- PlanB makes use of the Inventory-to-Move mannequin to foretell Bitcoin’s surge to $500,000.

- Current Bitcoin consolidation close to $70,000 units the stage for a bullish pattern, based on PlanB’s evaluation.

Bitcoin [BTC] continues to carry the highlight, particularly following the latest market consolidations.

Regardless of its present commerce barely beneath the $70,000 mark, with minimal fluctuations up to now week, famend crypto analyst PlanB has shared insights which may herald a major uptick for the cryptocurrency.

PlanB, a seasoned analyst identified for his exact predictions, outlined a possible surge in Bitcoin’s worth submit the most recent halving occasion.

In an in depth evaluation, he utilized his proprietary Bitcoin Inventory-to-Move mannequin (S2F), alongside different chart indicators, to attract parallels with earlier bull cycles, suggesting a burgeoning bull run is on the horizon.

Understanding the S2F mannequin and market cycles

The Inventory-to-Move mannequin, which measures the present inventory of a commodity in opposition to its stream of manufacturing, signifies that Bitcoin is gearing up for an exponential rise.

In keeping with PlanB’s newest evaluation, the shut of final month above $67,000 alerts the daybreak of a brand new cycle, doubtlessly mirroring the post-halving surges seen in earlier years.

The analyst’s projections put Bitcoin at a staggering $500,000 within the upcoming cycle, emphasizing the sample adopted in previous bull runs.

This prediction is supported by PlanB’s examination of the Bitcoin Market Cycle indicator, which corroborates the doorway right into a bull market section.

Nonetheless, the analyst advises persistence, suggesting that the actual momentum will begin as soon as a fast worth ascent begins.

This was additional affirmed by the Relative Power Index (RSI) readings, which presently resemble these seen earlier than the 2012 bull run, indicating early phases of a bullish pattern.

Including to the bullish outlook, PlanB mentioned the Bitcoin 200 Week Shifting Common (WMA), which is trending upwards—an indication historically seen as a precursor to a bull market.

The 200 WMA’s alignment with present market alerts means that Bitcoin may quickly breach the $100,000 mark.

Furthermore, the Bitcoin Realized Value indicator, which assesses the revenue ratio of cash moved on-chain, aligns with historic knowledge to additional help the bullish situation.

PlanB expects that Bitcoin’s worth won’t fall beneath $64,000 earlier than it embarks on the anticipated rally.

Tracing PlanB’s Bitcoin predictions

PlanB just isn’t new to creating daring forecasts within the cryptocurrency area.

With a historical past of correct predictions, the analyst gained recognition for his foresight in 2020 when, regardless of widespread skepticism and a market flooded with concern, uncertainty, and doubt (FUD), he predicted Bitcoin would attain $55,000.

True to his projection, by 2021, Bitcoin not solely hit that mark however soared previous it.

Nonetheless, monetary markets are inherently unsure, and never all of PlanB’s predictions have materialized as anticipated. As an example, he has lengthy maintained that Bitcoin would attain the $100k milestone.

Though he forecasted this achievement for 2021, Bitcoin fell wanting this goal. Regardless of not reaching the anticipated $100k, Bitcoin nonetheless achieved a major milestone by surpassing $69,000 for the primary time that yr.

