Picture supply: Getty Photos

Investing in FTSE 250 shares could be a wild journey. However over the long run, choosing shares from the UK’s second-tier share index could be a extremely worthwhile technique.

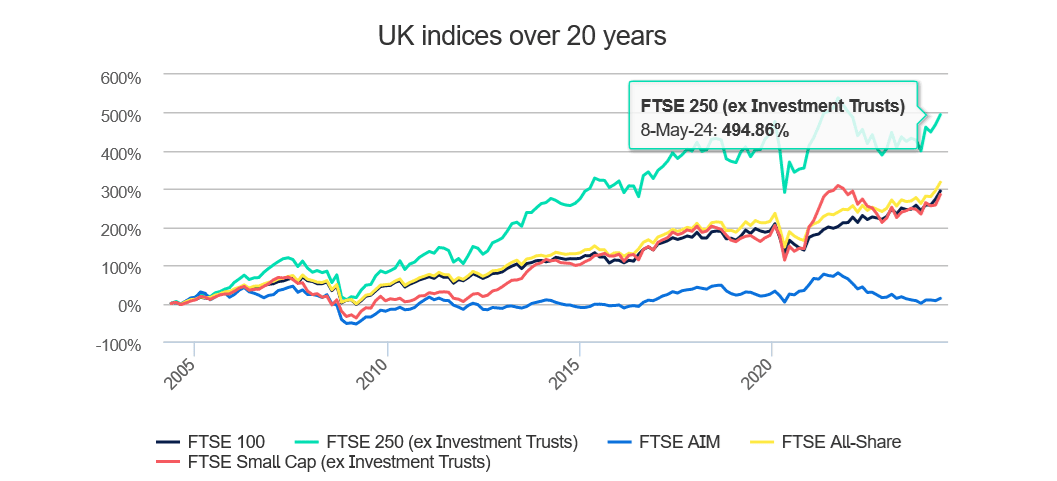

Hargreaves Lansdown analysts have been crunching the numbers. And their analysis exhibits that the index has supplied a return of just about 500% over the previous 20 years.

That is forward of the FTSE 100‘s return of around 300% over the period. It also beats the FTSE All-Share, FTSE Small Cap, and FTSE AIM categories.

Is investing in FTSE 250 shares still a good idea today?

Pros and cons

Well this strategy has its advantages and its disadvantages.

The FTSE 250 has less of an international flavour than the Footsie. So its performance is closely linked to that of the domestic economy, which is a problem as Britain’s GDP struggles for traction.

The FTSE 100 additionally has the next focus of secure corporations with market-leading positions, a number of income streams, and strong stability sheets than the FTSE 250. This helps the index carry out extra strongly throughout financial downturns.

Alternatively, the medium-sized corporations that dominate the FTSE 250 usually have extra room for progress in comparison with the bigger, extra established Footsie companies. What’s extra, as a result of it includes a broader vary of sectors that the FTSE 100, the FTSE 250 could be a simpler method for traders to handle threat.

A prime FTSE 250 inventory

I consider that creating a various portfolio of shares from each indexes is an efficient strategy to stability threat with alternative. It’s a technique I personally have pursued via common funding in my Particular person Financial savings Account (ISA) and Self-Invested Private Pension (SIPP).

At this second, I’m in search of extra FTSE 250 shares to purchase. And Video games Workshop (LSE:GAW) is close to the highest of my buying listing. I believe it may very well be one in all my finest bets to realize a 500% return within the coming a long time.

Previous efficiency isn’t a assure of future success. However the enterprise has grown its share worth by a surprising 1,350% throughout the previous 20 years. I’m assured it should proceed rising strongly, too, because it expands its international retailer property.

The corporate has 535 shops on its books right this moment, and plans 30 new openings this yr alone to capitalise on the fantasy growth. It’s also investing closely within the fast-growing on-line channel, and launched a brand new web site again in October.

I’m additionally excited by Video games Workshop’s plans to speed up licencing of its Warhammer mental property. Particularly, a movie and TV deal it lately signed with Amazon has the potential to supercharge royalty revenues and gross sales of its conventional tabletop video games and miniatures.

On the draw back, Video games Workshop shares commerce on a meaty price-to-earnings (P/E) ratio of 20.3 occasions. This form of valuation might set off a share worth slide if buying and selling information begins to spook traders.

Even accounting for this, I consider the FTSE 250 firm stays an important purchase for long-term traders like me. I even consider it may very well be promoted to the FTSE 100 elite index finally.