- Bitcoin merchants may not need to promote proper now, as an uptrend appears imminent.

- Miners, typically thought-about market-savvy members, have been unwilling to promote their holdings.

Bitcoin [BTC] famous a smaller vary formation after breaking out previous the $67k resistance final week.

This vary reached from the $70.5k resistance to the $$66.8k help, and the twenty seventh of Might noticed BTC rejected from the shorter-term vary excessive.

Nevertheless, not like the earlier time that Bitcoin examined the $70k space, issues are fairly completely different. The bulls have a a lot better likelihood of continuous the pattern upward.

Promoting stress from profit-taking exercise shall be far much less

Supply: Julio Moreno on X

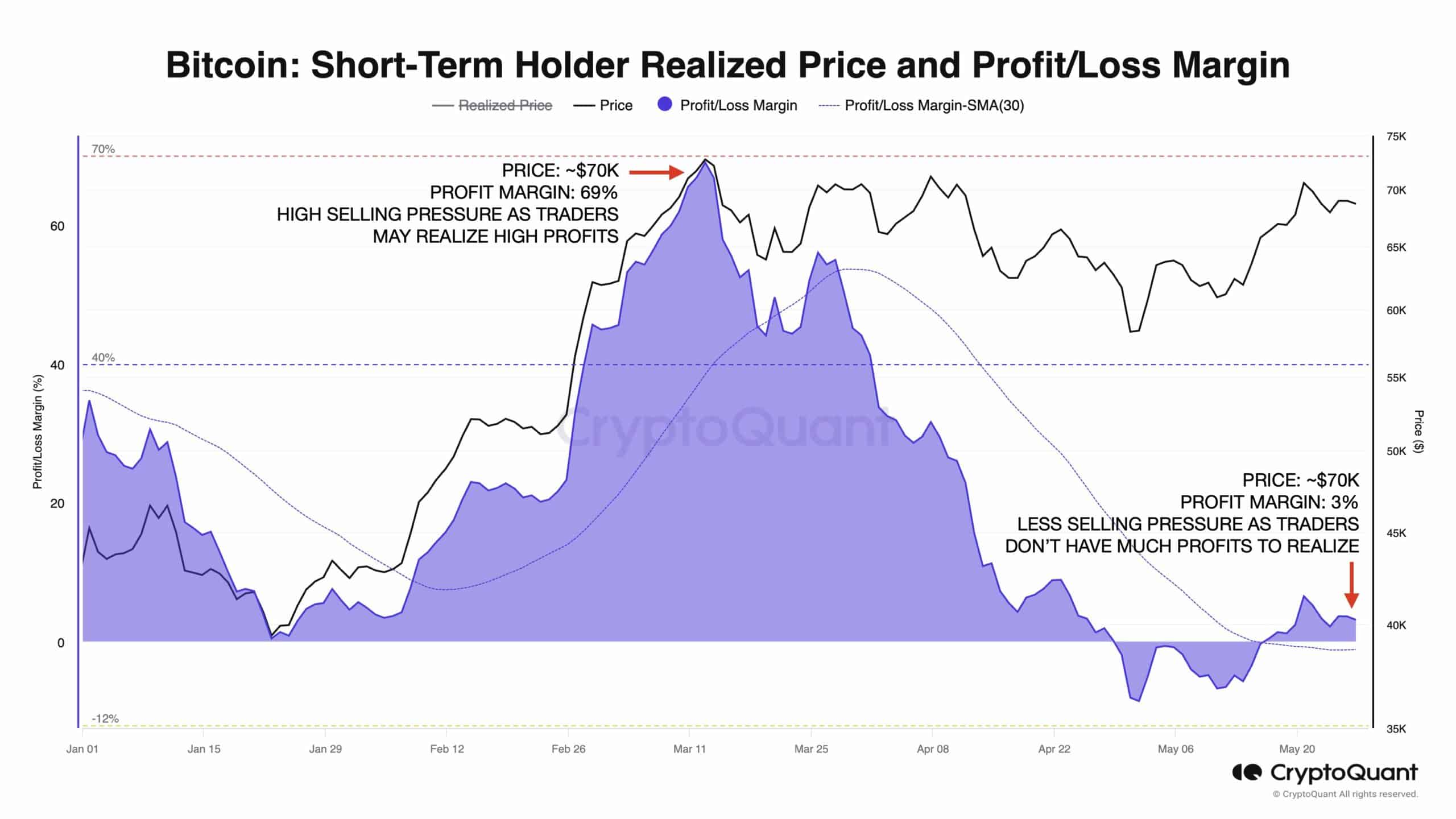

Crypto analyst and head of analysis at CryptoQuant Julio Moreno noticed that the revenue margin at present market costs is at 3% in comparison with the 69% it reached in mid-March when costs rallied that far north.

