- The crypto market capitalization has elevated barely within the final 24 hours.

- BTC and ETH’s value improve contributed to the rise out there cap.

The cryptocurrency market lately skilled a slight improve in market capitalization. This progress was largely pushed by the costs of Bitcoin [BTC] and Ethereum [ETH], which dominate the market.

Moreover, each property have been experiencing vital accumulation quantity lately.

Bitcoin, Ethereum contribute to market improve

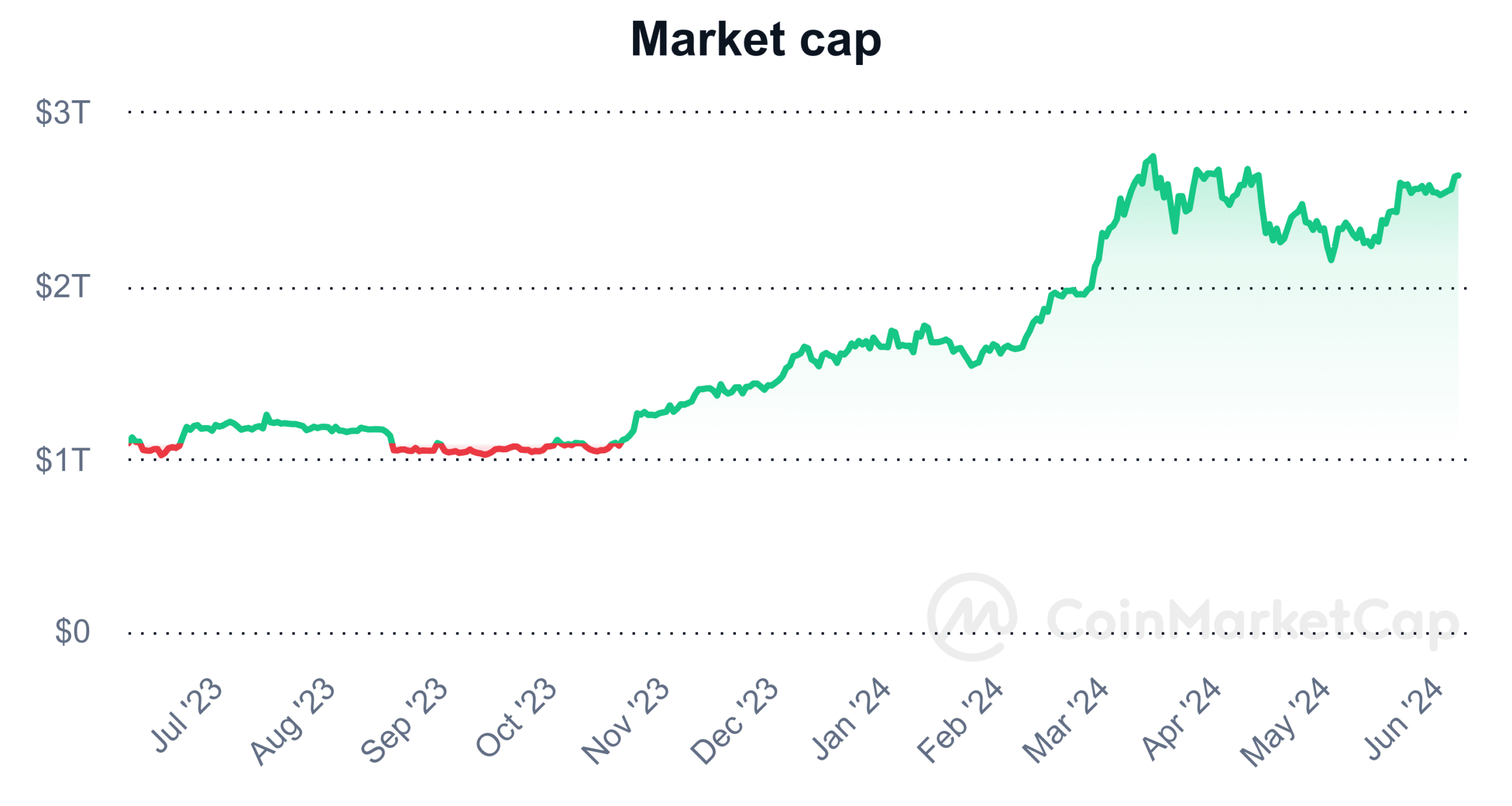

In keeping with information from CoinMarketCap, the cryptocurrency market’s market capitalization has elevated by over 1% within the final 24 hours.

