Picture supply: Getty Pictures

Speciality chemical substances firm Johnson Matthey (LSE: JMAT) dropped into the FTSE 250 on 18 September final yr and has proven little signal of preventing its method again into the blue-chip index. Its shares are down 11.83% over the past yr, and 51.54% over 5 years.

Based in 1817, many anticipated Johnson Matthey to profit from the shift to sustainable applied sciences. In addition to catalytic converters it invests in clear vitality initiatives, together with hydrogen gasoline, attracting the attentions of ESG (environmental, social and company governance) traders.

Can the share worth rebound?

The ESG development grew to become stretched and the sector gave up its beneficial properties as increased rates of interest drove up borrowing prices. Falling platinum costs hit Johnson Matthey’s headline profitability.

But investing is cyclical, and a variety of elements which have labored in opposition to the group might now be swinging again in its favour.

The plain one is that its shares are so much cheaper than they have been. At this time, they commerce at simply 9.83 occasions earnings, alerting discount hunters like me.

Like many struggling corporations, the board has been seeking to lower prices. Preliminary outcomes for the yr to 31 March confirmed that its transformation programme delivered round £75m of price financial savings, smashing its £55m goal. The board has set itself the bold goal of saving £200m this yr, because it simplifies the enterprise.

Johnson Matthey is promoting off non-core companies to deal with the worldwide vitality transition via its core valuable metals and catalysing applied sciences operations. It should use a few of proceeds to trim web debt, which it lower to £951m in 2025. That’s nonetheless comparatively excessive although, given at the moment’s decreased market cap of £2.36bn.

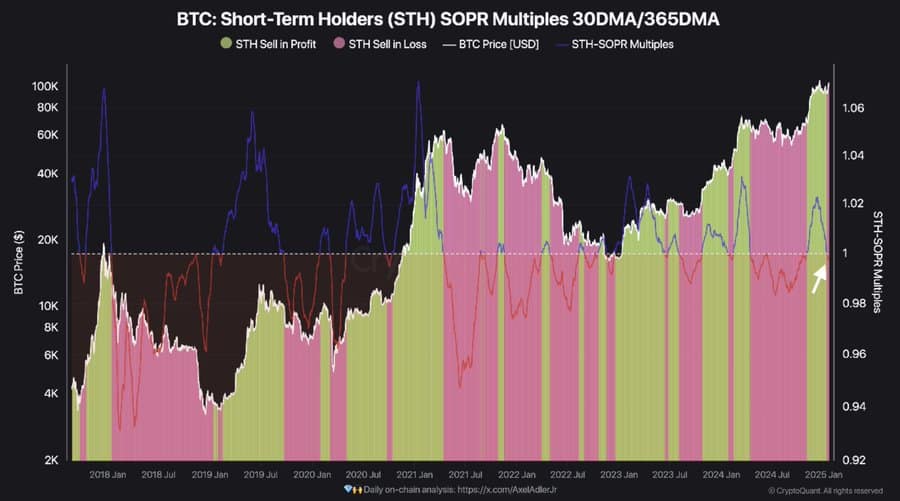

The inventory affords an attention grabbing trailing yield of 5.56%. The board has a good monitor file of sustaining dividends, as this chart exhibits, pandemic not withstanding.

Chart by TradingView

But there’s no getting away from the truth that the excessive yield is partly right down to the underperforming share worth.

I feel this share nonetheless has some approach to go

The Johnson Matthews share worth took one other hit on 27 November, when first-half outcomes confirmed reported revenues down 14% to £5.6bn, blamed on the “challenging” macroeconomic backdrop. Underlying working income fell 4% to £154m.

CEO Liam Condon praised its “resilient performance” and maintained full-year steerage, pinning his hopes on a powerful second half. However will he get it?

I’m not satisfied. Falling rates of interest fall ought to make funding the online zero transition simpler however we might not get them. Inflation might choose up in 2025, because the UK price range drive up enterprise prices president-elect Donald Trump stokes the US economic system. Trump’s plan to spice up fossil fuels and lower ESG subsidies gained’t assist.

The 11 analysts providing one-year share worth forecasts for the inventory have set a median goal of 1,762p. If appropriate, that’s up a powerful 27.15% from at the moment. Of 12 inventory rankings, 4 say a Robust Purchase and eight say Maintain. None say Promote, which I completely get. Few would wish to crystallise their losses at at the moment’s worth.

The shares ought to rebound sooner or later however I feel situations are too difficult for me to purchase it at the moment. I’m watching it although.