- Bitcoin dominance has surged to new heights, indicating a bullish market sentiment.

- But, dwindling new investor curiosity could impede this upward trajectory.

Bitcoin [BTC] dominance has surged to a brand new excessive, nearing 57% of the whole market share in opposition to altcoins. This rise aligns with BTC’s renewed momentum because it breaks previous the $64K mark, now buying and selling at $64,400.

This value vary good points significance resulting from its similarity to the late August rally, when bearish strain drove BTC down beneath $55K in simply two weeks.

Thus, this degree now represents a key battleground, with the potential to find out BTC’s subsequent huge transfer.

Bitcoin dominance doesn’t assure a rebound

Primarily, Bitcoin dominance exhibits BTC’s share within the general crypto market.

As the primary and largest cryptocurrency by market cap, BTC maintains a number one place, and merchants intently watch its dominance as an indicator of market sentiment.

Presently, the outlook is optimistic, with a good portion of stakeholders transferring out of internet loss positions. Nonetheless, for a breakout to materialize, these traders should keep away from offloading their positions.

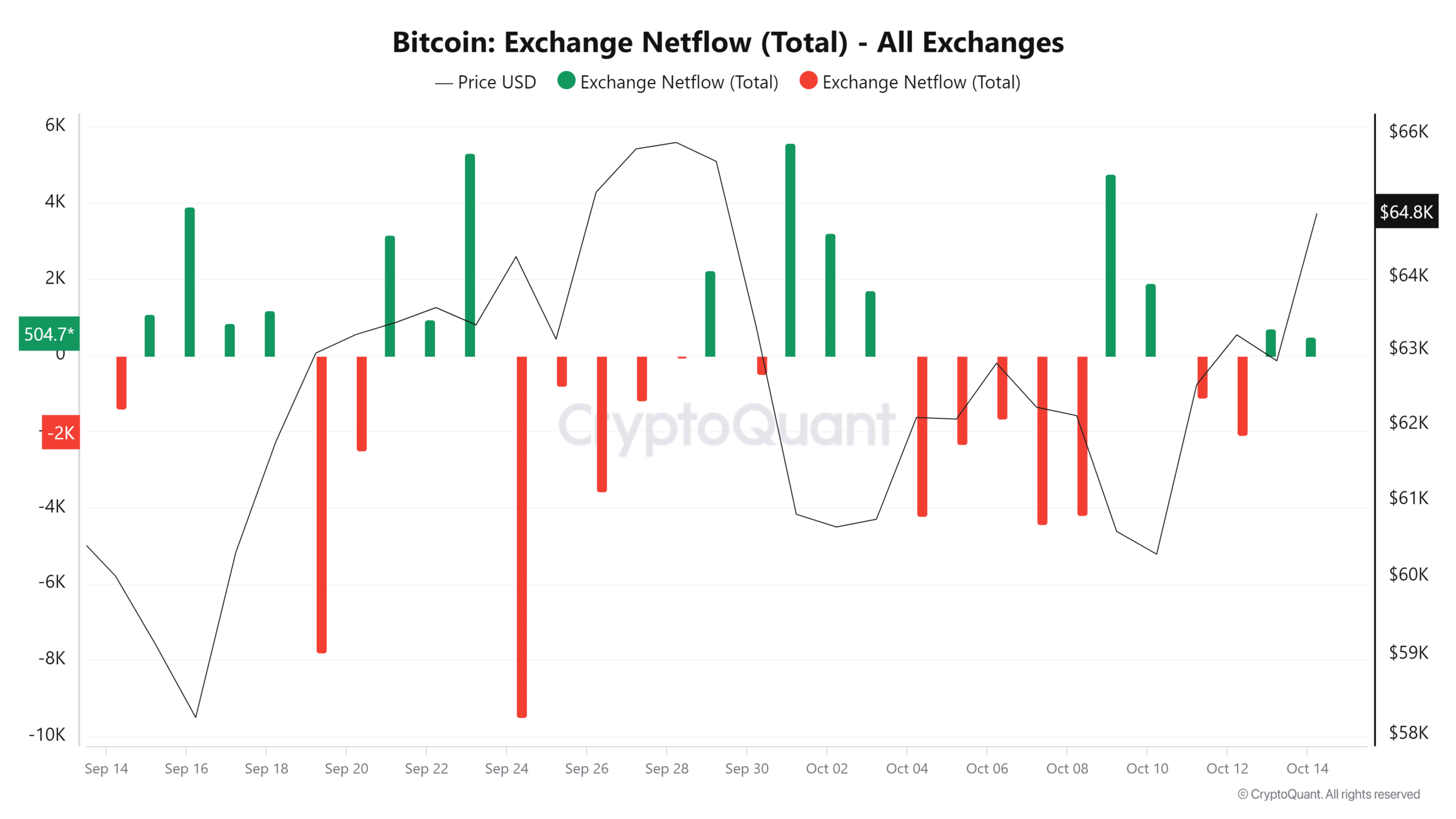

Traditionally, a surge in Bitcoin deposits to exchanges has coincided with day by day value lows. If merchants don’t view the present value as a “dip,” the anticipated rise to $66K could falter.

