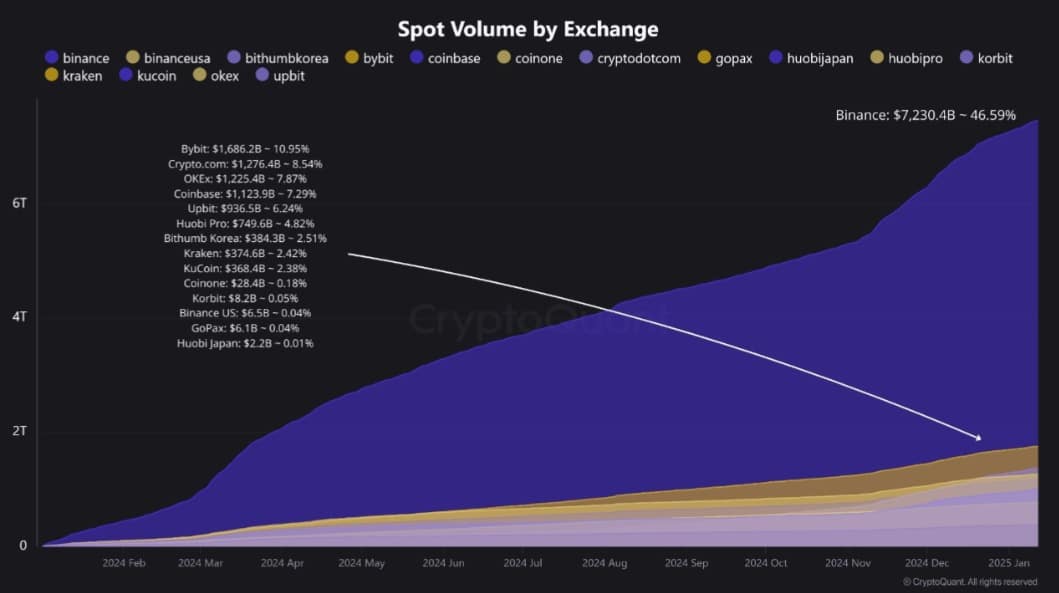

Binance’s cumulative spot quantity reached $7.23 trillion in 2024 marking 46.59% of the whole market share.

- Binance’s cumulative spot quantity reached $7.23 trillion in 2024.

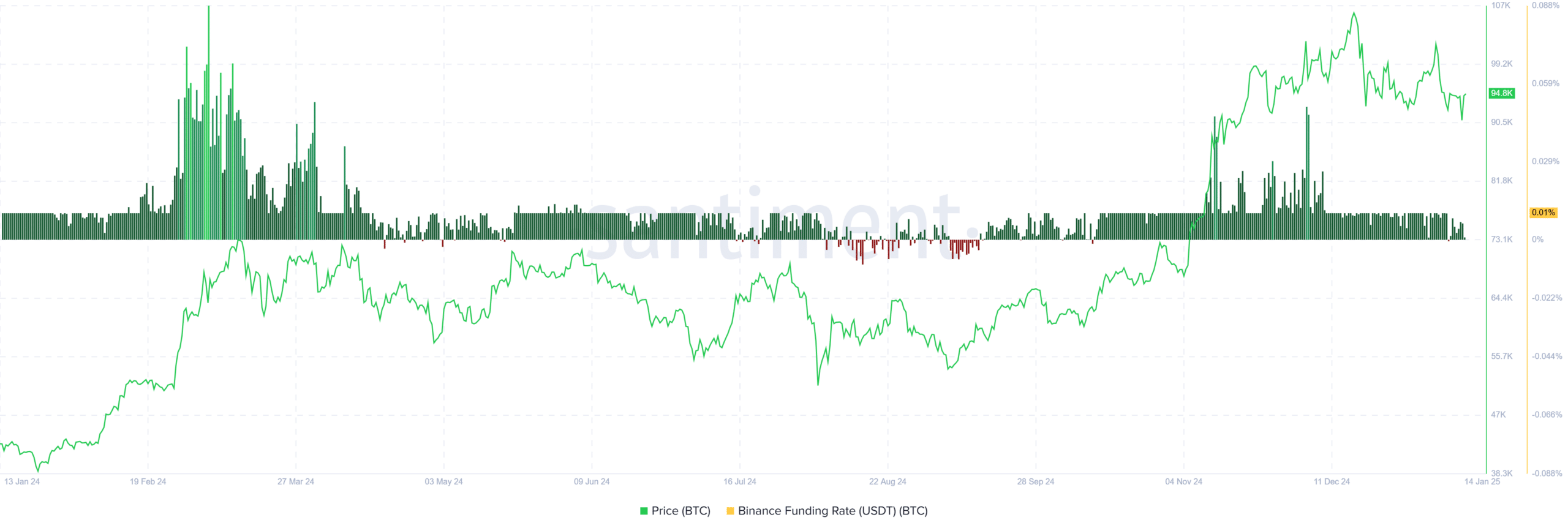

- BTC traders on the change remained bullish by 2024 driving costs to historic highs.

With the cryptocurrency market experiencing regular development all through 2024, Binance has turn into probably the most important Crypto Change platform.

