- Altcoin season skilled a surge in worth throughout the latest bull rally, pushed by BTC testing the $66K.

- Nevertheless, a vital issue is required to set off the onset of an altcoin season.

Bitcoin [BTC] is poised for a possible value correction after failing to maintain its $66K degree. AMBCrypto’s evaluation means that $61K may function the following assist, marking a key backside.

Traditionally, altcoin seasons observe Bitcoin’s bottoming. If this sample repeats, the present dip may set off the following Altcoin Season.

The following cycle may spark altcoin season

At the moment, Bitcoin’s market share stands at 57.37%, a big decline from its latest peak of 58.59% simply ten days in the past. This falling dominance might point out rising confidence in altcoins.

The rationale is obvious, two days in the past, BTC examined the $66K ceiling after a gradual uptrend, permitting many stakeholders to take income. Their exit may mark the following backside.

Moreover, this dip might appeal to renewed curiosity from holders, setting the stage for potential altcoin development.

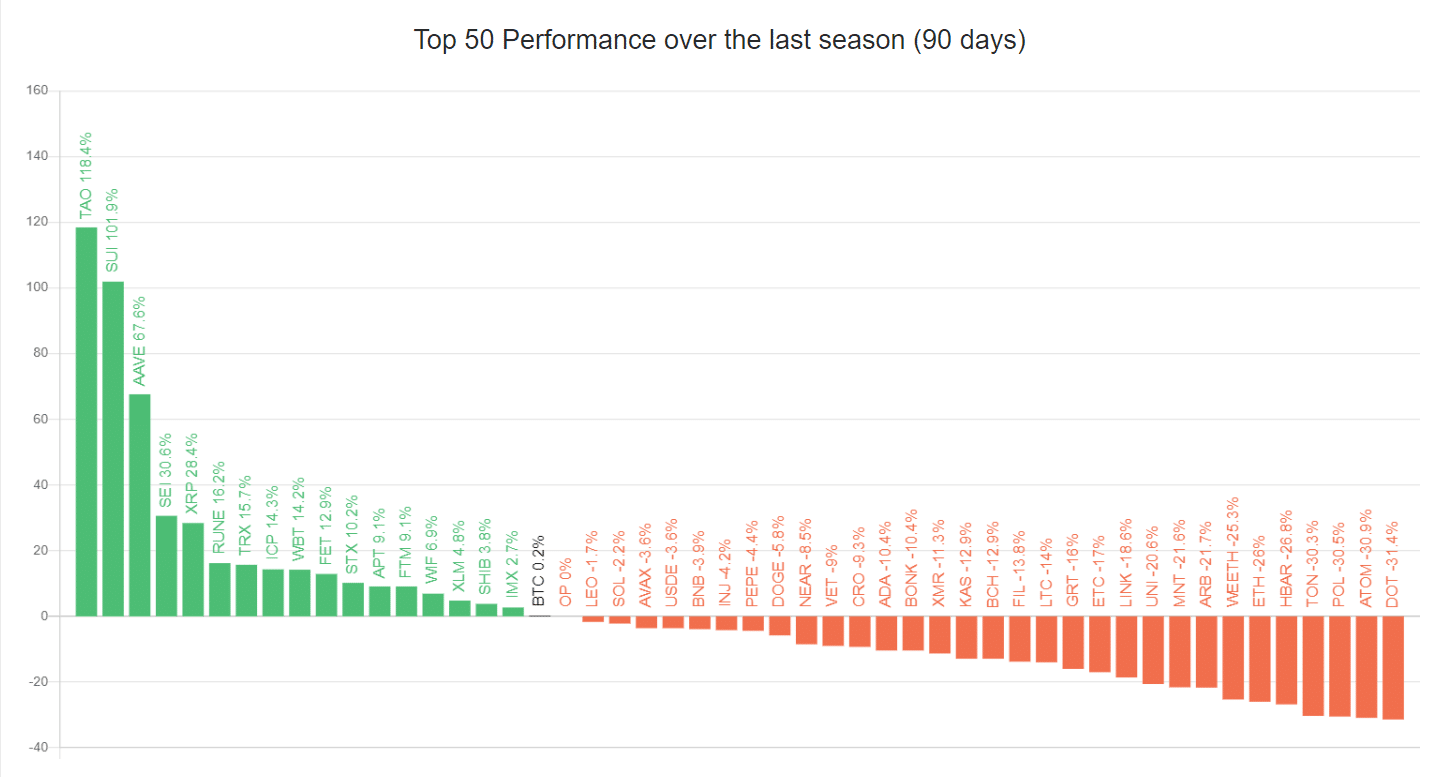

At current, 17 of the highest 50 cash are ranked above Bitcoin, leading to a 34% altcoin dominance.

With many altcoins exhibiting bullish momentum throughout the latest rally, one other cycle could also be wanted to catalyze the onset of the following altcoin season.

So, keeping track of the upcoming Bitcoin cycle is essential to determining when these cash may begin to rally. In easy phrases…

Bitcoin consolidation may be the important thing

Whereas the market euphoria hints at a bullish begin for Bitcoin in October, the each day value chart tells a distinct story.

If the mid-July rally repeats – the place BTC bulls held off resistance at $66K and broke by to $68K – Bitcoin dominance may be reinstated, dampening the prospects for an altcoin season.

