- Bitcoin has a robust bullish bias this week.

- The latest dip may be to engineer liquidity and extra volatility was doubtless.

Bitcoin [BTC] was buying and selling on the vary highs at $67 at press time. This vary has been in place since mid-April. The previous few days’ momentum, significantly the restoration previous $65k, satisfied bulls that additional positive aspects had been doubtless.

Different alerts from on-chain evaluation highlighted bullish sentiment out there. But, the liquidity within the $68k-$69k area may see a bearish reversal. What are the probabilities that this state of affairs would play out?

How liquidity runs may be engineered

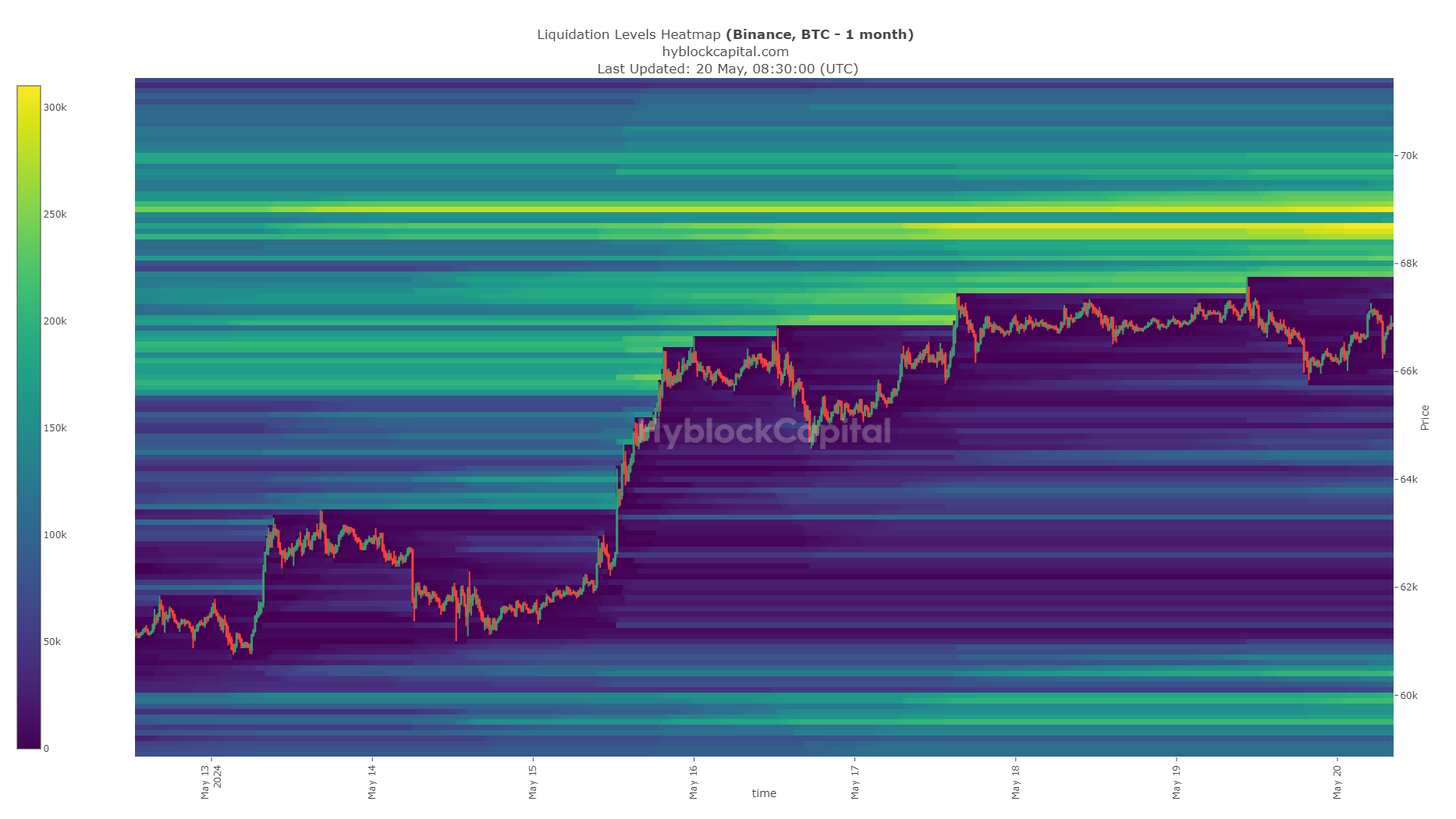

Crypto analyst CrypNuevo identified in a put up on X (previously Twitter) that the $69k area had a massive cluster of liquidation ranges. This degree may entice costs within the coming days, nevertheless it could possibly be accompanied by some volatility.

The concept is {that a} sharp, fast downward transfer earlier than this massive liquidity pocket is hit may encourage extra quick positions. It may additionally create false confidence in merchants who’re already quick, which builds much more liquidity across the $69k area.

