- Bitcoin noticed short-term volatility improve because the halving occasion drew nearer.

- The metrics forecast a bullish long-term future for Bitcoin.

Bitcoin [BTC] noticed a sudden drop in costs on the twelfth and thirteenth of April. The promoting strain heading into the weekend noticed BTC fall 14.5% from $70.9k on Friday to $60.6k to mark Saturday’s low.

This led to worry within the altcoin market and contributed to widespread promoting strain.

Market individuals who’ve referred to as for a high because the halving approaches could be ecstatic, however this view might be myopic. The long-term development stays firmly bullish. An inflow of recent traders was nonetheless underway.

The lifeblood of the bull run

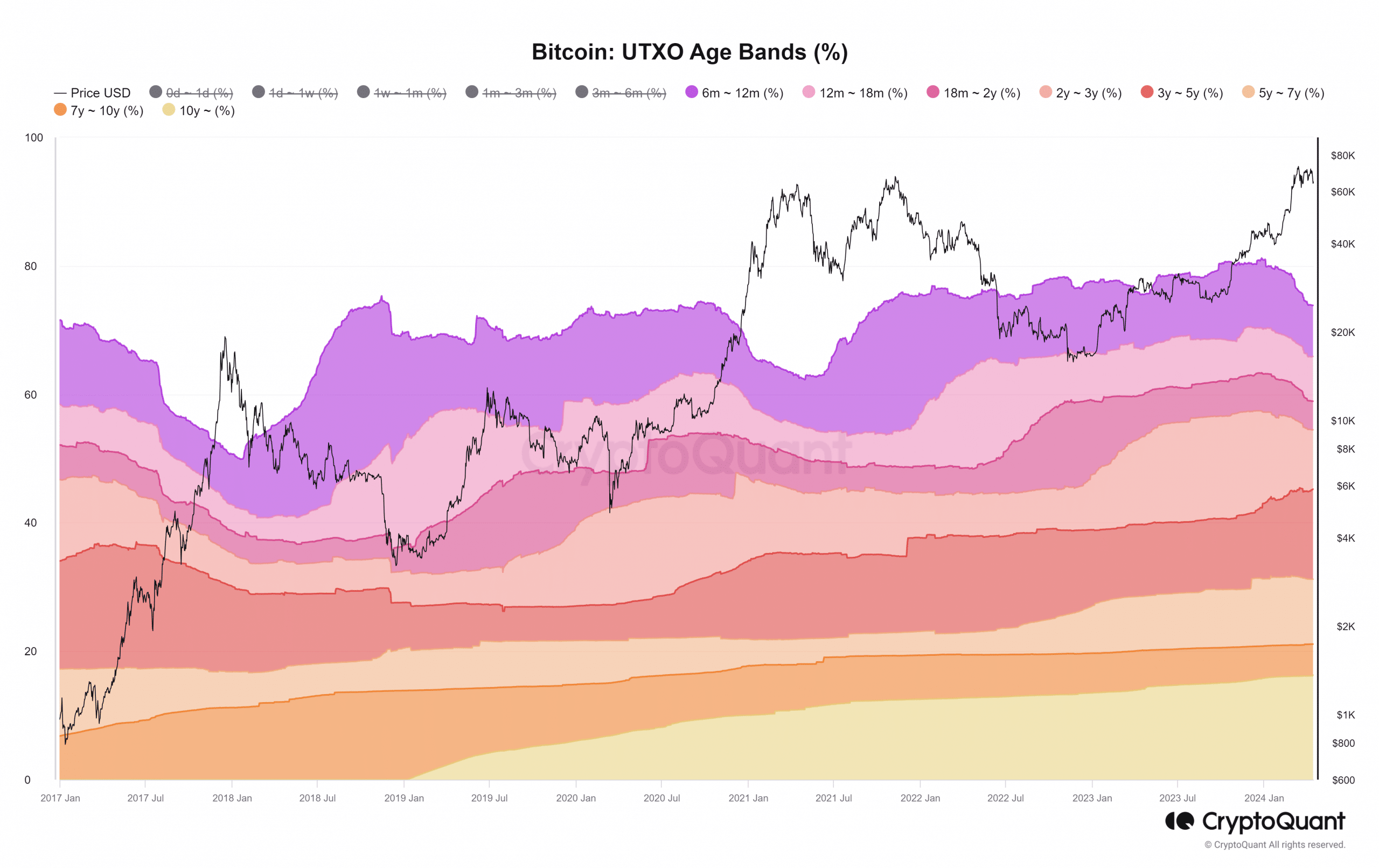

A CryptoQuant Insights submit by analyst Crypto Dan famous a lower within the proportion of Bitcoin held for greater than six months. This was evident from the Bitcoin UTXO Age Bands % metric.

