- Hayes suggestions a BTC get away as central banks begin reducing rates of interest.

- Nevertheless, the Fed’s assembly on twelfth June might assist outline the following BTC worth path.

Bitcoin [BTC] might be primed for a bullish breakout from its months-long vary as main central banks begin reducing rates of interest, per BitMEX founder and Maelstrom CIO Arthur Hayes.

Hayes had earlier projected that the breakout might occur in August. Nevertheless, he has adjusted his outlook following charge cuts by the European Central Financial institution (ECB) and the Financial institution of Canada (BOC).

‘The June central banking fireworks kicked off this week by the BOC and ECB rate cuts will catapult crypto out of the northern hemispheric summer doldrums’

This may mark the beginning of central financial institution ‘easing cycles’, and the US will compelled to leap in, per Hayes. Because of this, the manager nudged,

“Go long Bitcoin and subsequently sh*tcoins. The macro landscape has changed vs. my baseline. Therefore, my strategy shall change as well.”

Macro outlook and key catalysts

BTC has been holding above $70K for the previous two days and was poised to flirt with $72K or the March ATH if key macro occasions within the subsequent few days play out in its favour.

Most market watchers opined that Bitcoin might set a particular worth path after the Fed’s assembly subsequent Wednesday (twelfth June).

Not too long ago, Quinn Thompson, founding father of crypto hedge fund Lekker Capital, summarized the macro outlook and said,

‘The market wants conviction that Powell goes to chop in July. That would come from a weak jobs report Friday, weak CPI and/or dovish Fed subsequent Wednesday.”

Nevertheless, even when the Fed doesn’t lower instantly, the US mitigation in opposition to the large fall within the Japanese Yen’s worth might induce extra money provide and result in the identical final result, per Hayes.

Reacting to a reported Japan’s offloading of US treasuries to spice up its Yen, Hayes famous that,

‘Uh oh, Bad Gurl Yellen got some work to do. $JPY must strengthen to prevent the UST apocalypse.’

Already, the surge within the US cash provide has begun in earnest, and most analysts count on it to spice up BTC and general threat belongings.

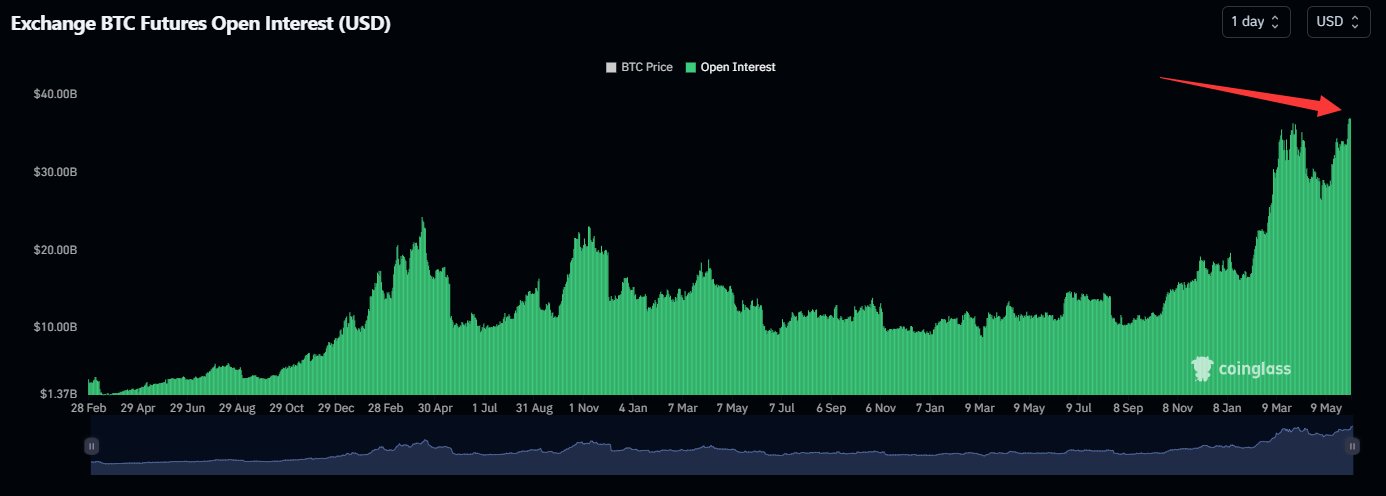

Within the meantime, BTC Open Curiosity (OI) charges have spiked to a file excessive, demonstrating an enormous inflow of liquidity into the king coin. Crypto spinoff monitoring platform Coinglass famous,

‘#Bitcoin open interest hits all-time high of $37.66B’

The OI spike underscores bullish expectations for the king coin. That stated, extra momentum and path might be set subsequent week after the Fed’s determination.