Supply: Hyblock

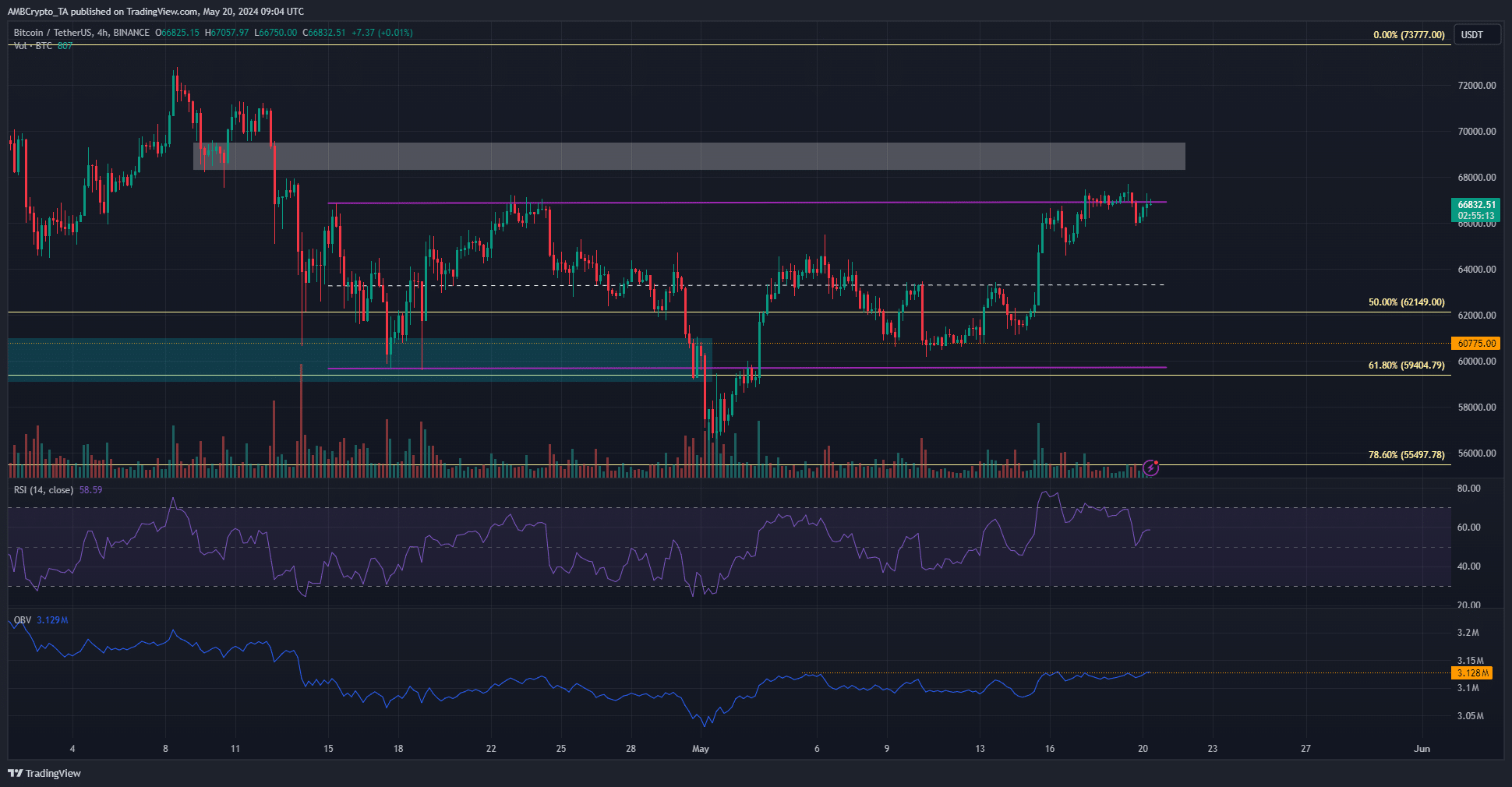

He additionally identified that these aggressive strikes occur initially of the week. The 50-EMA on the 4-hour chart at $65k was one other potential assist for Bitcoin. Such a deep drop may encourage much more short-selling.

Supply: CrypNuevo on X

Nevertheless, the liquidation heatmap showcased the $68.6k-$69.2k as a important resistance zone. The analyst expects a drop to $65k this week, adopted by a rally to $69k.

What does the 4-hour timeframe technical evaluation reveal?

The H4 RSI continued to maneuver above impartial 50 and indicated sturdy bullish momentum. But, the BTC buying and selling quantity has been low since Friday. Nevertheless, the OBV was on the verge of clearing a neighborhood resistance degree, which may add to the bullish impetus.

Is your portfolio inexperienced? Verify the Bitcoin Revenue Calculator

The 4-hour chart revealed sturdy resistance at $69k-$69.5k, however quick liquidations may gasoline a surge previous this tough resistance zone.

Therefore, merchants ought to be ready for some volatility however continued bullish progress this week.

Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion.