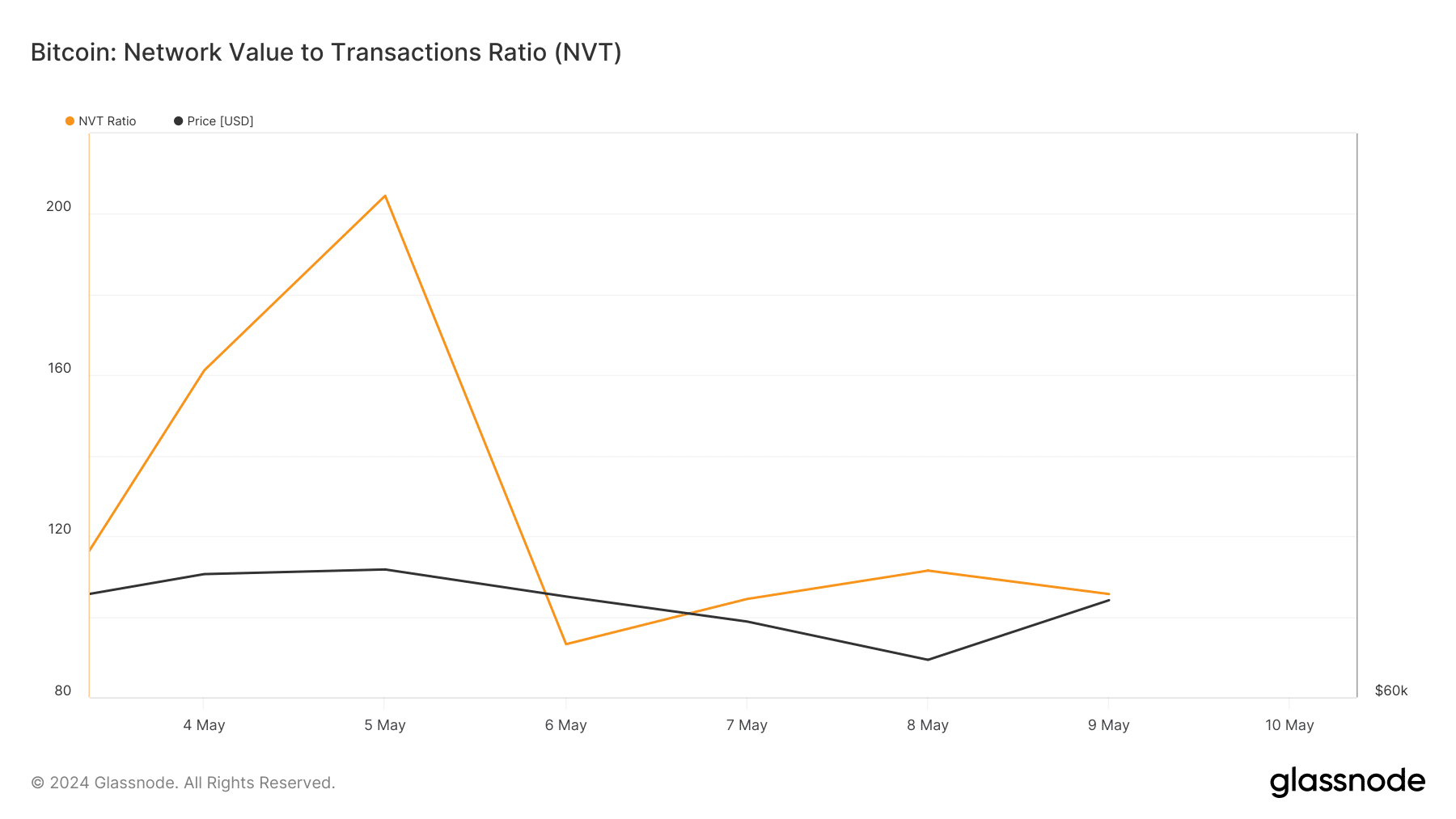

Its binary CDD urged that long-term holders’ actions within the final 7 days have been decrease than common, which means that they’ve a motive to carry their cash. On prime of that, BTC’s NVT ratio dropped final week, which means that it was undervalued. These metrics backed the potential of BTC touching or going above its ATH.

Nonetheless, its aSORP flashed opposing indicators.

At press time, BTC’s aSORP was crimson, indicating that extra traders have been promoting at a revenue. In the course of a bull market, this could point out a market prime.

To verify whether or not the market has reached its prime, AMBCrypto then analyzed BTC’s each day chart. As per our evaluation, BTC was testing its 20-day exponential shifting common (EMA) on the time. A profitable breakout above it will guarantee a sustained bull rally.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Its Cash Circulation Index (MFI) additionally registered a pointy uptick.

Quite the opposite, the Chaikin Cash Circulation (CMF) regarded bearish. This was an indication that BTC’s value may begin to decline, which may push its worth all the way down to $56k on the charts.