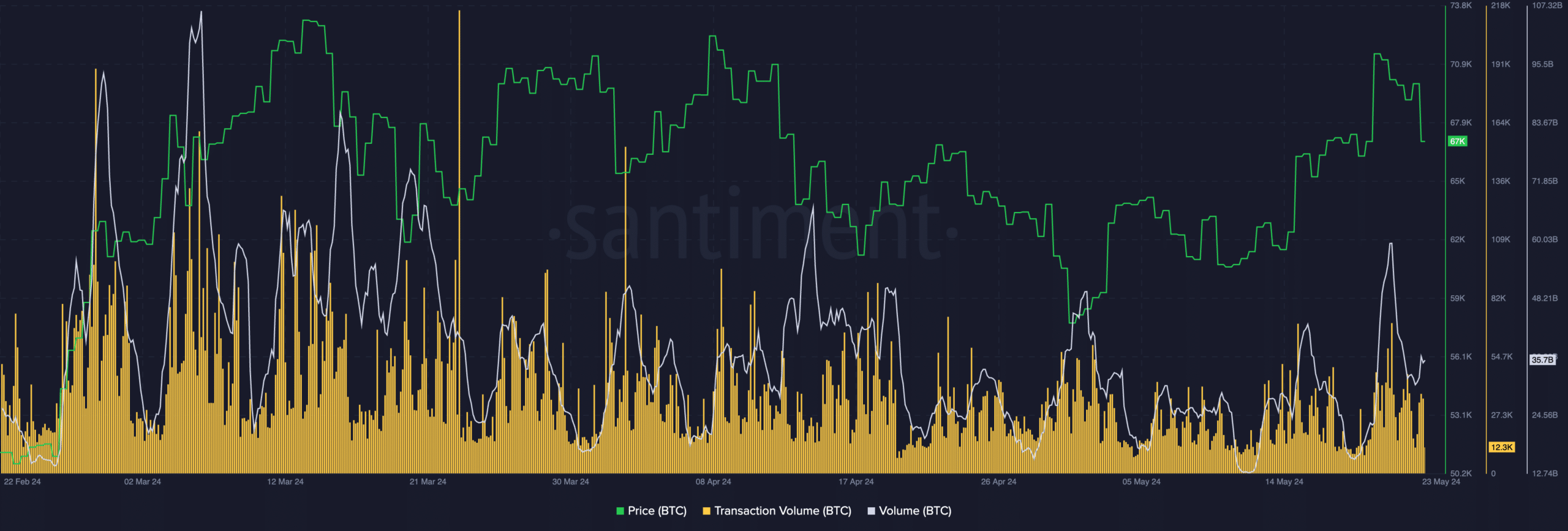

- Information confirmed that the seven-day buying and selling quantity has fallen beneath $14 billion.

- Value of BTC continued to soar whereas profitability grew.

As Bitcoin[BTC] approaches its all-time excessive, the anticipation and FUD across the king coin has additionally soared. Regardless of the optimism and curiosity in Bitcoin hovering, the buying and selling quantity round BTC has declined.

Bitcoin volumes decline

Information revealed that the seven-day buying and selling quantity dropped beneath $14 billion, reaching the identical stage as in 2023 when Bitcoin was buying and selling beneath $30,000.

This could possibly be a troubling indicator and will counsel that the market has cooled down. On the flipside, it may be seen as a optimistic as extra addresses are opting to carry their BTC.