Moreover, what’s extra regarding is the dearth of recent traders getting into the market regardless of excessive Bitcoin dominance. This lack of recent capital may restrict BTC from reaching its subsequent value goal.

If this pattern doesn’t reverse within the subsequent day or two, Bitcoin is perhaps dealing with a correction that might pull it again to $62K.

In brief, the present $64K degree hasn’t but flipped to help, indicating uncertainty amongst traders about getting into the market at this value. Many could also be ready for a retracement to purchase when BTC reaches a neighborhood low.

One other retracement could turn out to be needed

In its effort to repeat the late July rally when BTC closed close to $66K, Bitcoin dominance has faltered thrice since then, primarily pushed by speculative merchants.

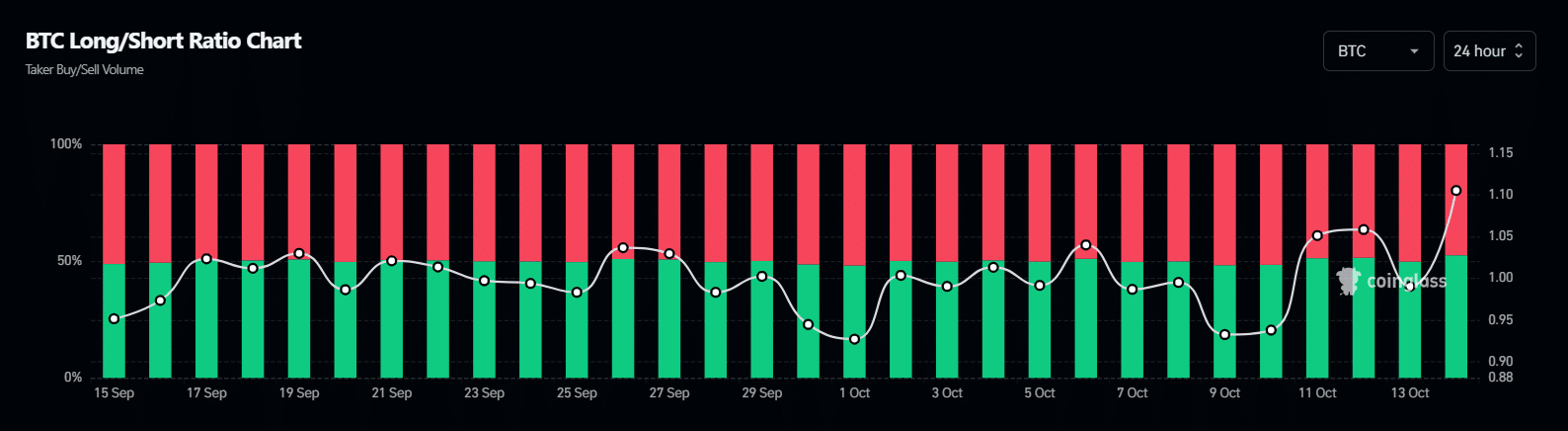

For example, in the course of the late September cycle, when BTC practically reached its value goal, extreme shorting led to a pullback as lengthy positions had been pressured to promote their holdings.

Presently, a majority of future merchants are betting on a rebound, as evidenced by the spike within the pink zone.

Nonetheless, warning is warranted, as spot market merchants don’t share the identical bullish outlook for BTC as these within the derivatives market.

This divergence could also be exploited by brief sellers, who’re more likely to improve their positions, capitalizing on the dearth of recent capital getting into the market.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Subsequently, alongside excessive Bitcoin dominance, changing the $64K degree into help is essential. This will happen if new patrons view the present value as a possibility to purchase the dip.

Conversely, in the event that they hesitate, a retracement to the $62K–$64K vary could also be needed for a wholesome shakeout earlier than BTC can break above $66K.

![Simply launched: October's higher-risk, high-reward inventory advice [PREMIUM PICKS] 5 Fire](https://www.fool.co.uk/wp-content/uploads/2023/05/Fire-1200x675.jpg)