Nevertheless, the sharp drop in RSI signifies a lack of shopping for momentum. If Bitcoin enters a consolidation part, it may enable main altcoins to take the highlight.

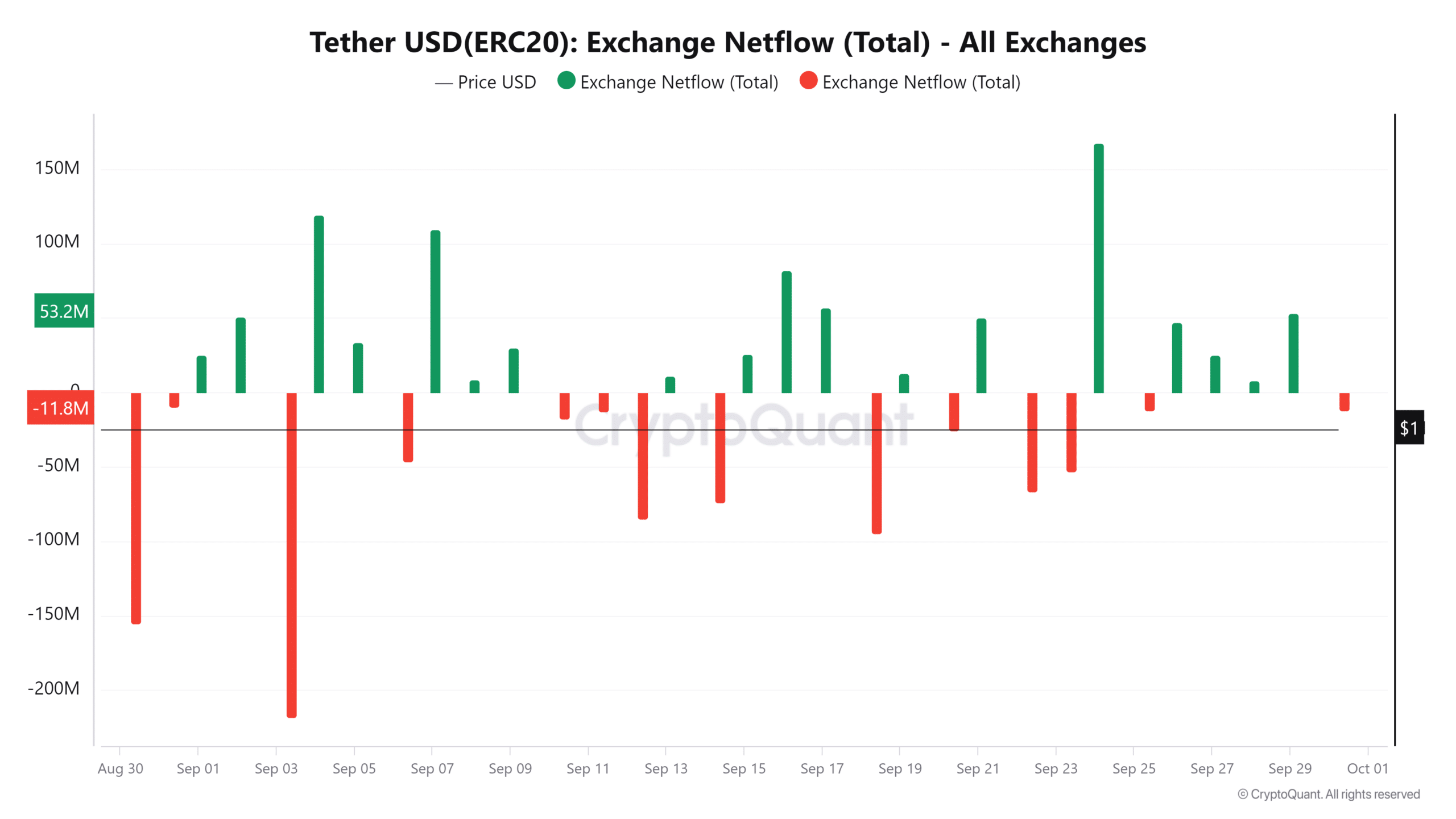

Moreover, rising USDT outflows counsel that extra stablecoins are being withdrawn from exchanges.

Traditionally, such withdrawals typically coincide with Bitcoin dropping a significant resistance zone, prompting buyers to show to USDT as a protected wager.

Moreover, these buyers see altcoins as extra enticing belongings whereas ready for Bitcoin to dip.

Consequently, liquidity flows into altcoins, that are seen as cheaper options, particularly throughout growing volatility.

In brief, if BTC consolidates round $64K or beneath, buyers might diversify their portfolios, probably inflicting altcoins to soar.

The season could also be inside attain

Apart from market sentiment, AMBCrypto recognized a hidden sample in historic traits.

Curiously, when BTC dominance bottomed six years in the past, a reversal occurred 761 days later, marking the beginning of the altcoin season.

Put merely, this sample suggests {that a} comparable timeline may sign the following altcoin season quickly.

In different phrases, if Bitcoin dominance is presently declining, it may finally result in a resurgence in altcoin values if historical past repeats itself.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

As beforehand talked about, the present market situations sign an optimum time for altcoins to surge, pushed by declining Bitcoin dominance, growing USDT outflows, and a historic sample supporting this occasion.

General, keeping track of these components is essential. If BTC slips into consolidation – which appears possible – the following altcoin season might be triggered.