- Grayscale’s Bitcoin ETF recorded a detrimental outflow of over $43M, triggering outflows for the opposite merchandise

- Nevertheless, Bitcoin’s market wasn’t significantly affected by it

It has been a sluggish month for U.S. spot Bitcoin ETFs, as soon as lauded as the massive catalyst for a 2024 bull run that may see Bitcoin climbing to as excessive as $100,000. In actual fact, simply yesterday, the merchandise noticed about $11.3 million in outflows, triggered by Grayscale.

Change in investor sentiment?

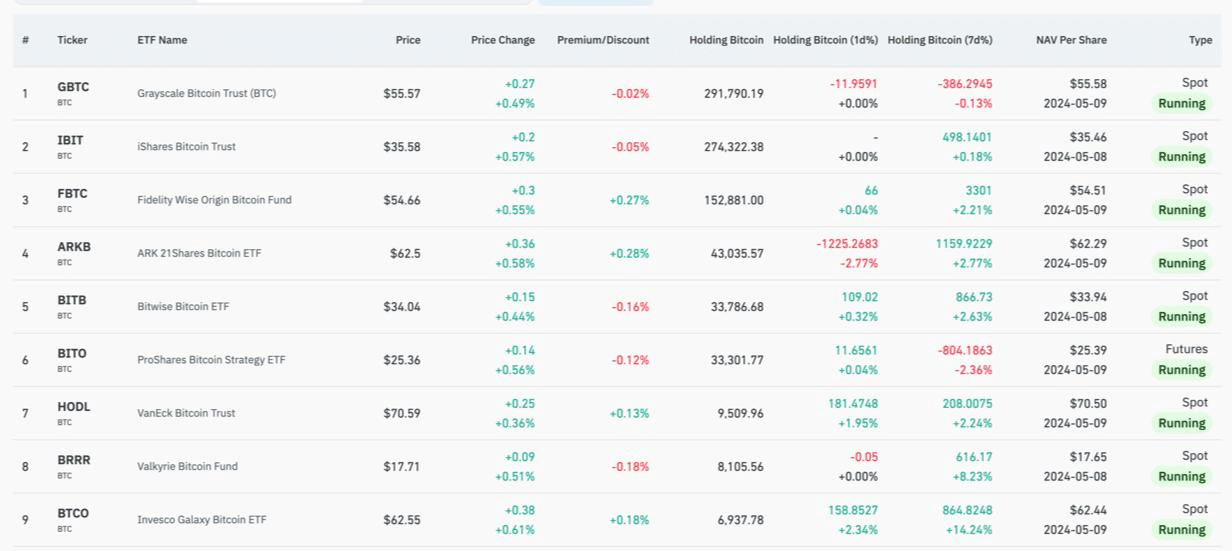

Information from Coinglass revealed an unsettling pattern for Grayscale’s GBTC, which continued to bleed with $43.4 million fleeing the fund. Regardless of this exodus, GBTC had a short second of respite final Friday, with a stunning $60 million pouring in, hinting at its nonetheless potent market presence.

Conversely, optimism appeared to glitter for BlackRock’s IBIT Bitcoin ETF, which welcomed a formidable $14.2 million. This rebound paints an image of rising investor belief on this explicit Bitcoin ETF. Constancy’s Sensible Bitcoin ETF wasn’t left behind both, having fun with a $2.7 million increase.

Bitwise’s BITB ETF additionally caught the investor’s eye, pulling in $6.8 million and standing out as Thursday’s favourite with $11.5 million in inflows, whereas its friends lagged behind. In the meantime, Ark 21shares (ARKB) ETF caught a $4.4 million wave of help on the identical day. WisdomTree’s BTCO and Franklin Templeton’s EZBC Bitcoin ETFs noticed extra modest positive factors, with inflows of $2.2 million and $1.8 million, respectively.

It was a quieter day for ETFs from Hashdex, VanEck, Valkyrie, and Invesco Galaxy, which recorded no new flows, highlighting a doable disinterest in these Bitcoin ETF merchandise amongst institutional traders.

Since their inception, these funds have collectively seen an inflow of $12.1 billion, with giants like BlackRock’s iShares and Constancy’s investments capturing the lion’s share. Regardless of related efficiency throughout the board, with returns hovering round 28%, investor reactions have various considerably.

