Picture supply: Getty Photos

FTSE 100 shares are hovering on the minute. But due to years of underperformance, the UK’s blue-chip share index stays full of good bargains.

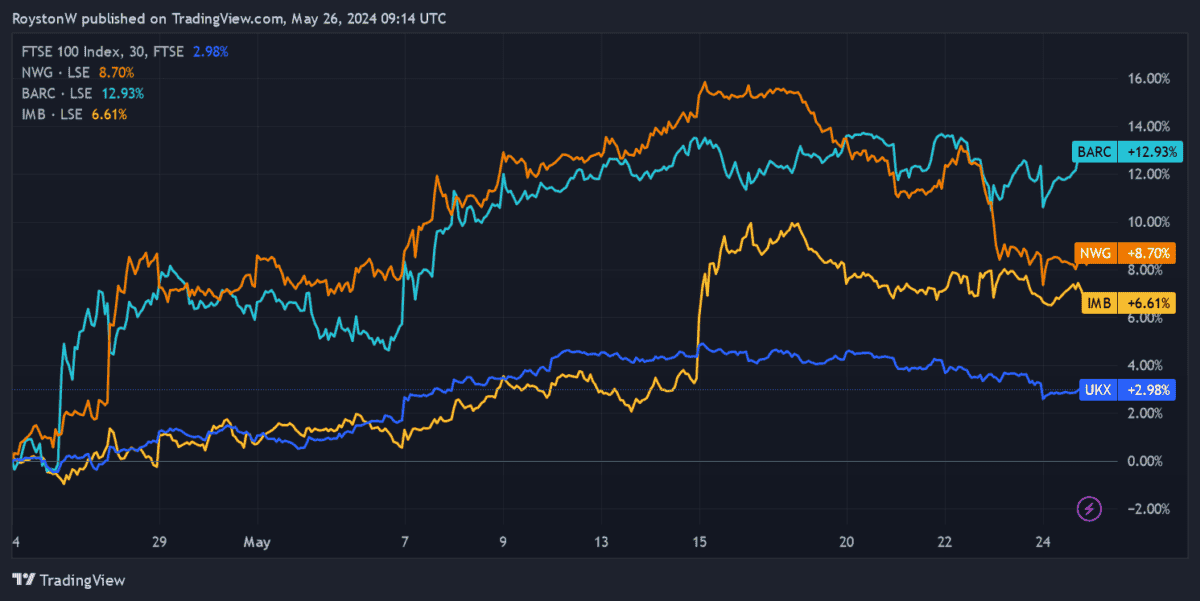

NatWest Group (LSE:NWG), Barclays (LSE:BARC), and Imperial Manufacturers (LSE:IMB) are a couple of Footsie shares which have surged in worth in current weeks and months. However they nonetheless look filth low-cost on paper, because the desk under reveals.

| Firm | P/E ratio for this FY | P/E ratio for subsequent FY |

|---|---|---|

| NatWest Group | 7.9 instances | 7.3 instances |

| Imperial Manufacturers | 7.3 instances | 6.6 instances |

| Barclays | 7 instances | 5.7 instances |

It’s price remembering that some shares commerce cheaply for good motive. With this in thoughts, ought to I purchase these recovering shares at present?

Large banks

UK excessive avenue banks NatWest and Barclays have been among the many FTSE 100’s strongest performers of late, because the above graph reveals.

Investor demand has been boosted by indicators of Britain’s economic system turning the nook. Additional drops in inflation, and the implication this might have for rate of interest actions, have additionally helped their share costs.

However keep in mind that price cuts are a double-edged sword for banks. Certain, they stimulate financial exercise, however in addition they cut back banks’ revenue margins.

NatWest’s internet curiosity revenue slumped 9% in quarter one, reflecting the tip of the Financial institution of England’s rate-rising programme. Barclays’ comparable revenue in the meantime, dipped by 4%.

It’s additionally questionable how far rate of interest rises will increase Britain’s financial restoration. In reality, the broader progress outlook stays poor. The OECD thinks the UK will put up the bottom progress amongst G7 nations in 2025.

Main structural issues (like labour shortages, commerce frictions and regional disparities) pose threats within the medium-to-long-term too, lowering banks’ potential for earnings progress.