At present, the market cap stands at over $2.6 trillion. The evaluation revealed that Bitcoin accounts for over 53% of the market cap, amounting to roughly $1.4 trillion, whereas Ethereum holds almost 18%, valued at round $463 billion.

Additional evaluation revealed that the market capitalization elevated by virtually $1 trillion from the tip of final month to now.

On the finish of Might, the market cap was roughly $1.54 trillion. At present, it stands at round $2.54 trillion, indicating a rise of almost $1 trillion.

Bitcoin, Ethereum see elevated accumulation

Latest evaluation signifies a rise within the accumulation of Bitcoin and Ethereum over the previous few days. This accumulation coincides with notable value actions, contributing to the rise in market capitalization.

In keeping with information from CryptoQuant, the pockets reserves holding between 1,000 and 10,000 Bitcoins have been rising.

These wallets now collectively maintain over 3.6 million BTC, indicating substantial accumulation regardless of current value fluctuations.

Additional evaluation confirmed that this pattern has been ongoing since March. Moreover, the wallets within the 1,000 BTC class now account for about 40% of the entire Bitcoin provide.

Moreover, information signifies that Ethereum has been experiencing elevated accumulation by massive addresses.

The chart reveals an upward pattern in accumulation from wallets holding between 10,000 and 100,000 ETH. These addresses now maintain over 340,000 ETH, valued at greater than $1.3 billion.

Ethereum sees extra holders than Bitcoin

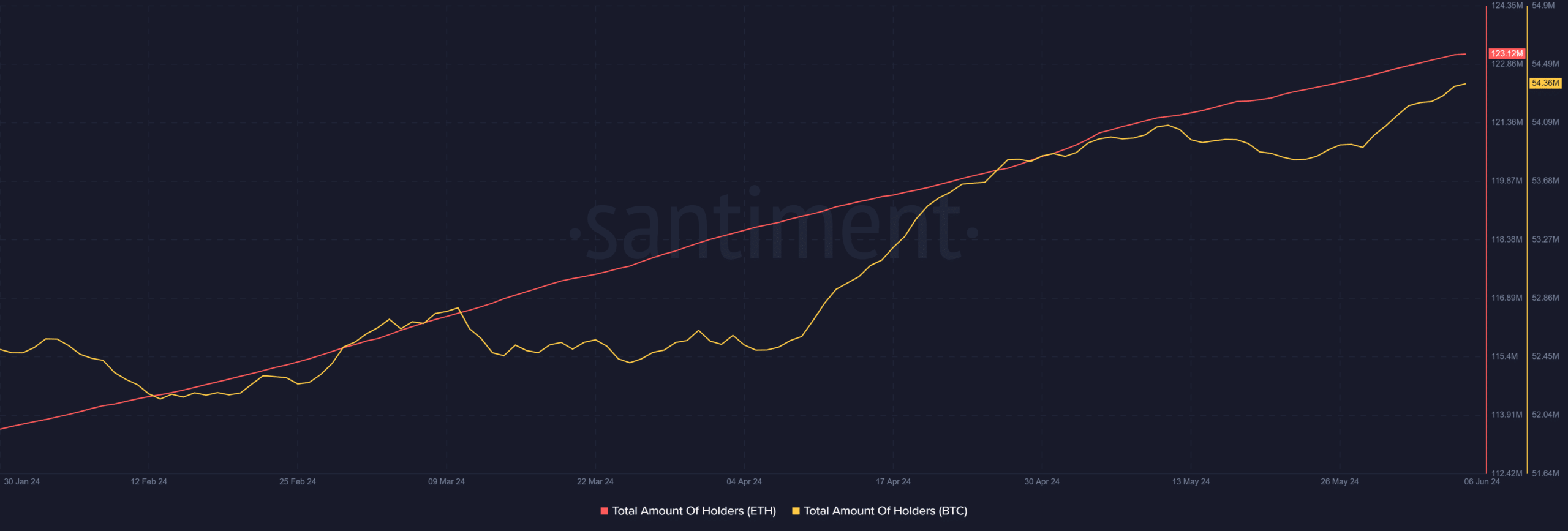

Bitcoin and Ethereum have each skilled elevated accumulation, however Ethereum at present has extra holders.

In keeping with information from Santiment, the variety of Ethereum holders has surged in recent times, reaching almost 123 million. In distinction, the variety of Bitcoin holders stands at round 54.2 million.