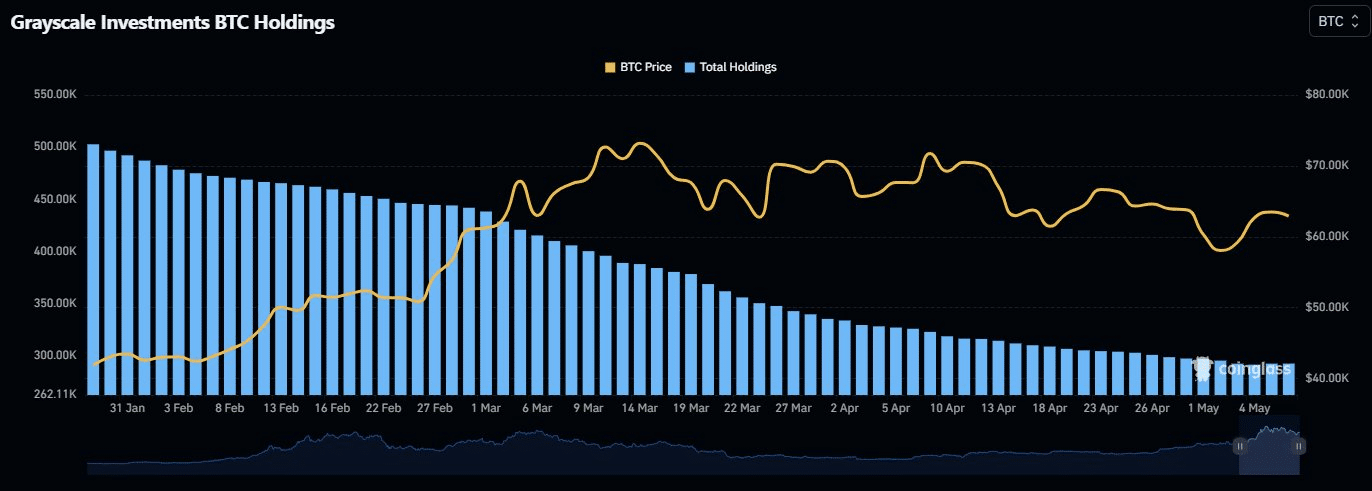

The massive loser? Grayscale. The fund has witnessed a staggering $17.2 billion withdrawal since its conversion. Even after slashing its charges, Grayscale’s expenses stay considerably larger than its opponents, who principally hover round a 0.20%-0.25% expense ratio.

In the meantime, Coinglass revealed that Grayscale nonetheless holds almost 293 BTCs, that are value $18.4 million.

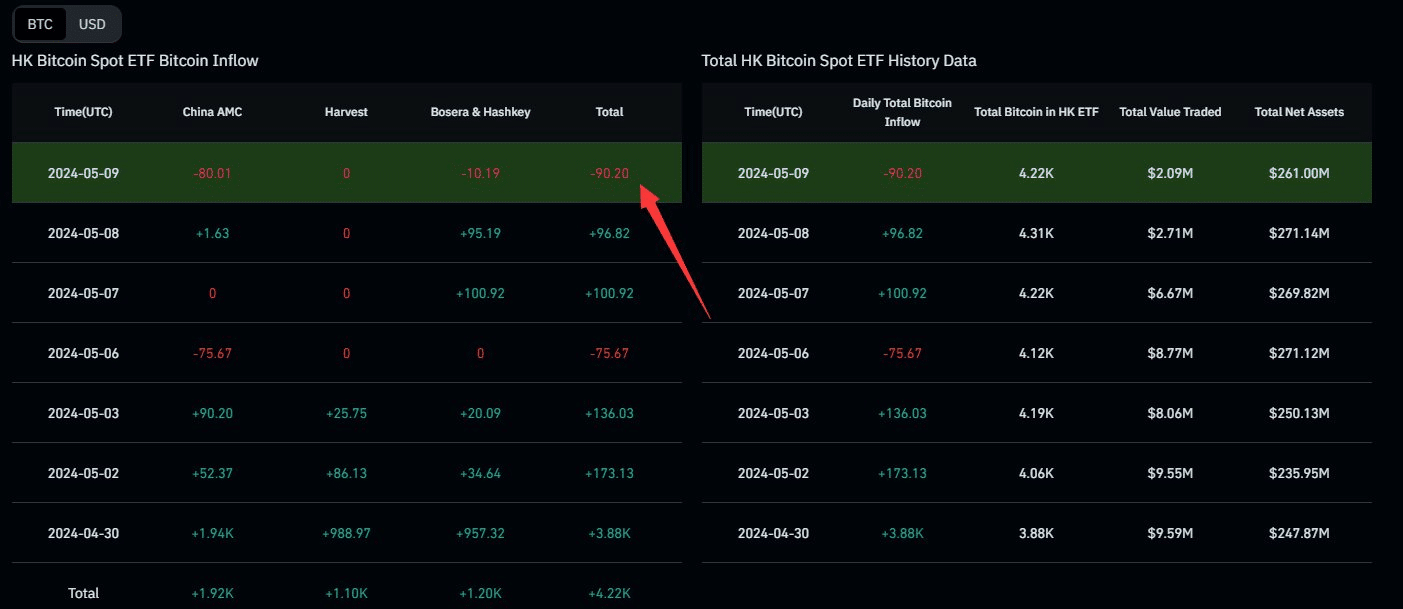

The outflows in crypto ETF merchandise isn’t remoted to simply america alone.

In actual fact, information confirmed that Hong Kong’s spot Bitcoin ETFs have seen outflows of over $5.5 million prior to now 24 hours, indicating a basic lack of curiosity within the merchandise.

What about BTC?

Amid this, Bitcoin has managed to carry its floor. At press time, the king of cryptos was nonetheless managing to hover above $63,000, with a hike of 4% within the final 24 hours. Additionally, the group is at present 78% bullish on BTC, based on information from CoinGecko.

The Bitcoin halving didn’t yield the outcomes many people have been hoping for and since then, all the highest ten cryptocurrencies have been seeing principally bullish sentiments by traders and typically, even merchants.

Nevertheless, with doubts peaking, the continuing exit of smaller traders would possibly mockingly clear the stage for Bitcoin and its fellow cryptos to stage a comeback as summer season approaches, hinting at a possible reset within the risky cycles of the crypto-market.