Supply: CryptoQuant

This decreased proportion implied that newer traders have been getting into the market. This new demand is the gasoline that might spark the subsequent run. In line with the analyst, this run has been in place for 3 months.

AMBCrypto’s evaluation of the identical metric additionally revealed one other fascinating issue. Prior to now two cycles, the 6-12-month-old BTC proportion drop in the course of the bull run has been the steepest.

The weeks following the cycle high noticed the identical age band development increased.

In 2021, this uptrend solely got here after the downtrend flattened out for 3 months.

This instructed that traders may look forward to the 6-12 month age band to kind a month-long sideways development earlier than seeking to promote their BTC.

This is only one piece of the complicated puzzle, and traders should even be utilizing different metrics and market developments to make that call.

A few of the different metrics that would mark a cycle high

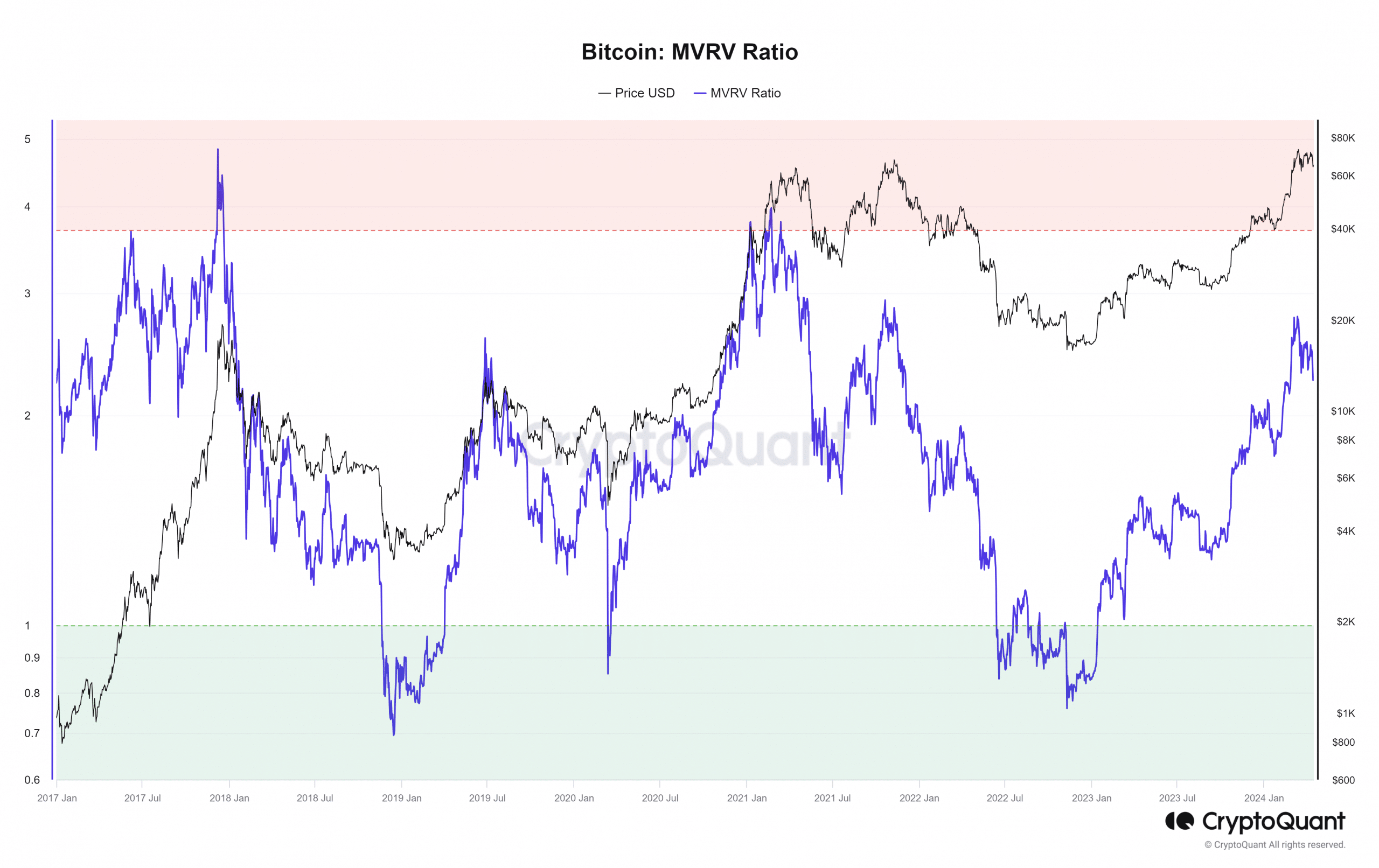

Supply: CryptoQuant

Two of the preferred Bitcoin long-term metrics are the MVRV ratio and the Internet Unrealized Revenue/Loss (NUPL). They, too, mirrored the bullish state of the market in current months.