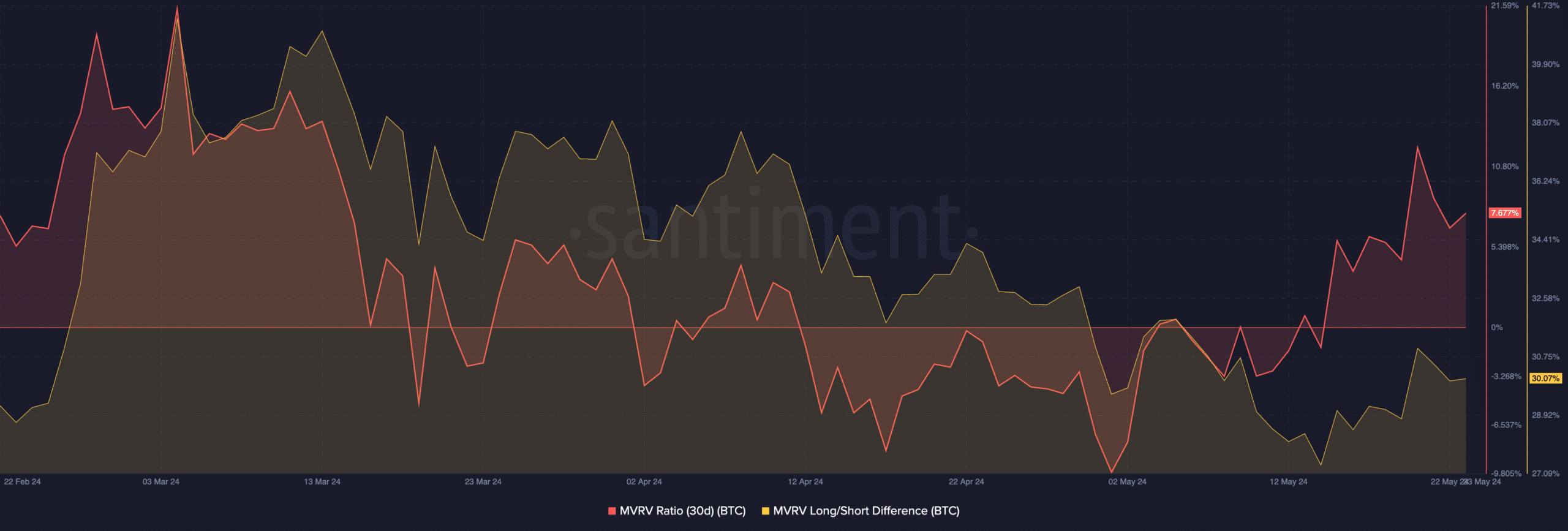

At press time, BTC was buying and selling at $68,899.70 and its worth rose by 2.14% within the final 24 hours. The MVRV ratio for Bitcoin soared, implying that almost all holders had turned worthwhile over the previous couple of days.

As a result of surge in profitability, extra holders could possibly be tempted to promote and drive the value of BTC down.

Nevertheless, the Lengthy/Brief distinction for BTC had additionally grown throughout this era. This implied that the variety of long run holders for BTC rose considerably over the previous couple of days.

Long run holders are much less prone to promote their holdings and are more likely to indicate a calmer temperament throughout vital worth fluctuations.

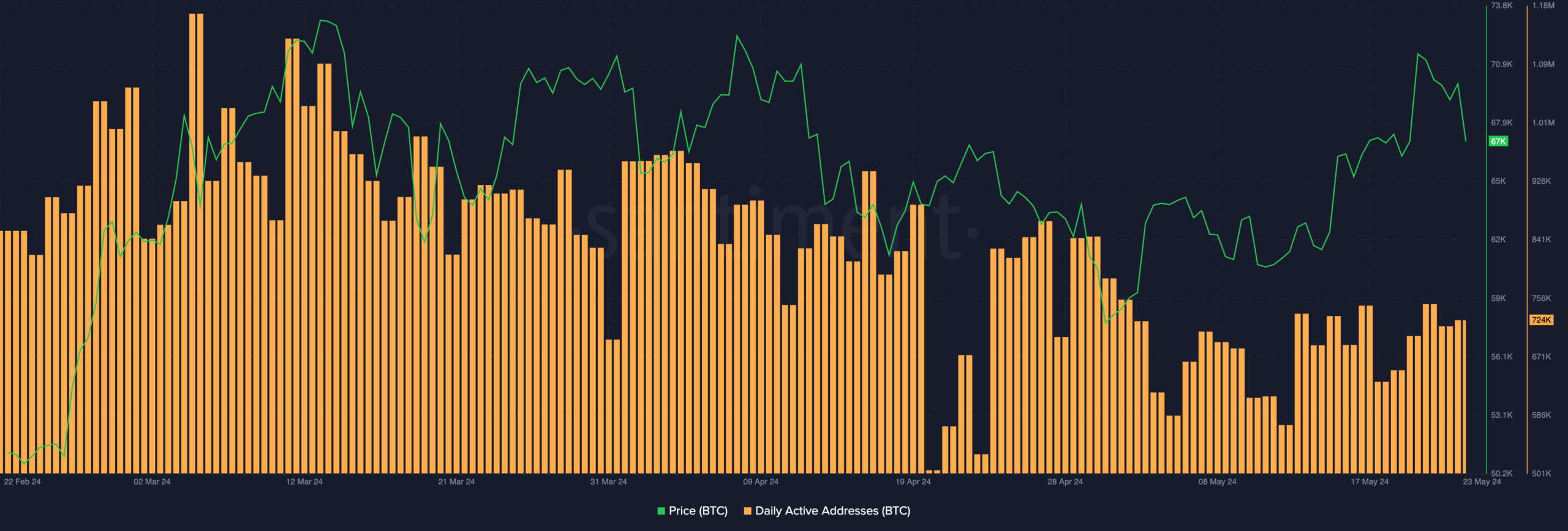

One other indicator of curiosity in Bitcoin can be the variety of lively addresses on the community. AMBCrypto’s examination of Santiment’s information revealed that the variety of every day addresses on the Bitcoin community fell considerably over the previous few weeks.

