- Bitcoin nears file highs, simply 1.8% away from its earlier ATH, signaling sturdy bullish momentum.

- Elevated accumulation by long-term holders and rising whale transactions counsel potential for an additional rally.

Bitcoin [BTC] has continued its spectacular climb, now only a 1.8% lower away from its all-time excessive (ATH) of $73,737 reached in March 2024.

Buying and selling above $72,000 at press time, BTC has posted an almost 10% improve over the previous week and is up by 0.2% up to now day. This constant upward pattern displays renewed investor confidence, bolstered by metrics signaling power in Bitcoin’s fundamentals.

Moreover, this latest value rally seems to be largely pushed by long-term holders (LTH) who’re actively accumulating Bitcoin, as highlighted by CryptoQuant analyst Darkfost.

Whales accumulate like by no means earlier than

In line with the CryptoQuant analyst, the LTH 30-Day Web Place Change—a metric that tracks the month-to-month development or discount of Bitcoin held by long-term holders—exhibits that, regardless of BTC nearing its ATH, there’s solely a slight dip in internet place change.

Darkfost explains that this minor dip in internet place change is “approximately 2.5 times smaller than the reduction seen at the previous ATH,” indicating that the present sell-off is extra measured.

This pattern means that long-term holders are displaying confidence in Bitcoin’s short-term potential by holding moderately than promoting.

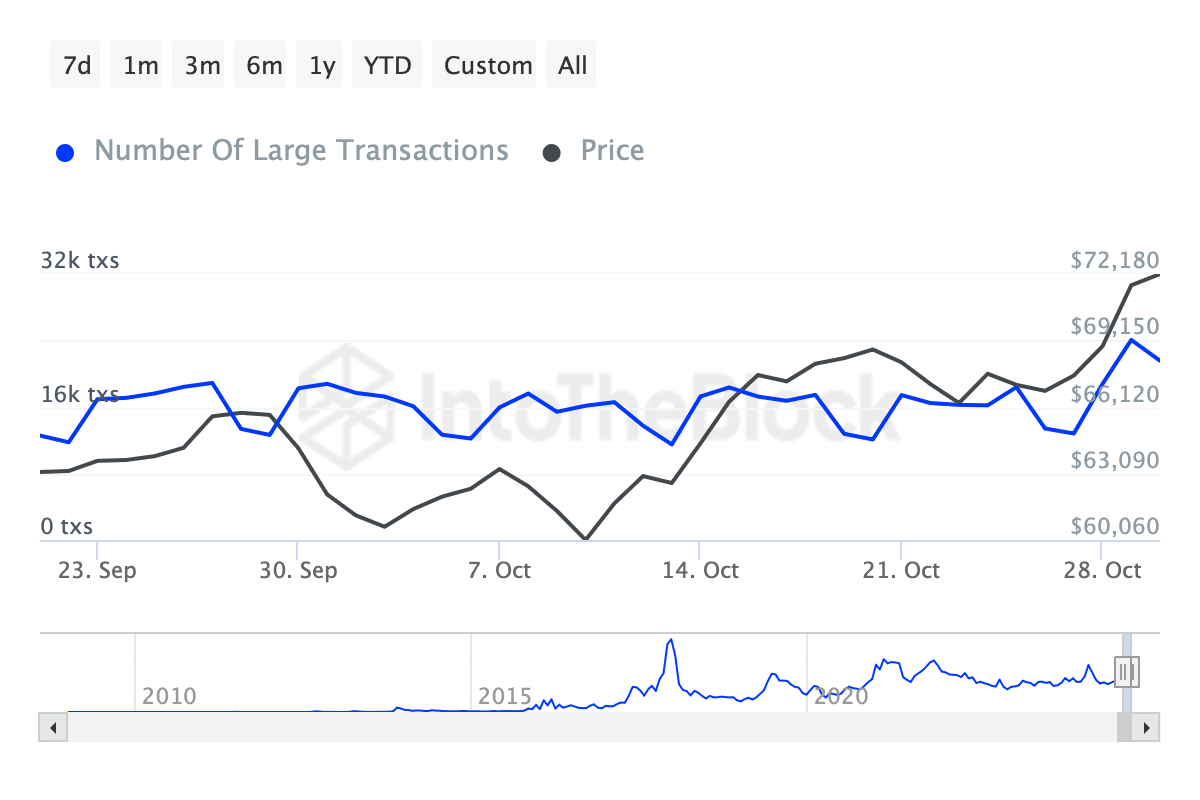

Along with exercise from long-term holders, Bitcoin is witnessing heightened curiosity from main buyers, typically often called “whales.” Information from IntoTheBlock signifies that whale transactions have seen a noticeable improve, rising from 15,000 transactions final week to over 20,000 as of press time.

