- Bitcoin value set to surge as world liquidity rises.

- Assessing subsequent liquidity clusters for Bitcoin.

Bitcoin [BTC] continues to point out energy, pushed by rising world liquidity and favorable macroeconomic circumstances.

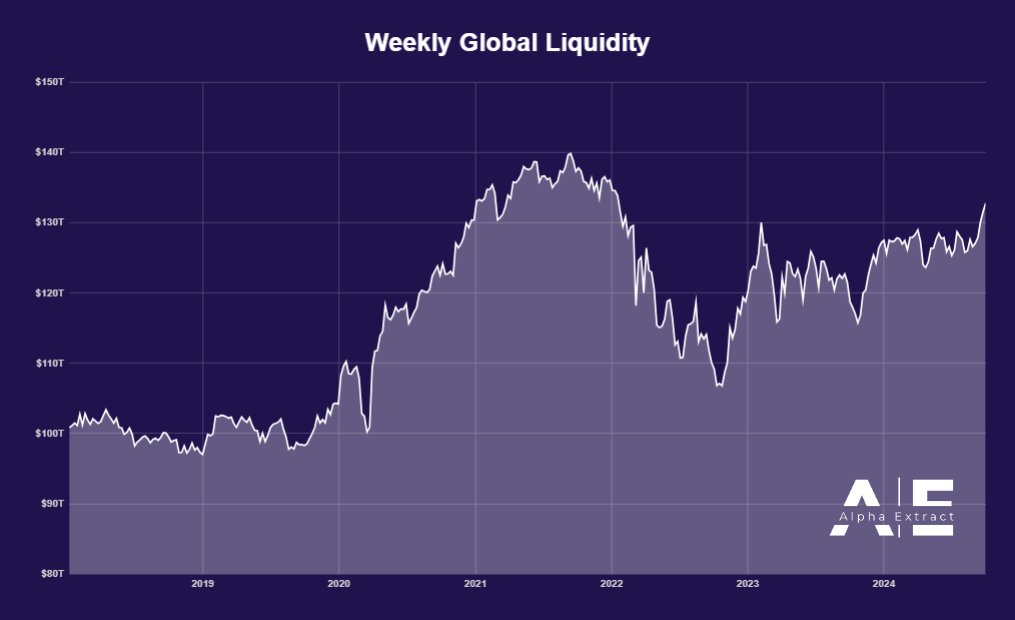

With world liquidity rising by 0.92% to $132.8 trillion, the very best since early 2022, Bitcoin is predicted to profit from this development.

Improved collateral values and actions by China’s central financial institution have contributed to this rise. Although the Federal Reserve has not but carried out a stimulus, markets are optimistic about future price cuts.

These elements recommend that Bitcoin may see larger costs, making the ultimate quarter of the yr significantly bullish for the broader crypto market.

Bitcoin’s value motion and key ranges

Bitcoin’s value just lately bounced off the vital 0.786 Fibonacci retracement degree, at present buying and selling at $66,000. This degree has persistently acted as a key indicator for each upward and downward actions this yr.

The sample of respecting this degree exhibits that Bitcoin stays aligned with world liquidity tendencies. As liquidity continues to rise, it’s anticipated to maneuver larger, with the following main goal being new highs above $66,700.

The worldwide liquidity enhance will seemingly profit Bitcoin because it stays a major hedge in opposition to financial inflation, alongside gold.

Influence of September’s bullish shut

This month closed with a 7.35% improve, making it the best-performing September in BTC’s historical past. This bullish sentiment is supported by Bitcoin’s potential to face up to latest corrections and keep upward momentum.

Regardless of market expectations of a decline, AI fashions from Spot On Chain precisely predicted a bullish month, noting,

“There’s a 69% chance of a new all-time high this month and a 54% chance of Bitcoin reaching $100K by year-end.”

The broader crypto market can also be anticipated to profit from favorable macroeconomic elements, significantly potential price cuts from the Federal Reserve and the European Central Financial institution.

The Fed has shifted its focus from inflation to employment, with a 42% likelihood of a 50 foundation level price lower in November.

If upcoming U.S. unemployment information is available in decrease than anticipated, this likelihood may improve additional. Fee cuts typically sign a extra favorable surroundings for threat belongings like Bitcoin, pushing its value larger.