One of many causes for a similar could possibly be the state of the NFT sector. Over the previous couple of weeks, the NFT gross sales, patrons and sellers declined.

The gross sales quantity for Crypto Slam fell by 75.36% over the previous couple of days. Coupled with that, the overall variety of the NFT transactions on the community decreased by 60% as effectively.

Is your portfolio inexperienced? Test the Bitcoin Revenue Calculator

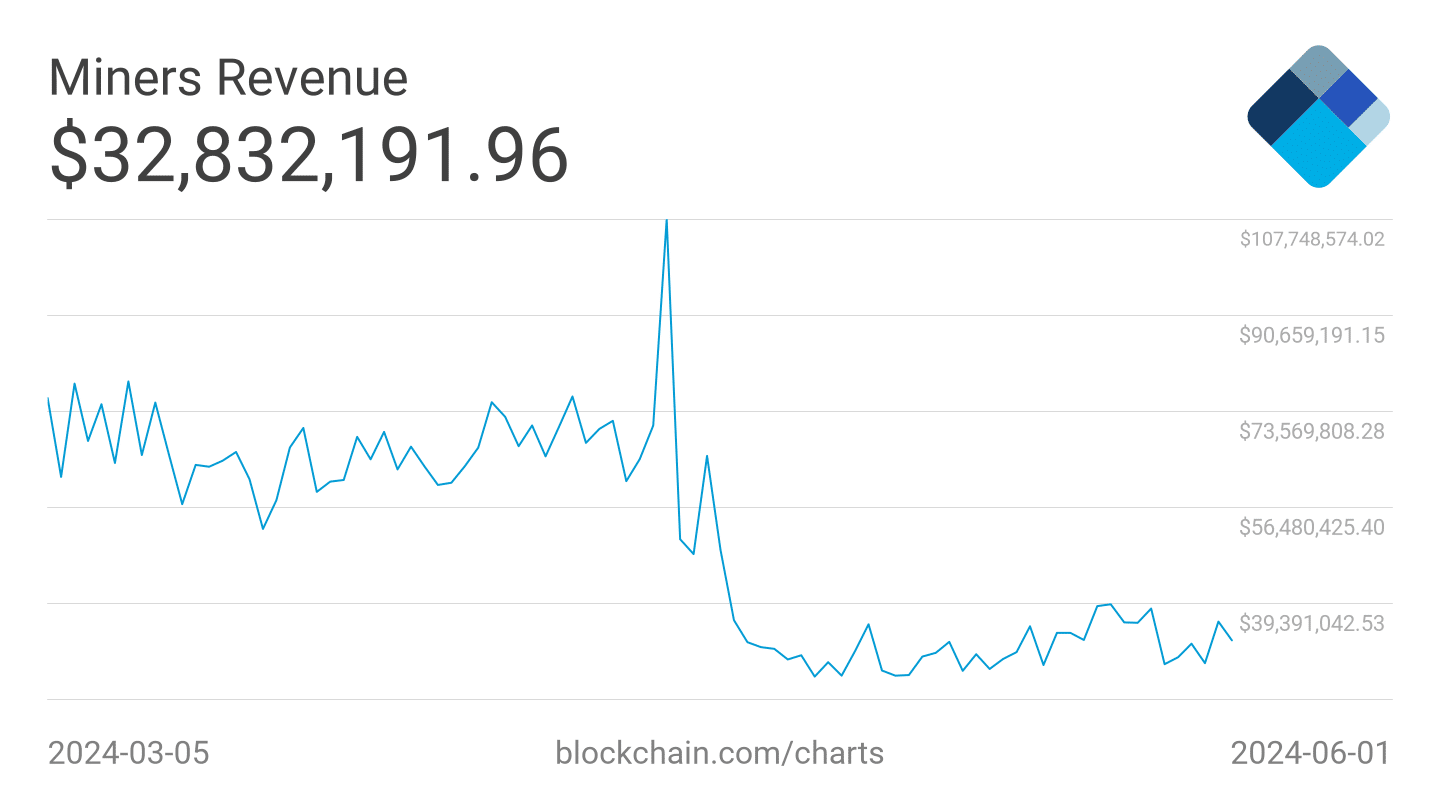

If exercise on the community continues to say no, miner income can get impacted.

Within the current previous, the every day income generated by Bitcoin miners had fallen considerably over the previous couple of days. If this continues, miners must promote their holdings for income, inflicting downward stress on BTC.