The MVRV ratio was at 2.25 on thirteenth April. That is effectively beneath the three.7 mark that has traditionally marked the cycle tops. The worth development of the previous few months noticed the MVRV ratio development increased.

The that means is that the market cap of Bitcoin has elevated sooner than the realized cap of Bitcoin. In different phrases, the motive to promote has been rising however was not vital but.

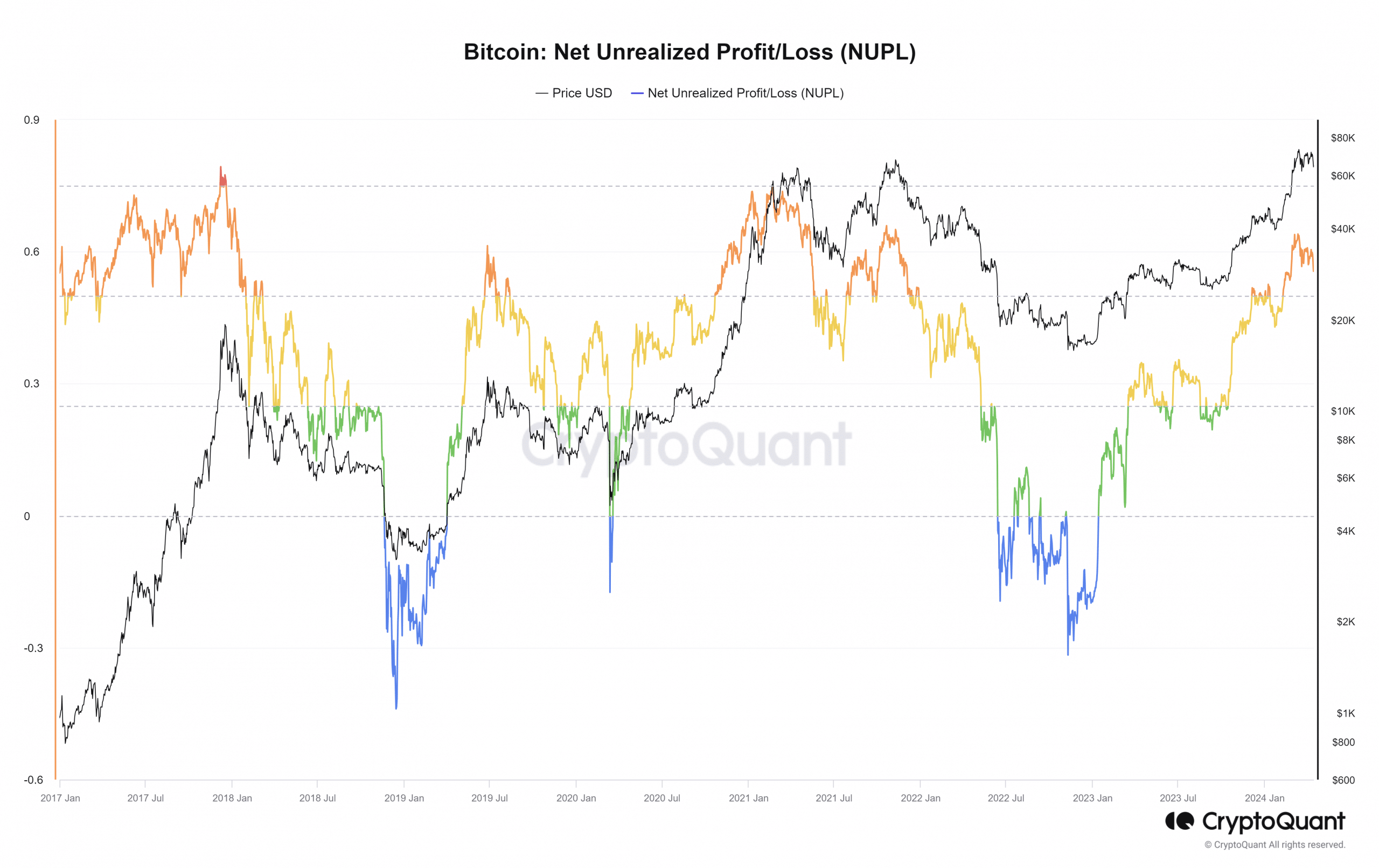

Supply: CryptoQuant

Equally, the NUPL was additionally rising, displaying that it was extra worthwhile to promote Bitcoin as the costs climbed.

With a studying of 0.55 on the thirteenth of April, there was nonetheless some technique to go for the metric to achieve the 0.7 mark that has marked cycle tops previously.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Traders can keep watch over the conduct of all three metrics within the coming months to grasp simply how shut Bitcoin is to this run’s high.

Nevertheless, it ought to be remembered that the Bitcoin ETFs are a colossal new addition to the market. It’s distinctive to this cycle, and the results of such behemoths available on the market are onerous to foretell.