Over this era, the crypto change has dominated the market, reflecting continued market confidence within the platform.

In accordance with CryptoQuant evaluation of 2024 cumulative spot quantity by exchanges, exchanges have performed a significant position within the continued development and improvement of the market.

Binance market dominance

As per CryptoQuant report, Binance has turn into probably the most dominant change platform.

As such, Binance recorded a cumulative spot quantity of $7.23 trillion in 2024. This marked 46.59% of the whole market share.

Supply: CryptoQuant

In comparison with different prime exchanges corresponding to Bybit, Crypto.com, OKEx, and Coinbase, Binance accounted for 34.65% of the market share, reflecting an 11.94% lead over these rivals.

With the change’s market share rising, it means that a good portion of Bitcoin’s liquidity and worth actions happen on Binance.

Subsequently, Binance’s efficiency is straight correlated with BTC worth actions, stability, and tendencies, given its excessive buying and selling quantity on the platform.

What it means for BTC

Since Binance is the dominant crypto change, traders’ sentiment on the platform displays broad market sentiment.

In accordance with AMBCrypto’s evaluation, the change’s market share has grown steadily, however traders have been principally constructive about Bitcoin.

All through 2024, BTC traders on Binance have proven optimism, driving costs to historic highs.

This bullish sentiment is evidenced by a constructive Binance funding fee. All through 2024, 10 months recorded a constructive funding fee, aside from October and September.

When the funding fee stays largely constructive, it means that traders are bullish and prepared to pay a premium for lengthy positions, reflecting optimism about future worth actions.

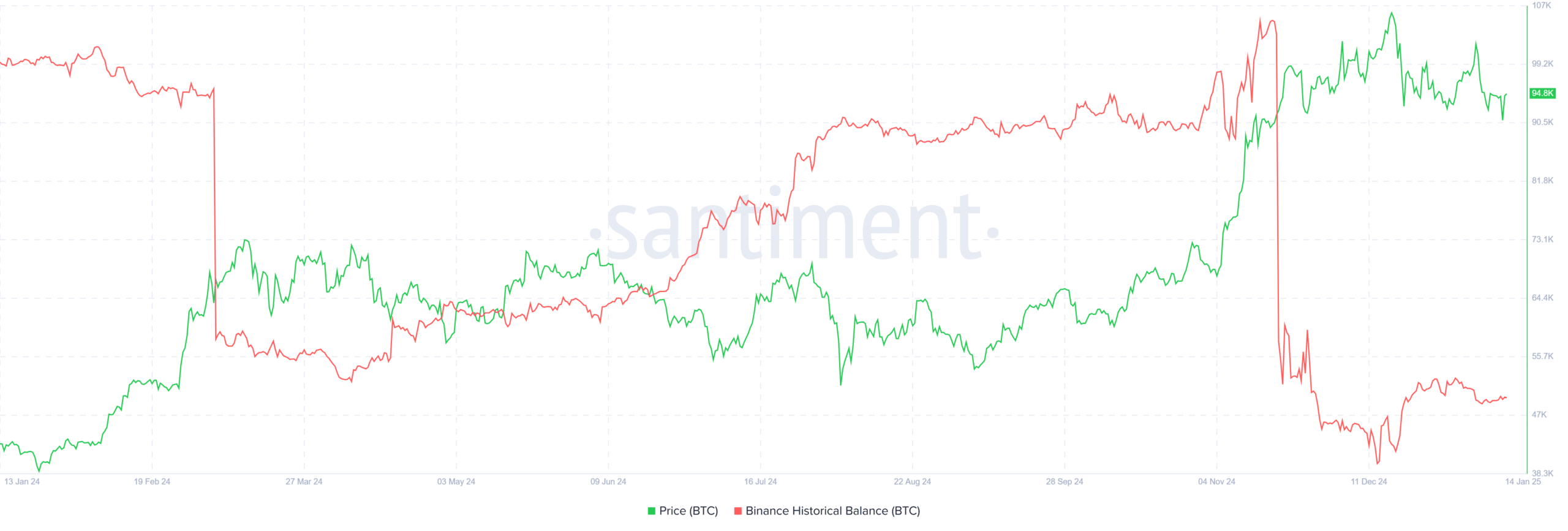

Moreover, Binance’s historic BTC balances skilled a powerful decline by November 2024. This drop suggests traders are accumulating BTC as they withdraw extra belongings from the change to private wallets.

Traditionally, modifications within the change’s BTC balances have at all times affected costs. As an example, when it dropped to a yearly low, BTC surged to an all-time excessive (ATH) of $108k in November 2024.

An identical sample was seen in March 2024 when BTC reached $70k for the primary time. Conversely, a surge in Binance balances precipitated a worth drop, corresponding to in August 2024 when costs fell to $49k.

Learn Bitcoin’s [BTC] Worth Prediction 2025-26

In conclusion, rising Binance market dominance has considerably impacted the crypto market. Whereas the change has skilled large development, BTC traders’ optimism on Binance has pushed costs to new ATHs.

With favorable situations, Bitcoin is well-positioned for extra good points. As such, we might see BTC reclaim $96,700 if merchants stay bullish on the change.