Which means that the previous 10 weeks of consolidation have absorbed the promoting stress from profit-takers.

It has additionally probably worn out high-leverage longs and shorts within the futures market and paved the best way for a extra natural, spot-driven uptrend.

That is strongly bullish for the market and particularly for traders with a excessive time horizon. The sellers are exhausted, and the patrons have had sufficient time to assemble steam for the following upward cost.

Miner’s place reveals a bullish signal too

Supply: CryptoQuant

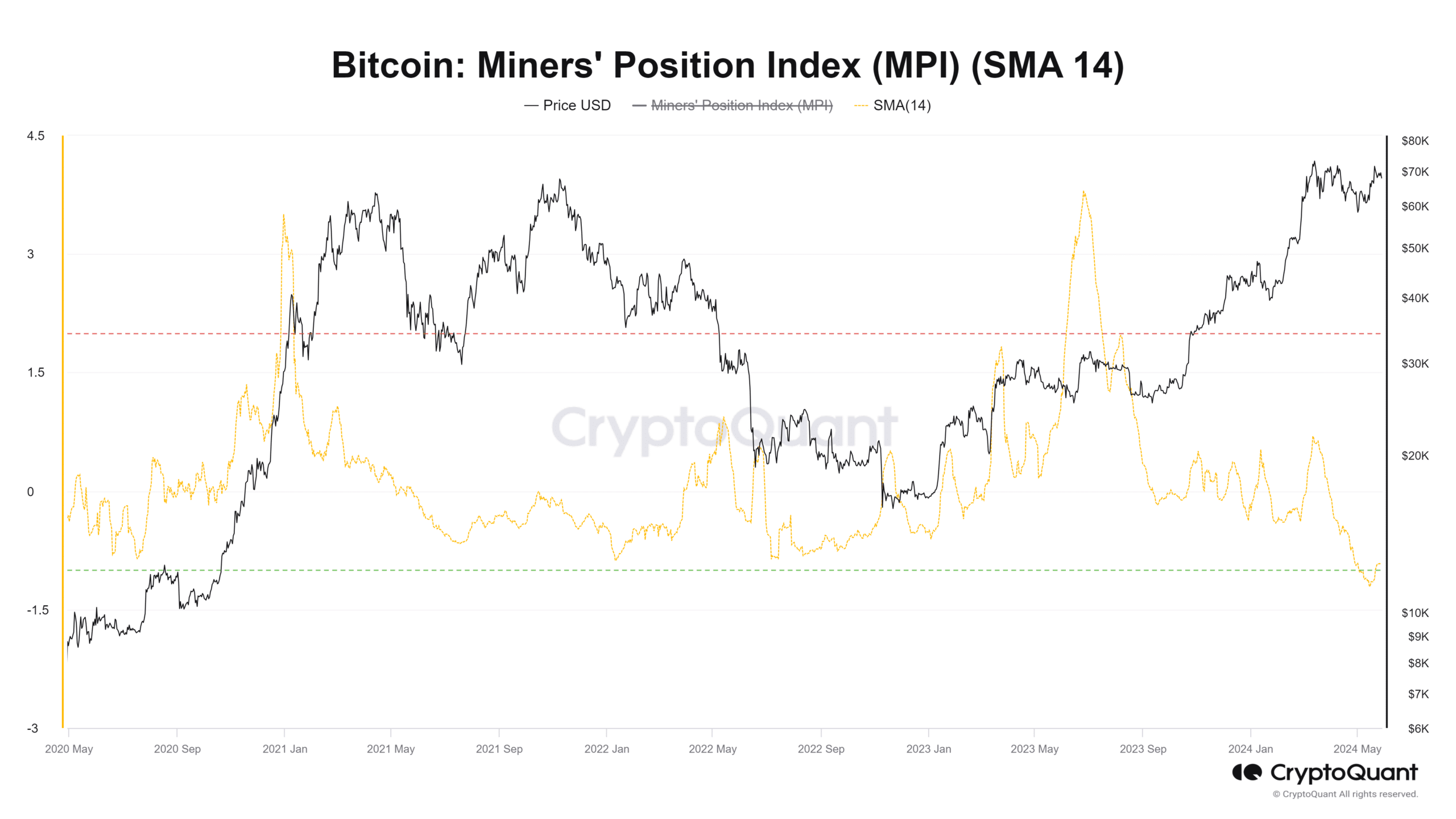

The miner’s place index is the ratio of complete outflow from miners to the one-year transferring common of the full outflow from miners.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

A downtrend on this metric is a bullish signal, because it reveals miners are much less prepared and fewer concerned in promoting.

The 14-period easy transferring common reached a low not seen in additional than 4 years. This confirmed that miners will not be prepared to promote. An uptrend on this metric may inform merchants of a possible prime.