Such a spike in whale transactions typically factors to substantial curiosity in Bitcoin from massive buyers, who could also be positioning themselves for additional value positive factors.

In crypto markets, whale exercise can drive vital value shifts, as their substantial holdings have the potential to affect provide and demand dynamics.

Optimistic indicators align as Bitcoin approaches key value milestone

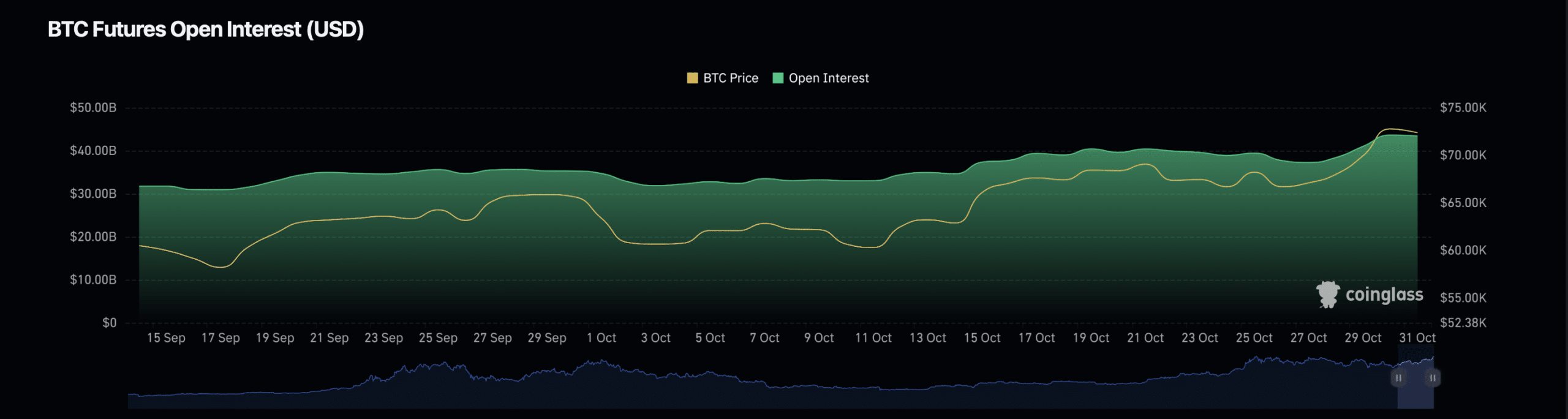

One other key indicator of sturdy investor sentiment is Bitcoin’s open curiosity, which measures the full variety of excellent by-product contracts tied to the asset.

Information from Coinglass reveals that BTC’s open curiosity has seen a slight rise, growing by 0.33% to achieve a valuation of $43.59 billion.

Nevertheless, Bitcoin’s open curiosity quantity has proven a contrasting pattern, with a lower of 37.63% to a valuation of $56.13 billion.

An increase in open curiosity typically indicators that merchants are actively partaking with the asset, whereas a dip in quantity may point out warning amongst some buyers, presumably ready for added value indicators earlier than making substantial trades.

The convergence of those components—long-term holder accumulation, heightened whale curiosity, and elevated open curiosity—has set a positive backdrop for Bitcoin’s continued upward momentum.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Lengthy-term holders displaying resilience and holding again on promoting at close to ATH ranges suggests a prevailing sentiment of optimism throughout the Bitcoin neighborhood.

Darkfost concludes that this cautious however regular accumulation by long-term holders may pave the best way for a possible rally within the close to future.