Coinspeaker

BTC ETFs Now Maintain Over 1M Bitcoins in Three Months of Launch

The spot Bitcoin ETFs proceed to hit new milestones with inflows resuming once more previously two weeks. Within the newest growth, the full holdings of the BTC ETFs have crossed over 1 million.

Earlier this yr on January 11, the US SEC authorised the spot Bitcoin ETFs. Inside three months of launch, these ETFs have scooped greater than 855,619 Bitcoin, whereas accumulating a median of 6,200 BTC per day.

As per the info shared by HODL15Capital, different 21 exchange-traded merchandise from areas like Germany, Canada, Brazil, and many others. have collected over 150,000 Bitcoins taking the the full quantity to greater than $1 billion, price a staggering $68 billion. Consequently, all the spot Bitcoin ETFs globally collectively maintain 1,002,343 BTC, or 5.08% of the present circulating provide of cash, which is nineteen,704,484.

These ETFs facilitate entry to Bitcoin for big establishments as effectively. First-quarter reporting information indicated that greater than 20% of publicity to US spot Bitcoin ETFs was held by massive buyers and establishments with mixed property surpassing $100 million. This numerous group consists of hedge funds, banks, and even the Wisconsin state pension fund.

Grayscale vs BlackRock

Regardless of large outflows, the Grayscale Bitcoin ETF GBTC nonetheless retains its spot as the biggest Bitcoin fund at the moment out there. As of now, GBTC holds 289,040 Bitcoins price round $19.9 billion. Grayscale has misplaced almost 53% of its Bitcoin holdings, or 330,960 BTC, within the final three months because the ETF launch.

It faces swift competitors from BlackRock’s iShares Bitcoin Belief (IBIT), boasting 287,168 BTC valued at roughly $19.8 billion. If inflows to IBIT stay regular and GBTC continues to expertise outflows, IBIT might surpass GBTC’s holdings this week.

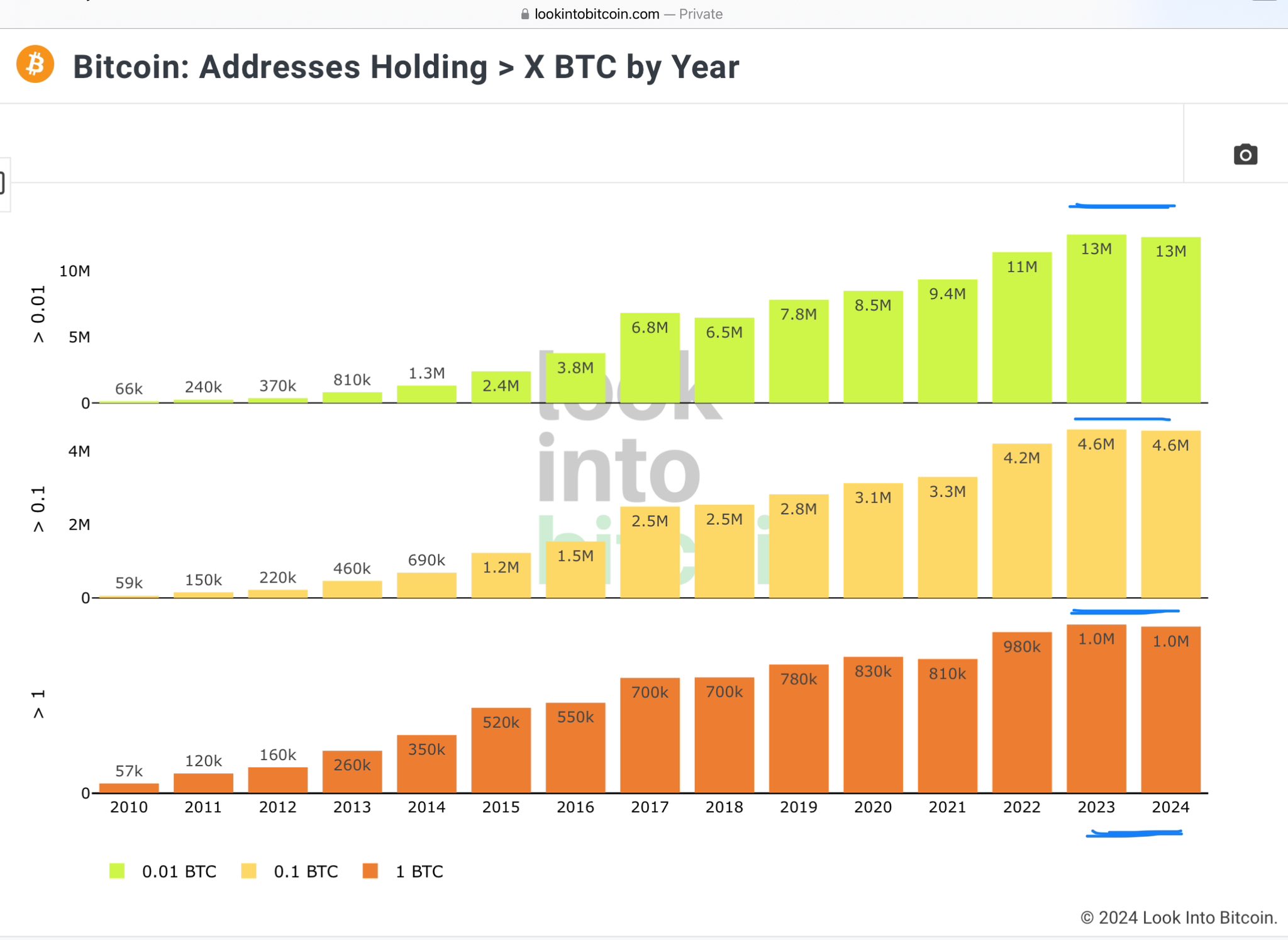

In a separate X submit on Could 28, HODL15Capital raised issues about whether or not ETFs have been impeding the expansion of Bitcoin held in self-custody. A chart depicting BTC holdings throughout totally different addresses reveals stagnant progress in self-custody from 2023 to 2024. Equally, there was no progress noticed between 2017 and 2018, in keeping with the chart. In line with LookIntoBitcoin, only one million addresses maintain 1 BTC or extra.

-

Picture: HODL15 Capital

BTC Value Motion

On Monday, March 27, the Bitcoin bulls made a quick try to take the worth previous $70,000. Nonetheless, it may maintain at that time for extra time with the BTC value dropping underneath $68,000 as soon as once more.

On the draw back, $66,000 stays a vital assist for Bitcoin. If the BTC value drops additional, it could open that gate for $60,000 on the draw back.

BTC ETFs Now Maintain Over 1M Bitcoins in Three Months of Launch