- Bitcoin rebounded to $96k after dropping to $89k, with restricted whale exercise impacting momentum

- Key metrics, together with open curiosity and whale transactions, underlines blended alerts for Bitcoin’s near-term outlook

Bitcoin (BTC) started the yr with promising momentum, hitting a excessive of $102,000 on 07 January. Nonetheless, this preliminary rally was short-lived because the cryptocurrency quickly noticed main corrections, falling beneath $100k quickly after.

On the time of writing, Bitcoin was priced at $96,556, following a partial restoration from a dip to $89,000 earlier within the week. The worth drop beneath $90,000 highlighted considerations amongst market members, with some analysts delving into the underlying components shaping this motion.

Actually, a CryptoQuant analyst famous the sample of “stop hunting,” the place worth declines quickly break key assist ranges earlier than rebounding. Evidently, this exercise has raised questions on Bitcoin’s capability to maintain a development reversal with out the involvement of key market gamers.

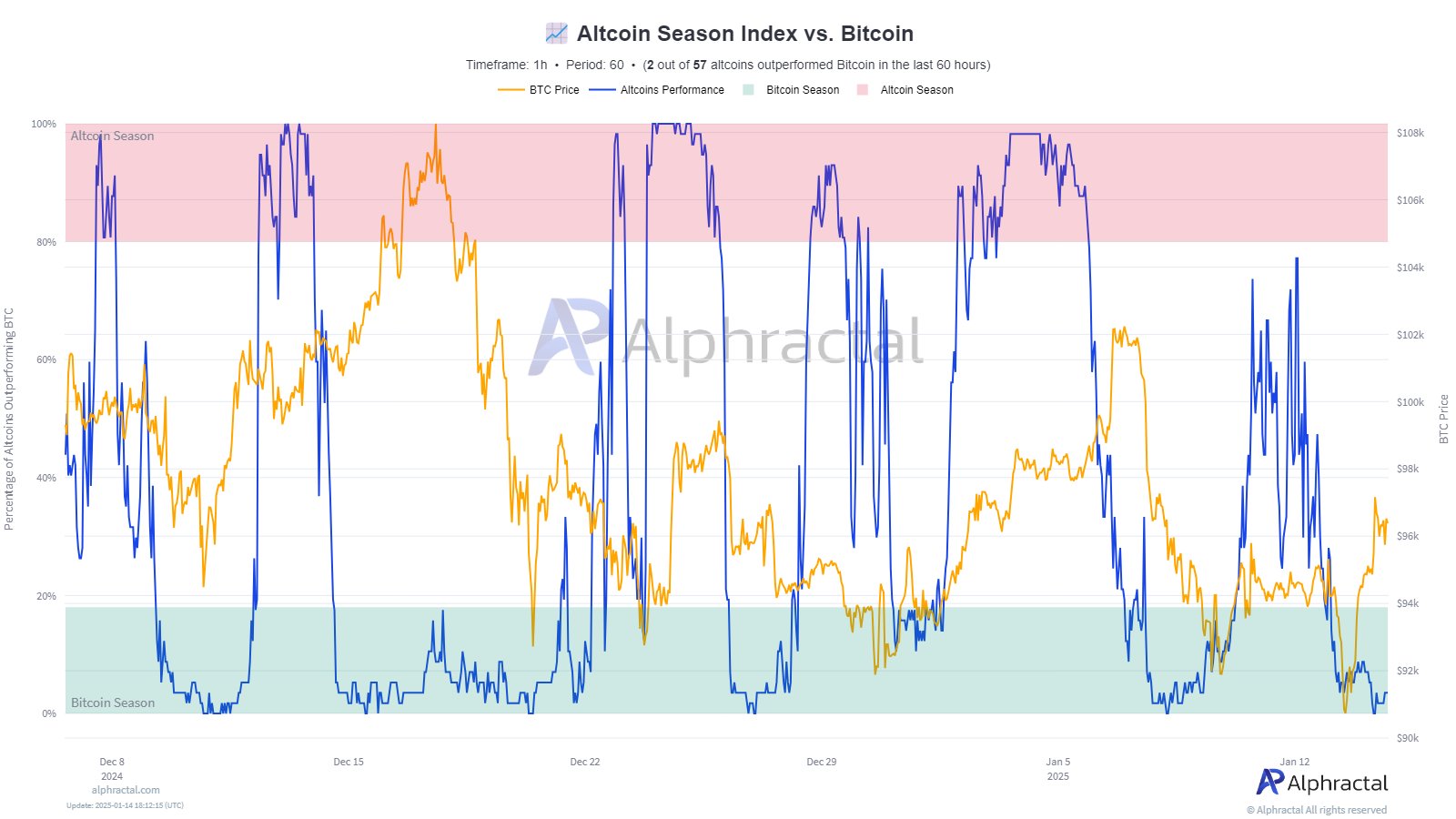

Whale exercise and market sentiment

CryptoQuant’s ‘analysis pointed to whale inactivity as a major contributor to Bitcoin’s restricted restoration. The Coinbase Premium Hole (CPG) information highlighted important promoting exercise by whale entities, however no corresponding shopping for motion to soak up the drop.