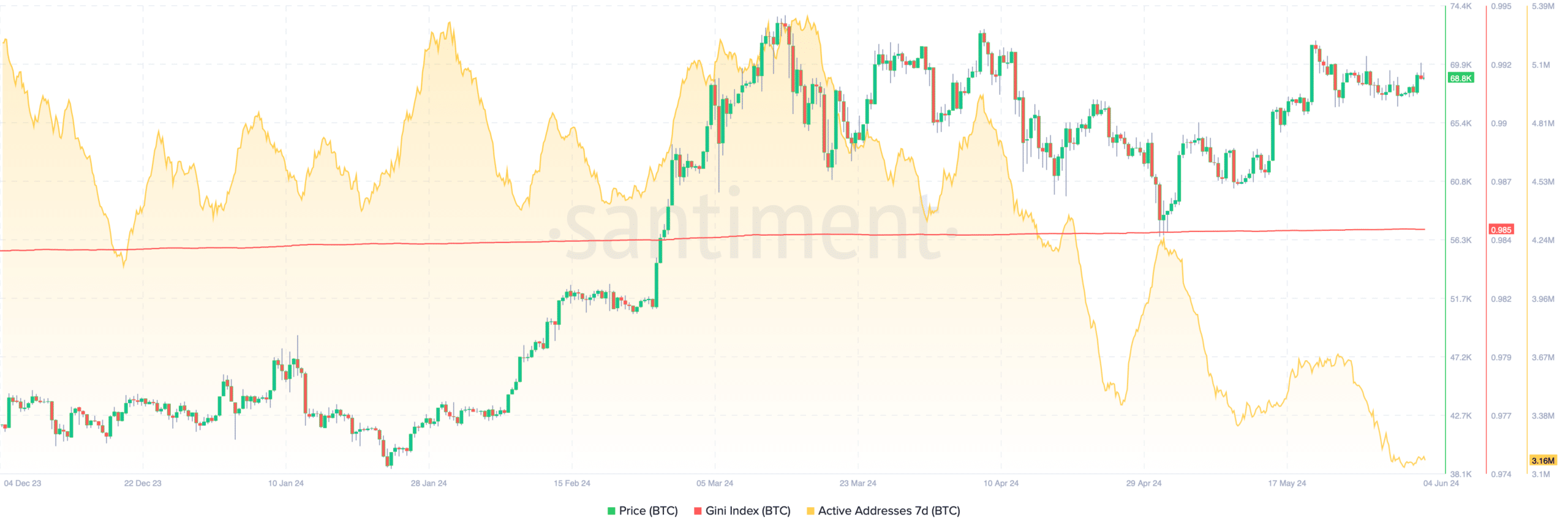

As PlanB revisits his $100,000 Bitcoin forecast, it’s essential to look at the underlying fundamentals. Market knowledge from Santiment exhibits a declining pattern in Bitcoin’s 7-day lively addresses, suggesting a doable lower in market participation or buying and selling exercise.

Concurrently, the Gini index of BTC stands at 0.985, indicating a excessive focus of wealth amongst holders, which may impression worth volatility and buying and selling habits.

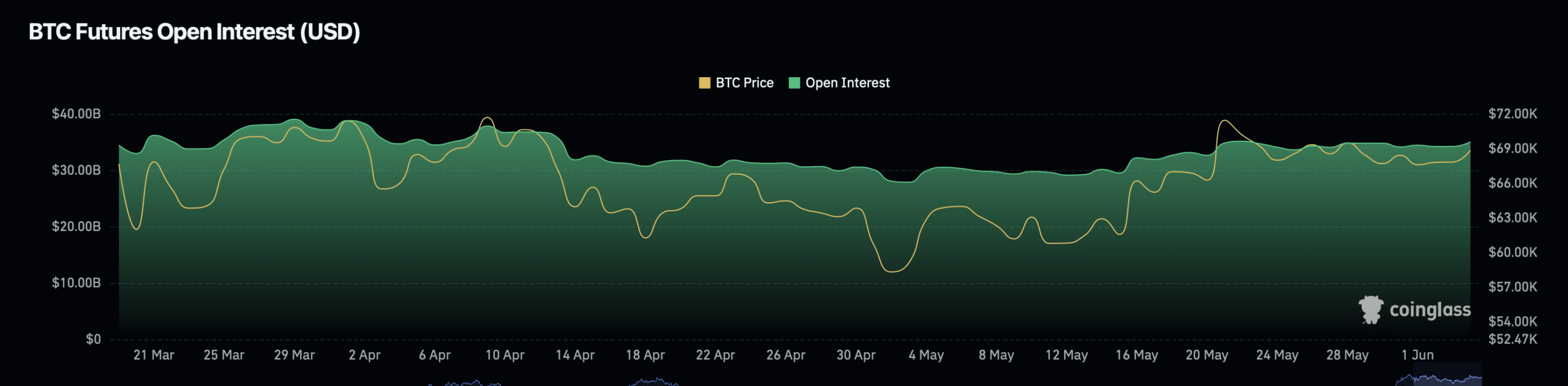

On a extra optimistic word, Bitcoin’s open curiosity—a measure of the full variety of excellent by-product contracts that haven’t been settled—has proven vital development.

Over the previous 24 hours alone, this metric elevated by 1.36%, with the full valuation rising to $35.83 billion.

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

This improve, together with a virtually 25% surge in open curiosity worth throughout the identical interval, factors to a bullish sentiment amongst merchants.

Supporting this optimistic outlook, AMBCrypto reported that Bitcoin has fashioned an asymmetrical triangle on the 4-hour chart, a formation that sometimes precedes a major worth motion, doubtlessly propelling BTC to as excessive as $74,400.