This means that the variety of Ethereum holders is greater than double that of Bitcoin holders. A serious motive for this may very well be the price of entry into these property.

At present, Bitcoin’s worth has elevated once more, with predictions of additional rises sooner or later.

This improve could drive extra merchants towards different property like Ethereum and others, subsequently impacting the costs of those property.

How ETH, BTC have trended within the final 24 hours

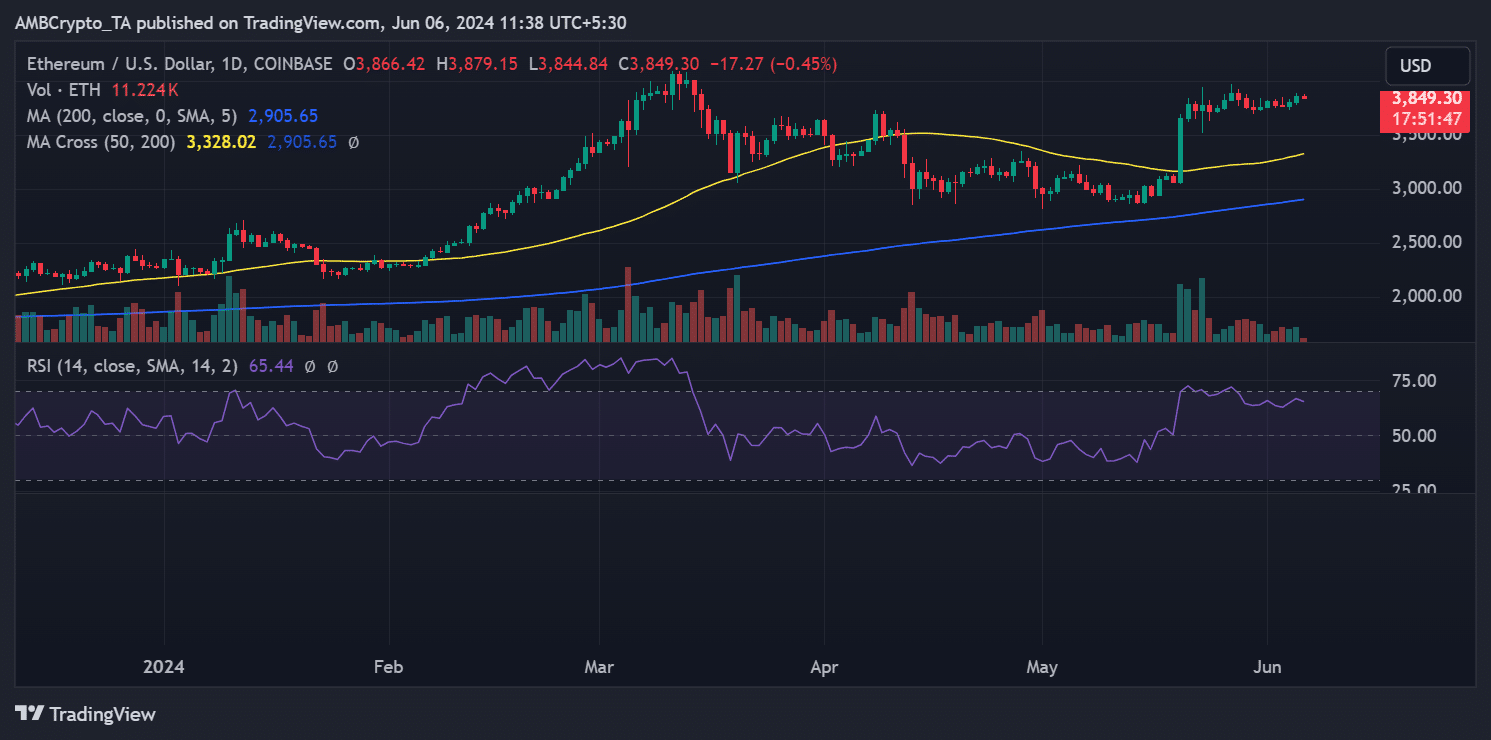

AMBCrypto’s every day evaluation of Ethereum revealed a constructive value motion on fifth June, with a 1.48% improve, bringing its value to round $3,866.

Regardless of current struggles, Ethereum has managed to remain inside this value vary. As of this writing, it’s nonetheless buying and selling within the $3,800 vary, with a decline of lower than 1%.