Usually, when whales step in to buy Bitcoin throughout a decline, the market sees heightened volatility. Nonetheless, this wasn’t the case throughout its newest worth motion.

The analyst emphasised the significance of exercise on main exchanges, notably Binance, the place whale participation typically leaves traces in market-buy ratios.

On this occasion, no proof of considerable shopping for by Binance whales emerged, suggesting a cautious method by large-scale buyers. Whereas the each day candle sample indicated potential for a development reversal, the dearth of engagement from main gamers raises uncertainty about Bitcoin’s near-term trajectory.

Bitcoin’s metrics flash blended alerts

Past whale exercise, different Bitcoin metrics shared extra insights into the asset’s efficiency.

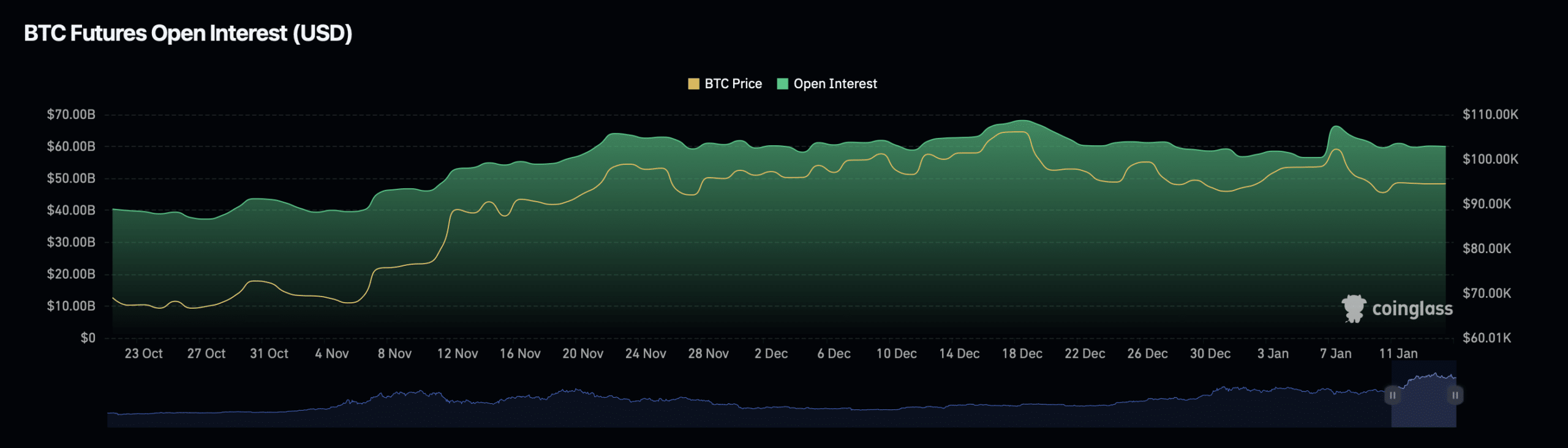

For instance – Open curiosity, a measure of the overall variety of excellent by-product contracts, rose by 2.09% during the last 24 hours to $61.88 billion.

This hike in Open Curiosity alluded to a renewed urge for food for buying and selling exercise and will point out extra hypothesis about Bitcoin’s future worth actions. Moreover, the Open Curiosity quantity surged by 213.18% over the identical interval – An indication of heightened market engagement.

