- Although whales have been shopping for, promoting sentiment stays dominant available in the market

- Few metrics and indicators hinted at a worth drop too

Bitcoin [BTC] managed to reclaim $70k a couple of days in the past, however the pattern didn’t final because the crypto’s worth quickly began to say no on the charts. Whereas that occurred, whales grabbed the chance to build up extra BTC at a lower cost. Ergo, the query – Does this level to one more bull rally?

Bitcoin whales again in motion

CoinMarketCap’s knowledge revealed that BTC’s worth gained bullish momentum final week, permitting it to the touch $70k on 21 Might. The bulls couldn’t maintain the pump, nevertheless, leading to BTC as soon as once more falling below $69k. Whales tapped this chance to purchase BTC whereas its worth was low.

In actual fact, Ali, a preferred crypto-analyst, just lately shared a tweet highlighting the truth that BTC whales bought over 20,000 BTC – Value $1.34 billion.

Abramchart, an analyst and writer at CryptoQuant, additionally shared an evaluation that painted an analogous image. In response to the identical, the whales’ urge for food for getting Bitcoin has returned strongly after a two-month decline in shopping for curiosity since March. This growth indicated that BTC’s present costs are appropriate for buying and accumulating.

AMBCrypto then checked CryptoQuant’s knowledge to search out out whether or not shopping for sentiment was dominant total available in the market. We discovered that whereas whales purchased, retail traders may need been promoting BTC because the coin’s trade reserve has been growing. Other than that, each BTC’s Korea Premium and Coinbase Premium had been pink. This clearly meant that promoting sentiment was dominant amongst U.S and Korean traders.

Will whales push Bitcoin up?

The buildup from whales did assist BTC as within the final 24 hours, the crypto climbed by 2.6%. On the time of writing, Bitcoin was buying and selling at $68,797.25 with a market capitalization of over $1.36 trillion.

Nonetheless, whales’ efforts may not be sufficient to maintain this uptrend. BTC’s aSORP was pink, that means that extra traders are promoting at a revenue. In the midst of a bull market, it might point out a market high. Moreover, its NULP prompt that traders at the moment are in a perception section the place they’re in a state of excessive unrealized earnings – A bearish sign.

Is your portfolio inexperienced? Test the Bitcoin Revenue Calculator

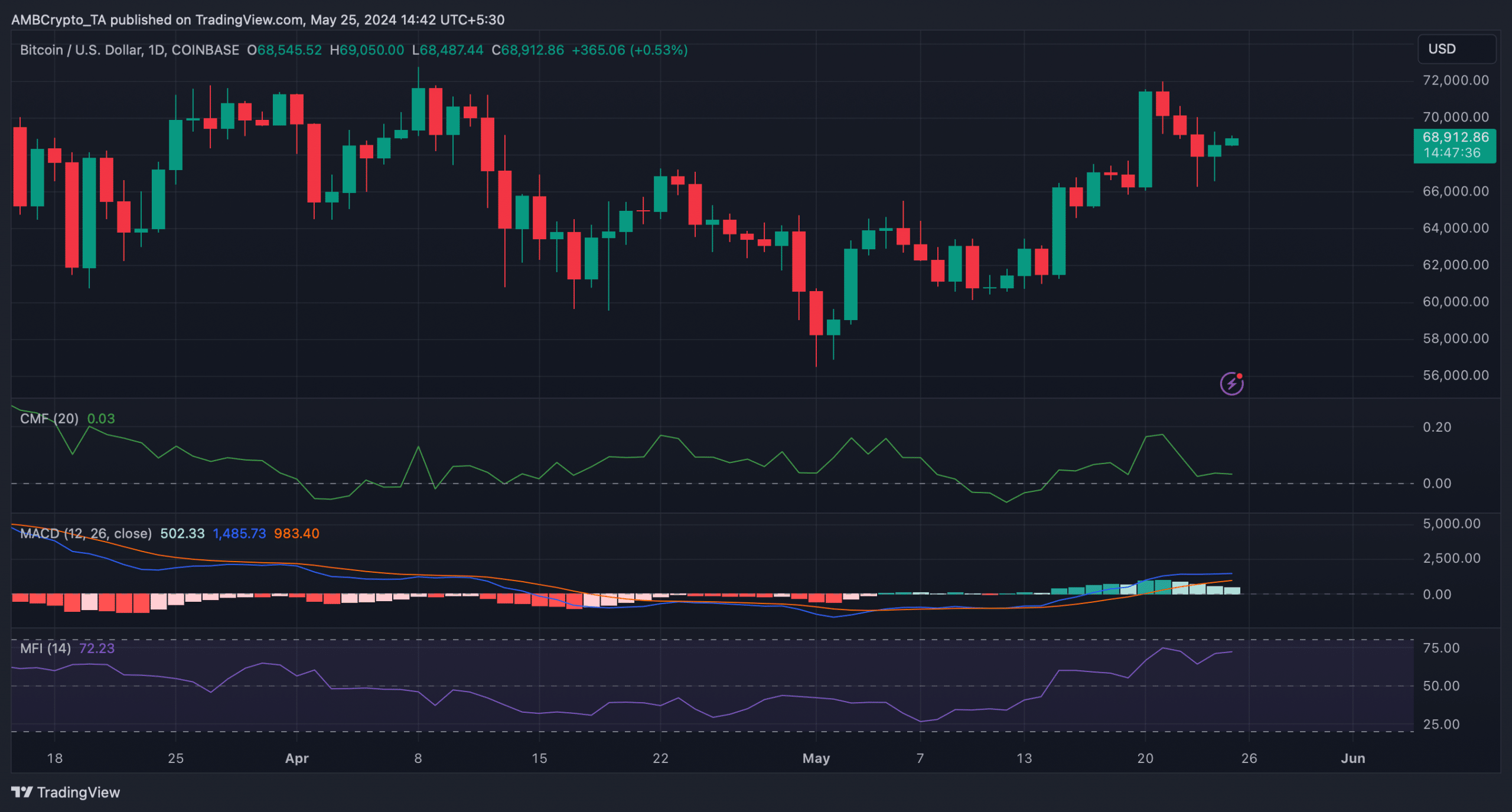

To raised perceive whether or not BTC is anticipating a worth correction, AMBCrypto analyzed its each day chart.

As per our evaluation, BTC’s MACD displayed the opportunity of a bearish crossover within the coming days. Its Chaikin Cash Circulate (CMF) additionally moved sideways close to the impartial zone.

Quite the opposite, the Cash Circulate Index (MFI) regarded bullish because it registered a pointy uptick.