Moreover, an evaluation of Ethereum’s Relative Energy Index (RSI) indicated that it stays in a powerful bull pattern. As of this writing, its RSI is above 65.

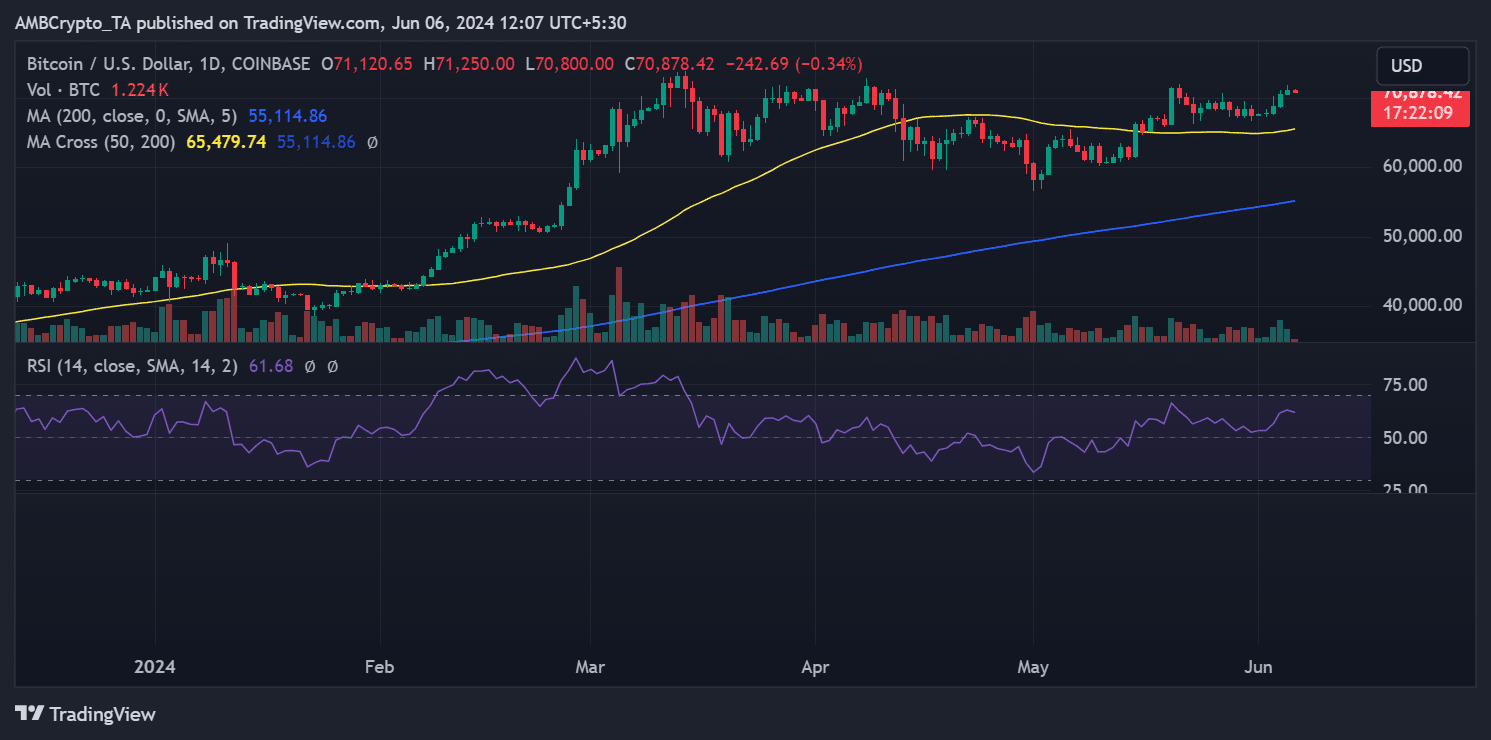

Evaluation of the Bitcoin value pattern confirmed constructive bounces over the previous few days. The chart indicated a five-day consecutive rise, taking its value from round $67,700 to over $71,000.

Learn Bitcoin (BTC) Worth Prediction 2024-25

By the tip of buying and selling on fifth June, Bitcoin was buying and selling at roughly $71,121, marking a rise of virtually 1%. As of this writing, it has barely declined to the $70,000 area, with a lower of lower than 1%.

In keeping with its RSI, BTC remained in a bull pattern regardless of the current value decline. The RSI was above 60 as of this writing.