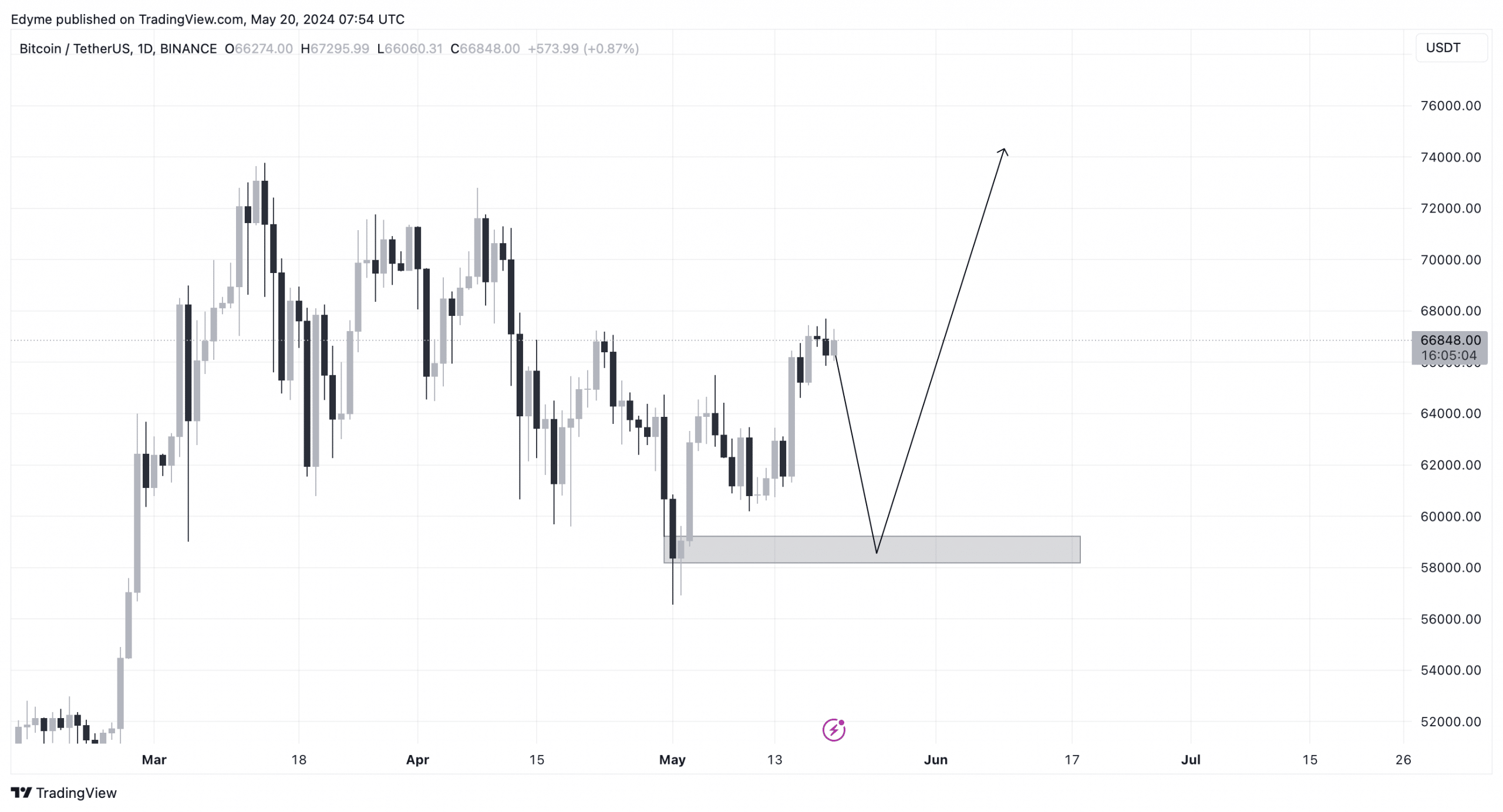

- Technical evaluation prompt BTC might quickly dip to $60k to collect liquidity earlier than launching into a serious rally.

- Information tendencies indicated that the promoting of BTC by smaller wallets to bigger ones is a bullish signal.

As Bitcoin [BTC] continues to dominate the cryptocurrency market, its latest value actions have caught the eye of buyers and analysts alike. Over the previous few months, Bitcoin has proven a major enhance, with a surge of over 100% 12 months thus far, and a notable rise of 9.8% in simply the previous week.

Regardless of reaching a brand new peak above $73,000 in March, Bitcoin is at the moment dealing with challenges in surpassing the $67,000 resistance degree. Just lately, after hitting a 24-hour excessive of $67,697, it barely retracted by 0.7%, bringing its present buying and selling value to round $66,800.

This value motion happens amid broader market tendencies, the place analysts are intently observing Bitcoin’s efficiency.

Rekt Capital, a widely known crypto analyst, has identified that Bitcoin is in its remaining halving retrace earlier than it’s anticipated to renew an upward development.

The analyst highlighted that this 12 months, the Halving Retrace reached -23.6%, the deepest retrace of the present cycle, signaling what many think about the “final bargain-buying opportunity” earlier than a major rally post-halving.

Understanding the re-accumulation part and predicting future actions

In keeping with Rekt Capital, the completion of the Halving Retrace has set the stage for the Re-Accumulation Vary, a essential part in Bitcoin’s market cycle. This vary sometimes varieties just a few weeks earlier than the halving and concludes with a breakout just a few weeks afterward.

The value throughout this part is predicted to fluctuate between roughly $60,000 and $70,000, with potential extensions past these limits. The length of this Re-Accumulation part can last as long as 150 days (or about 5 months), after which Bitcoin would possibly enter a “parabolic uptrend,” marked by a notable spike in value.

Historic information from 2020 reveals an identical sample, the place Bitcoin underwent a -19% retracement round its halving occasion, adopted by a 160-day consolidation interval earlier than getting into a speedy progress part.

In 2024, Bitcoin’s practically -24% retracement round its halving means that, if historical past repeats, then Bitcoin would consolidate for the same interval earlier than breaking into a major uptrend.

This potential for a considerable value enhance after a interval of stability presents perception into Bitcoin’s conduct following halving occasions.

Indicators level to a Bitcoin rally

Including to this evaluation, information from Santiment signifies that Bitcoin is hovering simply above $66,100 as smaller merchants liquidate their holdings amid a common market rebound over the previous week.

Traditionally, this development of smaller wallets promoting to bigger ones has been seen as a bullish indicator for Bitcoin.

Furthermore, technical evaluation of BTC’s every day chart signifies a possible retracement to the $60,000 ranges to collect extra liquidity earlier than a parabolic rise.

Ought to Bitcoin attain this retracement degree, it might pave the best way for a robust rally, enabling the cryptocurrency to interrupt by the $67,000 resistance with ease.

AMBCrypto’s latest report provides one other layer of perception, noting that the stablecoin provide ratio was under the 200-period Easy Transferring Common however above the decrease Bollinger Band.

When Bitcoin’s value hit $56k in early Might and rebounded, it was a key second of curiosity. The oscillator stays within the decrease band, suggesting additional beneficial properties are probably, and the stablecoin provide ratio has seen a downtrend over the previous month.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

This aggressive development greater since October 2023, together with intervals of “stasis or pullback” like these seen in early January and mid-Might, precede important value actions.

Following the January pullback, Bitcoin costs soared previous the $46k resistance effortlessly. Within the coming 2–4 weeks, an identical rally might doubtlessly push Bitcoin properly past the $73k mark, as prompt by market tendencies and analytical forecasts.