Picture supply: Getty Photos

The UK market is understood for its high-yielding earnings shares, however the firm I’m in the present day is phenomenal, even right here.

This enterprise has a £500m market cap and operates within the power sector. Its shares at present boast a forecast dividend yield of 17%. Administration lately reiterated their assist for this payout and my sums counsel it may very well be sustainable.

I lately purchased these shares. I’m hopeful that when the mud settles after the Autumn Price range on 30 October, investor confidence on this enterprise might enhance.

Pumping out money

Serica Power (LSE: SQZ) is among the high 10 oil and gasoline producers within the UK North Sea. The corporate has grown quickly in recent times by shopping for mature fields from bigger operators comparable to BP.

This development run was then prolonged with the acquisition of rival North Sea agency Tailwind Power in 2023.

Serica’s concentrate on producing property signifies that it doesn’t carry the all-or-nothing threat of oil and gasoline explorers. As a substitute, the corporate’s expenditure is fastidiously focused to maximise manufacturing from recognized reserves.

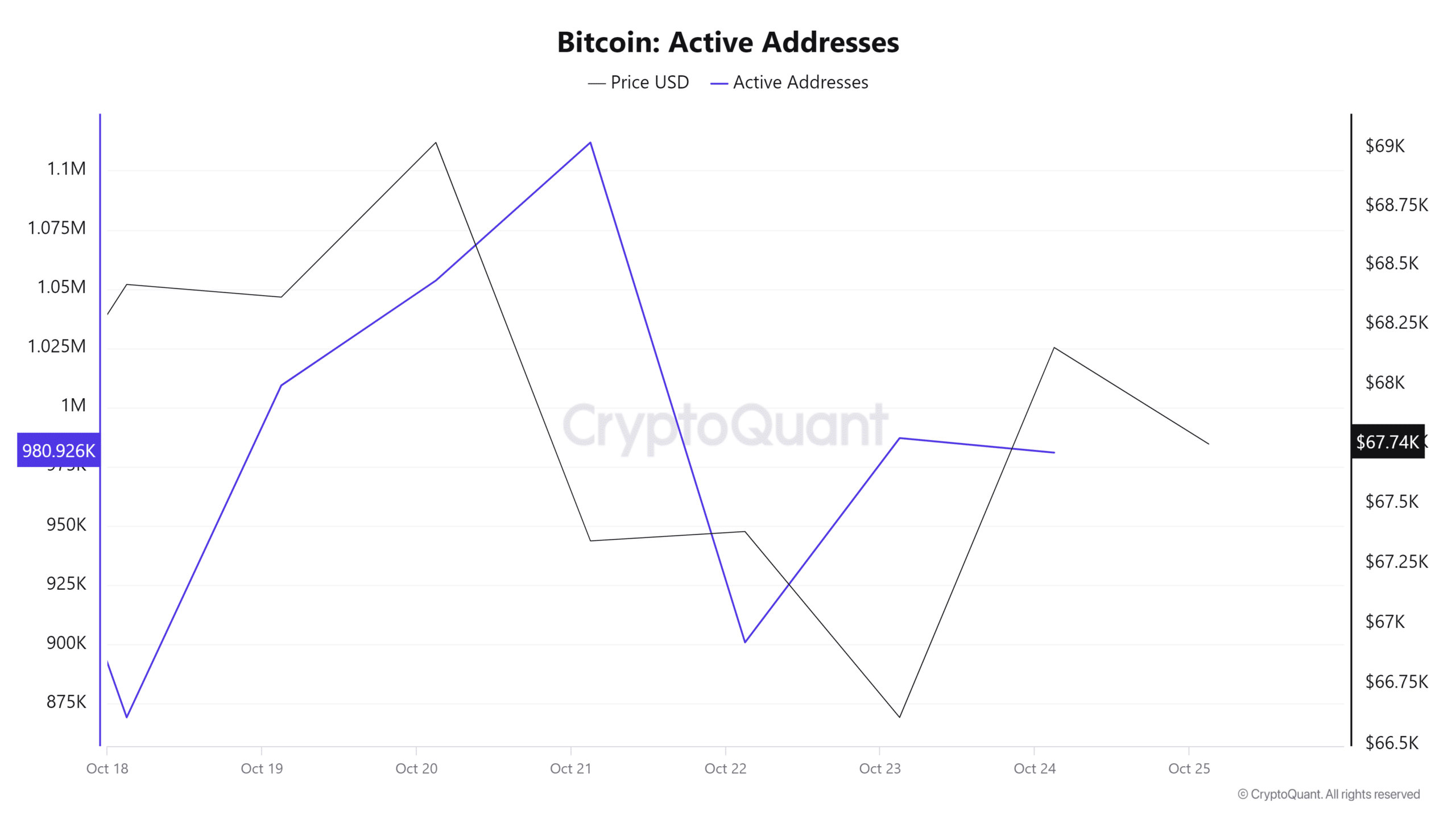

In consequence, the group enterprise generates quite a lot of surplus money. A lot of this has been returned to shareholders over the previous few years, as this chart exhibits.

Chart by TradingView

The most recent dealer forecasts counsel Serica’s dividend will stay at 23p per share this 12 months. That provides a forecast dividend yield of 17.4%, primarily based on the current 132p share value.

Why are Serica shares so low cost?

This excessive yield is partly a mirrored image of the inventory’s low valuation. Serica shares at present commerce on simply 3 times 2024 forecast earnings, in line with current dealer estimates.

The shares have fallen by 40% to this point this 12 months as buyers have taken fright on the prospect of adjustments to UK tax and power insurance policies.

One concern is that potential adjustments within the Autumn Price range might make it more durable to function profitably within the North Sea.

One specific threat flagged up by Serica’s new chief government pertains to capital allowances. Briefly, adjustments to those guidelines may scale back corporations’ potential to say tax reduction on future spending. This might make it much less engaging to spend money on North Sea property.

The opposite important threat I can see is just that Serica’s present manufacturing charge gained’t be sustainable endlessly. Many of those fields are comparatively mature. Manufacturing will steadily decline with out funding in extra developments and the acquisition of latest property.

The uncertainty across the funds means planning is troublesome proper now. There’s a chance that Serica may run off its current property and enter a managed decline. In that case, the 17% dividend yield could be offset by a gradual decline within the share value.

Why I’ve been shopping for

I gained’t lie. Serica Power might be one of many riskier shares I maintain at present.

Nonetheless, I’m snug with the place as a part of a diversified portfolio. Right here’s why.

In my expertise, markets hate uncertainty and concern change. However what I’ve discovered is that very often, when new guidelines are established, good corporations are in a position to adapt and stay worthwhile.

My guess is that’s what’s going to occur right here. I’m sitting tight forward of the funds. I’m hopeful that Serica shares will get better when there’s extra readability about future funding selections.