Picture supply: easyJet plc

A lift within the easyJet (LSE:EZJ) share value over the previous month has allowed the low-cost airline to cling on to its place within the FTSE 100 index. The corporate had been tipped for potential relegation from the UK’s main benchmark on this week’s quarterly reshuffle.

As a shareholder, I’m happy by this information. Nevertheless, I’m additionally acutely acutely aware that easyJet shares are nonetheless down 62% from their pre-pandemic excessive.

Right here’s what the charts say concerning the outlook for the Luton-headquartered enterprise.

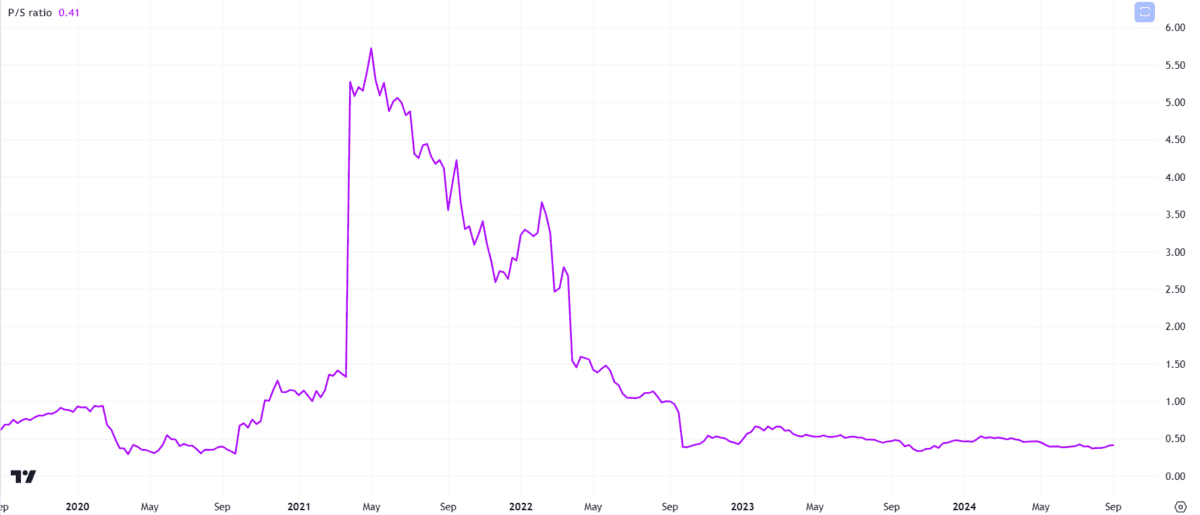

Valuation

Utilizing the price-to-sales (P/S) ratio as a valuation metric, easyJet shares have traded firmly again in cheaper territory for the previous couple of years. Again in 2021, the inventory seemed fairly costly as gross sales had been decimated amid pandemic journey restrictions.

Presently, the inventory has a P/S ratio of 0.41, which suggests it’s a possible discount at right now’s value of £4.82. Usually, any ratio beneath one is seen as a really enticing quantity.

Nevertheless, it’s price treating this determine with a level of warning. A number of airline shares have had their valuations depressed for some time now because the market digests their future in a post-Covid world.

For example, FTSE 250 competitor Wizz Air appears a bit cheaper on this metric with a P/S ratio of simply 0.36 and easyJet’s FTSE 100 bedfellow IAG additionally has a decrease 0.39 a number of. Accordingly, the inventory’s valuation isn’t particularly low cost when in comparison with the broader trade.