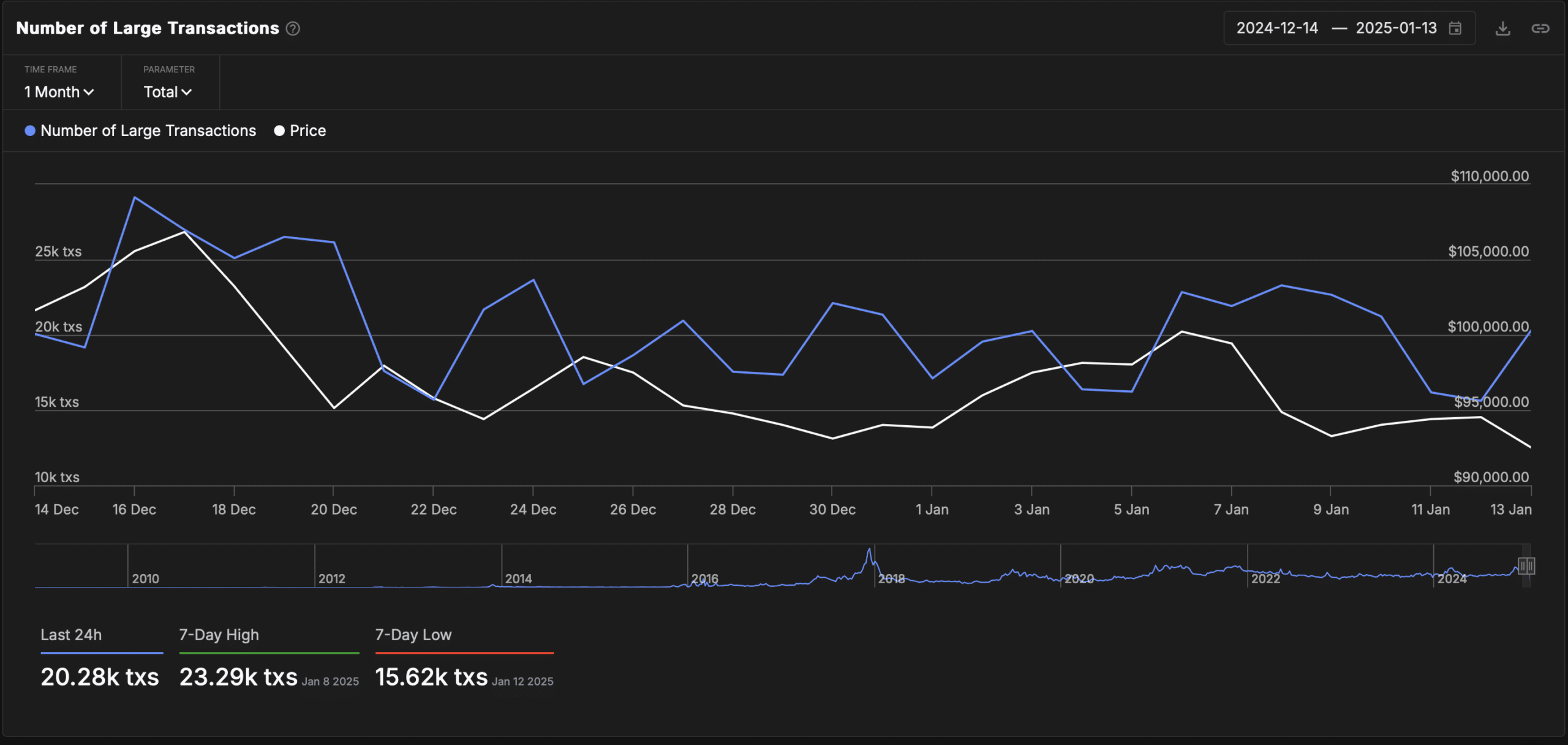

In the meantime, information from IntoTheBlock highlighted fluctuations in whale transactions, outlined as transfers exceeding $100,000. Over the previous month, the variety of these transactions fell from 26,000 on 16 December to fifteen,000 by 12 January.

Nonetheless, there was a notable rebound, with over 20,000 transactions recorded on 13 January. This resurgence in whale exercise might imply renewed curiosity in Bitcoin amongst giant buyers, probably influencing market momentum within the coming weeks.