- Bitcoin’s October positive aspects largely stem from halving-driven provide shortage.

- As per AMBCrypto, a provide shock has but to dissipate.

Bitcoin [BTC] has been consolidating throughout the $66K-$67K vary for the previous seven days, presently buying and selling at $67,160 with a slight 0.57% acquire from yesterday. This consolidation mirrors BTC’s July sample, the place resistance at $68K led to a swift drop under $55K. Thus, staying inside this vary is essential to keep away from the same downturn.

Curiously, October’s positive aspects have largely been pushed by a post-halving provide squeeze, bringing contemporary shortage to the market. Now, as BTC wraps up its most bullish month, situations could also be ripe for a provide shock if demand aligns.

Bitcoin halving impression is but to materialize

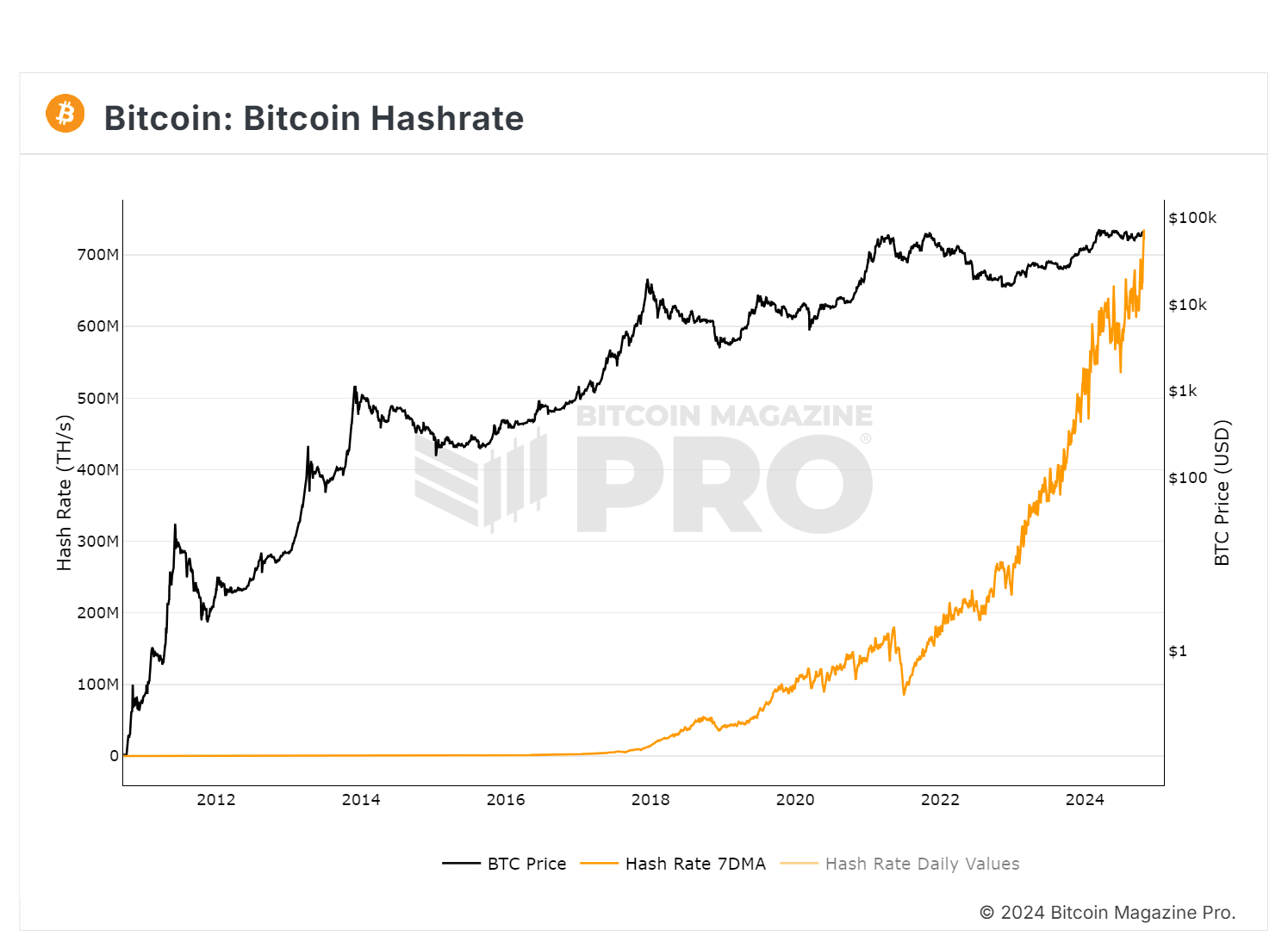

Traditionally, the post-halving interval has acted as a big catalyst for bullish rallies, notably from an financial standpoint. As BTC provide tightens, miners are sometimes probably the most impacted, resulting in their widespread capitulation.

In easy phrases, as block rewards lower, miners might discover it difficult to cowl their operational prices, prompting many to exit the market.

This shakeout leaves solely probably the most environment friendly miners within the ecosystem, probably making a extra strong atmosphere for value appreciation as provide diminishes.