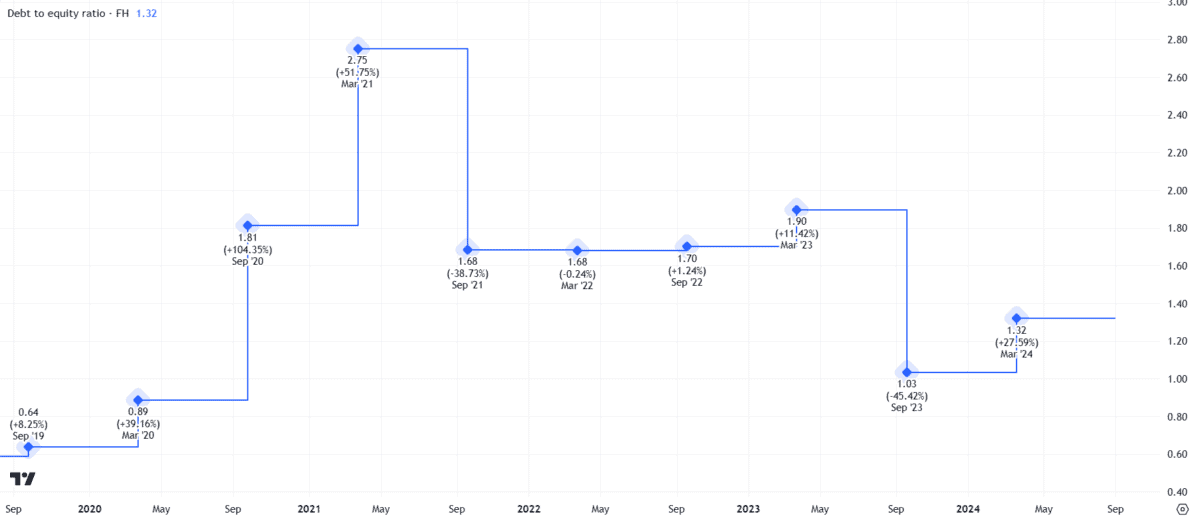

Debt

General, easyJet’s stability sheet seems to be in fine condition. Within the first half, the corporate moved right into a web money place of £146m, having ended FY23 with £485m in web debt on the books.

The debt-to-equity ratio of 1.32 suggests the enterprise shouldn’t have an excessive amount of problem in paying off its collectors. Contemplating the airline needed to enhance its liabilities significantly to remain afloat in the course of the pandemic, I’m inspired by the agency’s progress.

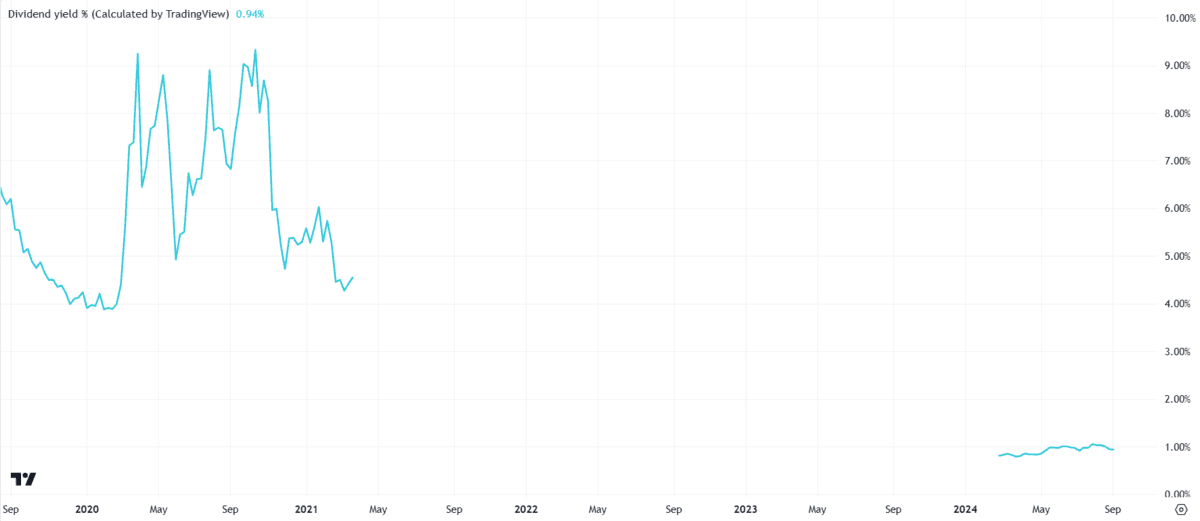

Dividends

On the passive revenue entrance, it’s good to see easyJet has resumed dividend funds. Nevertheless, a yield beneath 1% means the inventory is a shadow of its former self.

At some factors up to now 5 years, easyJet shares had been yielding above 9%. Sadly, I don’t see these glory days returning any time quickly.

Nonetheless, Wizz Air doesn’t reward shareholders with dividends presently and IAG’s yield of 1.3% is just marginally higher than easyJet’s.

Can the share value fly larger?

General, I’m optimistic concerning the prospects for additional development within the easyJet share value.

Granted, the inventory faces dangers. Margins are tight and growth is troublesome in a notoriously aggressive trade. There’s additionally a danger of environmental taxes being levied on the corporate amid rising concern round local weather change.

On the flip aspect, retaining a coveted FTSE 100 spot helps to keep up investor confidence. The airline’s post-Covid restoration stays intact and it has taken prudent steps to restore its stability sheet in recent times.

As well as, the package deal holidays division — launched in 2019 — has proved to be an enormous success. It provides diversification to the enterprise mannequin and the board initiatives this arm will ship £180m in pre-tax revenue this 12 months, which might signify a formidable 48% uplift.

I’ll proceed to carry my easyJet shares for the long run.