- BTC and the S&P 500 have been seeing a excessive correlation currently

- Cryptocurrency has continued to commerce above $65,000 on the worth charts

Bitcoin [BTC] just lately broke via a big resistance degree, persevering with its optimistic uptrend on the charts. Curiously, the cryptocurrency’s correlation with U.S shares has climbed to a two-year excessive too. Which means that Bitcoin is more and more transferring in tandem with conventional monetary markets.

Bitcoin’s correlation with U.S shares hits two-year excessive

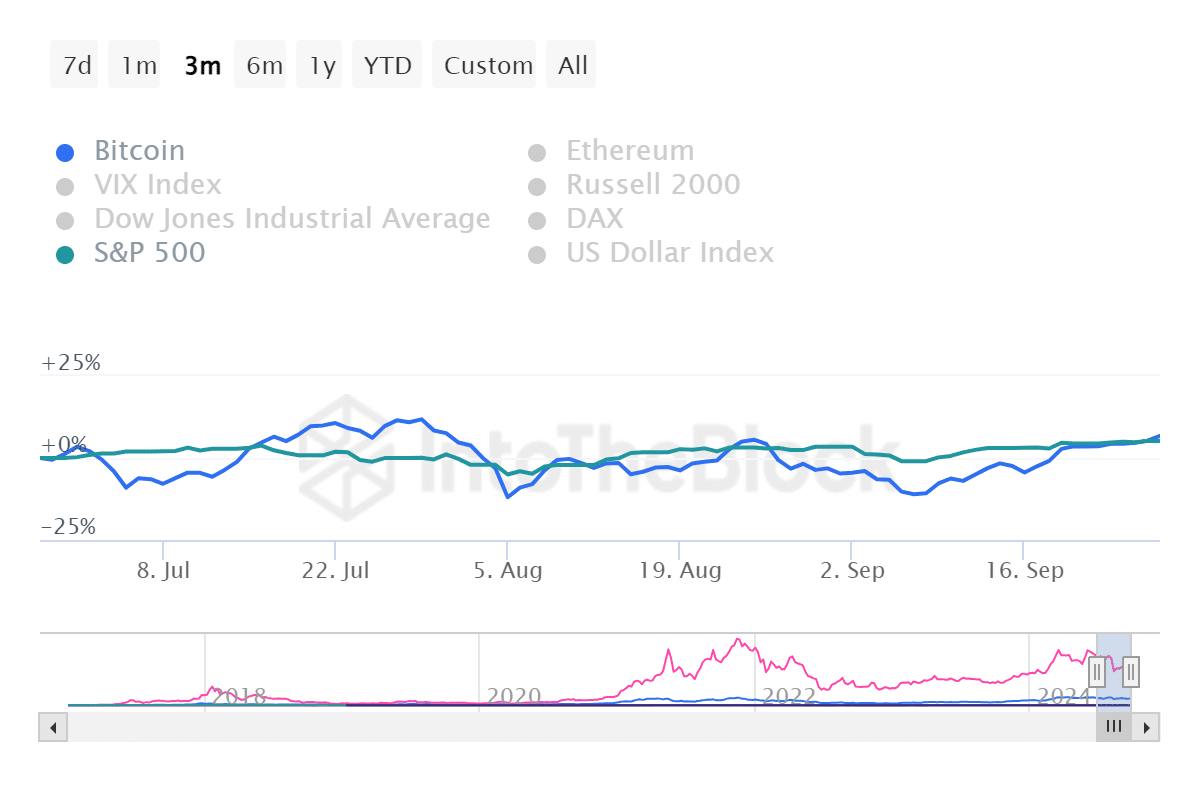

Latest information from IntoTheBlock revealed that Bitcoin’s correlation with U.S shares has hit a two-year peak. Over the previous three months, Bitcoin has seen average volatility with durations of slight will increase and reduces, sustaining a variety near its beginning worth.

Total, BTC’s worth motion has been comparatively secure, with a refined optimistic pattern in direction of the top of September.

Quite the opposite, the S&P 500 has exhibited regular performances with much less pronounced volatility, in comparison with Bitcoin. Each property have moved comparatively in sync although, reflecting comparable market sentiments.

Whereas BTC’s inherent volatility leads to barely extra pronounced actions, the parallel traits point out that it’s at the moment behaving like a threat asset. One intently following macroeconomic traits and investor sentiment.

Implications for Bitcoin traders

Bitcoin’s worth pattern suggests a “risk-on” setting, one the place traders preserve or barely hike their publicity to conventional equities and cryptocurrencies. BTC may gain advantage from the optimistic sentiment if the S&P 500 continues its regular efficiency or improves. Nonetheless, any unfavorable shocks within the fairness market may additionally have an effect on BTC as a consequence of their correlated actions throughout this era.

Because the correlation persists, Bitcoin’s worth actions might more and more mirror these of conventional equities. In occasions of rising inventory markets, this may be bullish for BTC, as a risk-on sentiment drives extra inflows into BTC and different crypto property.

Bitcoin continues its upward momentum

An evaluation of Bitcoin’s each day chart revealed that it closed with positive aspects of lower than 1% within the final buying and selling session.

Nonetheless, the worth briefly touched the $66,000-level earlier than settling round $65,789. On the time of writing, BTC was buying and selling at roughly $65,660, following a slight decline of lower than 1% on the charts.

Moreover, an evaluation of its Common True Vary (ATR) highlighted a worth of round 2,099.44. This meant that on common, Bitcoin’s worth vary (from excessive to low) over the past 14 durations is roughly $2,099. The ATR has been declining since mid-August, indicating that volatility has decreased over time.

This might imply that the market has been seeing much less intense worth actions, in comparison with earlier months.

– Learn Bitcoin (BTC) Value Prediction 2024-25

When the ATR is low, it might point out that the asset is gearing up for a breakout in both course.