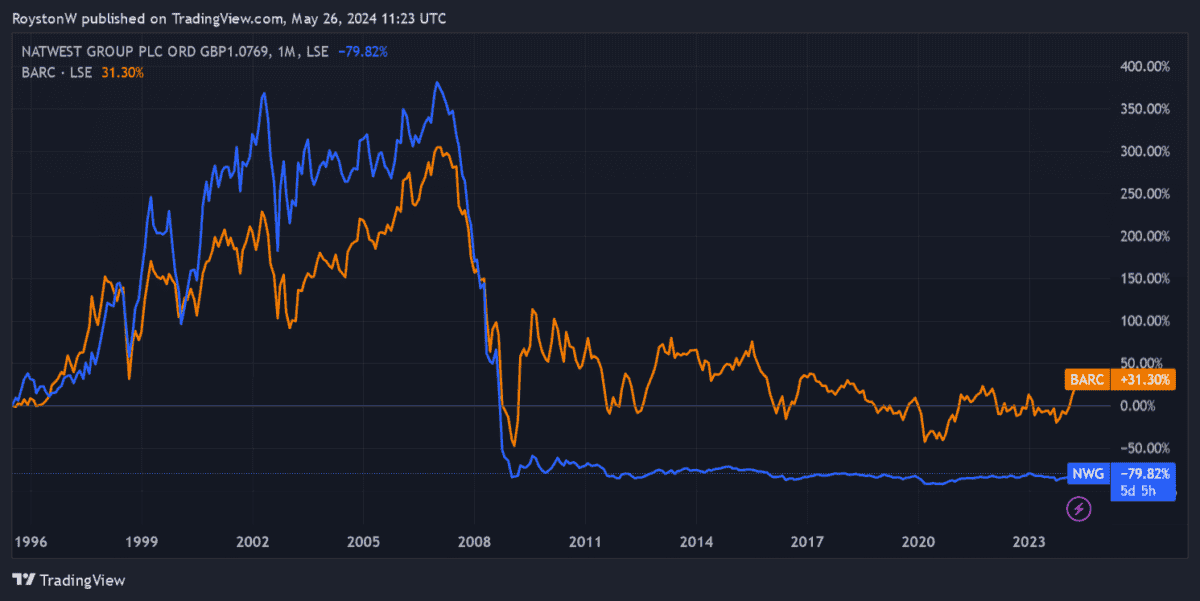

NatWest’s share value is down 17% previously decade. Barclays’ shares are 12% cheaper over the identical interval. With aggressive pressures additionally rising, I can’t see the companies breaking out of this long-term downtrend.

Tobacco titan

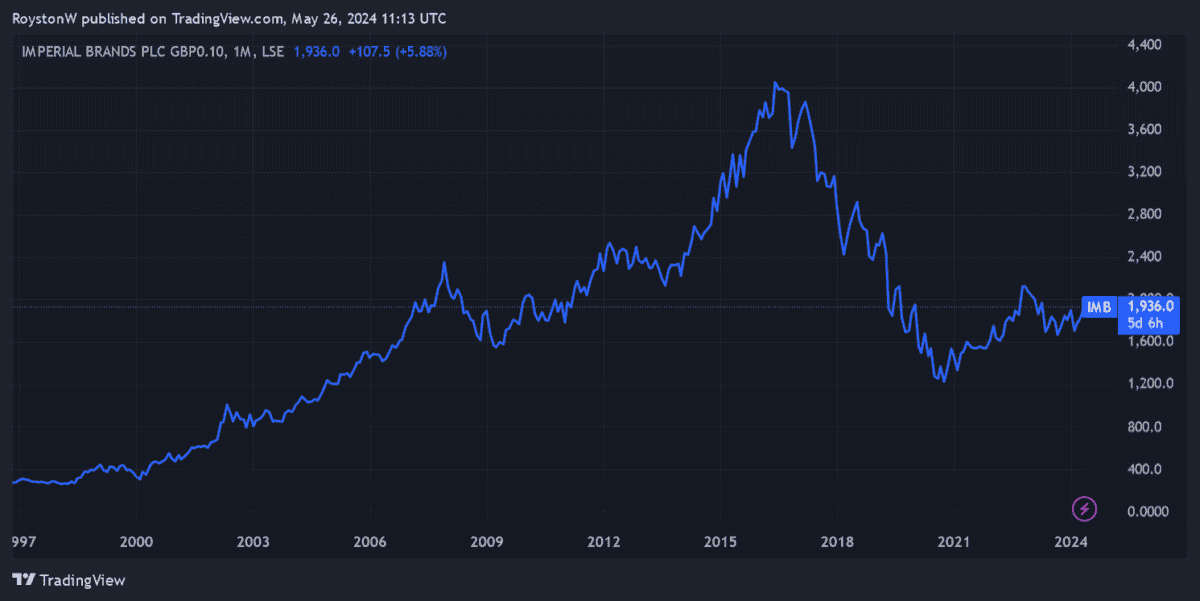

Imperial Manufacturers is one other UK share with a protracted historical past of underperformance. Its share value has plunged 27% in the course of the previous decade as smoking charges have steadily declined.

This isn’t an issue that’s going away both. Imperial Manufacturers’ volumes reversed greater than 6% within the six months to March. Large Tobacco will stay beneath strain too, as legislators proceed to limit how these merchandise are offered, marketed and consumed.

But it surely’s not all unhealthy. Certainly, the Footsie inventory’s newest financials confirmed the way it may nonetheless thrive whilst the entire market shrinks.

Mighty manufacturers like Davidoff and West proceed to say market share in essential areas, whilst costs are hiked to drive revenues. Gross sales of next-generation merchandise like vapes are additionally rising sharply. These elements drove Imperial Manufacturers’ internet revenues 3% increased within the first half.

However this isn’t sufficient to make me make investments. The tempo at which world cigarette gross sales are declining provides the agency an more and more small alternative to develop revenues.

Based on the World Well being Organisation, one in 5 adults worldwide at present devour tobacco in comparison with one in three in 2000. And, worryingly, rising restrictions on vapes and comparable merchandise threaten the expansion potential of those next-generation merchandise.

Like NatWest and Barclays, Imperial Manufacturers is a share I plan to keep away from in any respect prices.