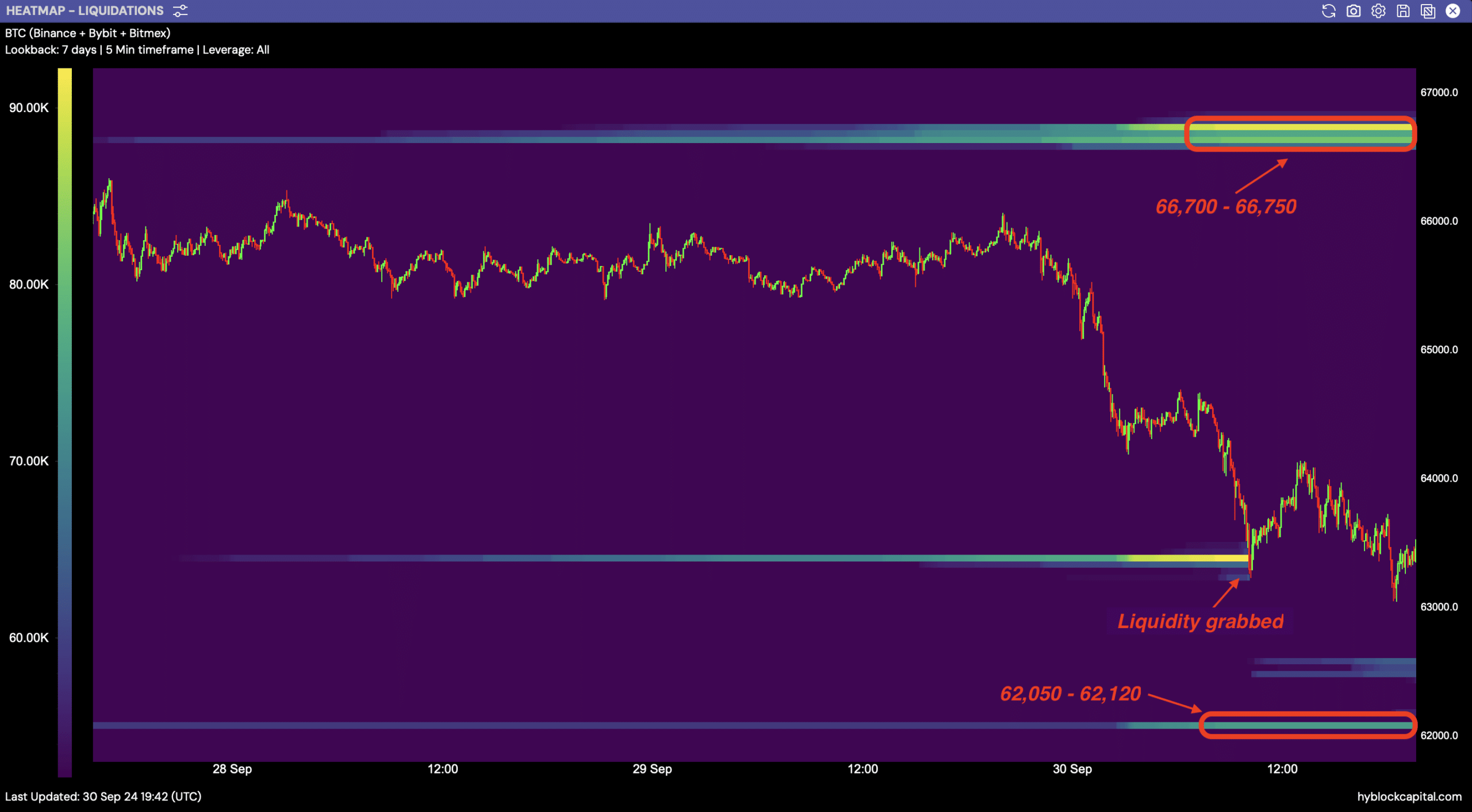

Liquidity clusters to observe

Key liquidity clusters for Bitcoin are rising as the value climbs. Current retraces in direction of $63,225 allowed Bitcoin to seize liquidity, setting the stage for the following transfer.

The following high-liquidity clusters sit between $66,700 and $66,750, whereas decrease clusters round $62,050 to $62,120 present assist.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

These ranges shall be essential to observe as Bitcoin continues its upward development, doubtlessly resulting in a breakout to larger costs.

Rising world liquidity, bullish technical patterns, and optimistic macroeconomic alerts place Bitcoin for larger costs quickly.