As evidenced by the chart above, miner reserves have been steadily declining because the April halving, reflecting these dynamics.

Whereas one may assume this may create promoting stress, the shortage of BTC amongst miners – particularly as block rewards hit decrease lows – has not considerably impacted the market.

If demand stays excessive, a lot of the promoting stress is absorbed, creating best situations for a provide crunch.

This atmosphere stored October bullish, with BTC almost testing $70K. Nevertheless, a breakout has but to materialize, indicating that the anticipated provide shock has not occurred.

This situation maintains optimism for a possible parabolic rally as we strategy the top of This fall.

Environment friendly miners are nonetheless within the recreation

The consequences of the halving are evident: Bitcoin’s mining problem has reached an all-time excessive, that means it now requires extra computational energy to course of transactions. This example is forcing out much less environment friendly miners.

In consequence, the hash price has additionally elevated, indicating a safer and strong community. This pattern highlights the consolidation of mining operations, the place solely these with the very best expertise and lowest prices can survive.

Briefly, a mass capitulation might nonetheless be on the horizon, probably resulting in a big value enhance as accessible provide dwindles towards persistent demand.

Institutional curiosity is rising

At present, all exchanges are seeing a big enhance in BTC reserves, indicating promoting stress primarily from the mining neighborhood for the explanations talked about above.

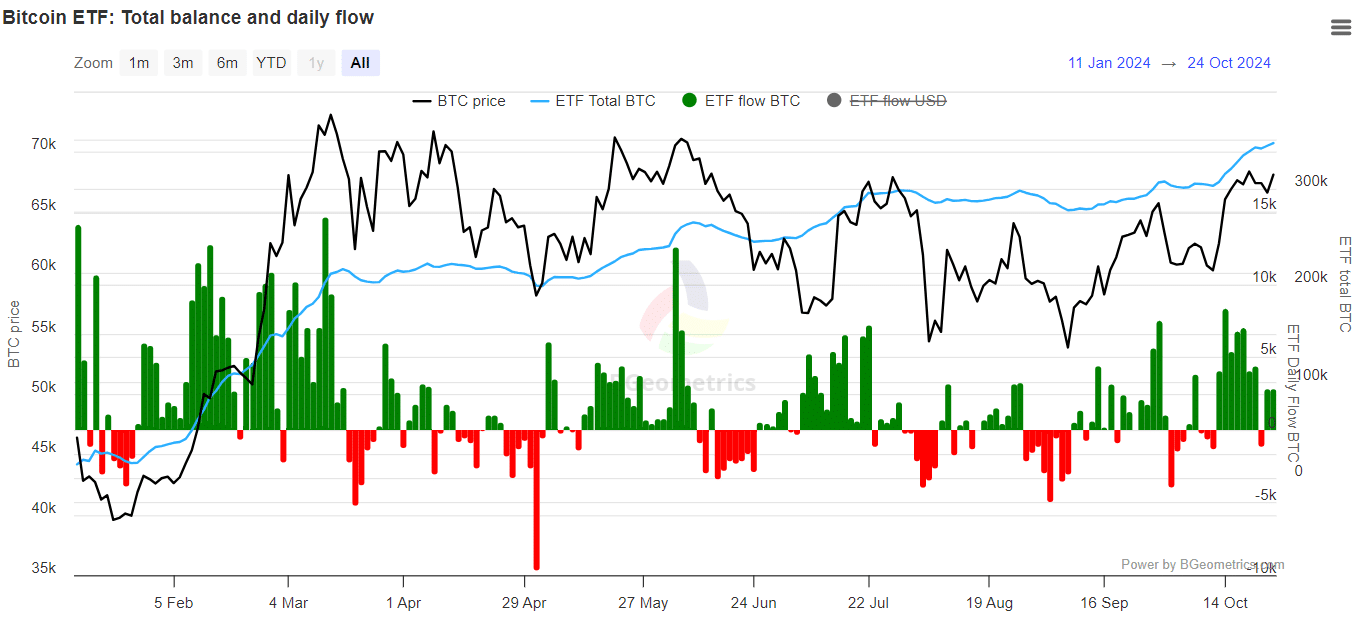

As famous earlier, a provide shock might materialize if demand stays excessive regardless of this stress; in any other case, a repeat of the July cycle may happen. Curiously, October has seen a notable uptick in ETF inflows, suggesting rising retail curiosity.

Moreover, BlackRock’s Bitcoin holdings have exceeded 400K BTC, reaching 403,725 BTC, price $26.98 billion. Over the previous two weeks alone, BlackRock has bought 34,085 BTC, valued at $2.3 billion.

This means that institutional demand is surging, reinforcing AMBCrypto’s preliminary speculation of a brewing provide shock.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Whereas the present consolidation is essential for stopping BTC from faltering, a constant steadiness between demand and provide will in the end decide whether or not BTC can attain a brand new ATH earlier than the top of this quarter.

Regardless, the miner capitulation highlights the consequences of the post-halving atmosphere; their exit now requires a extra sustained shopping for effort at present costs. Whereas a slight retracement might happen, a full-fledged pullback appears unlikely.