- Curiosity in Bitcoin accumulation remained excessive regardless of the latest correction.

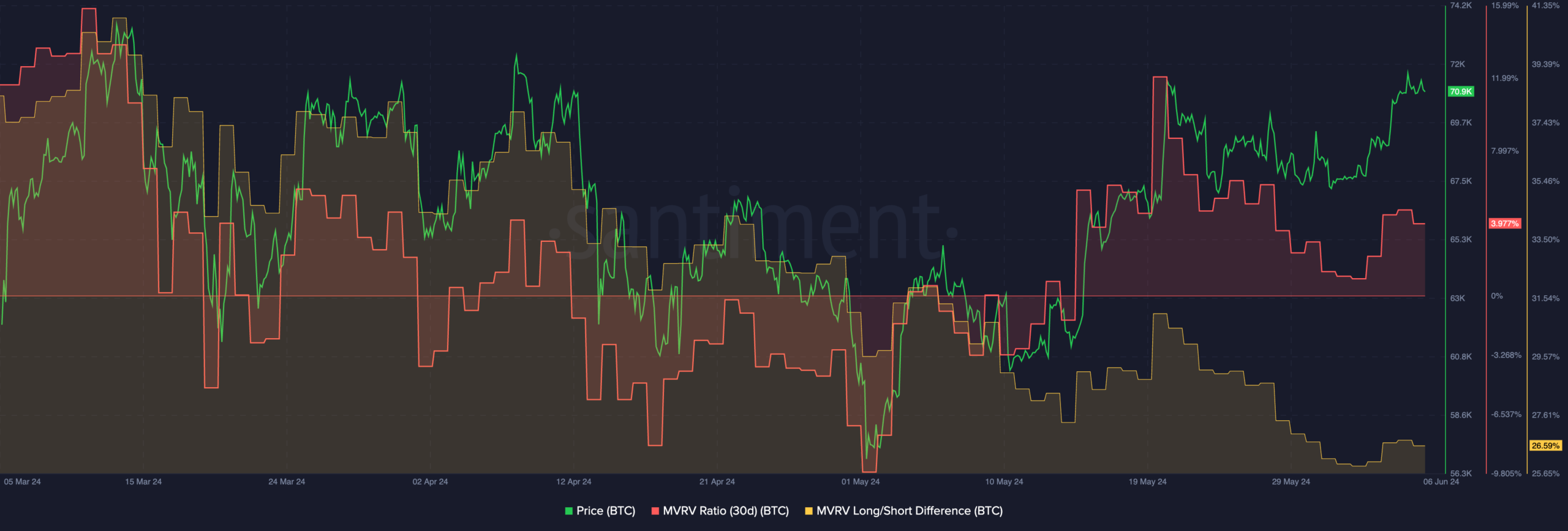

- The profitability of BTC was excessive though costs fell.

Bitcoin [BTC] witnessed a major correction over the previous few days. Regardless of the worth decline, patrons continued to indicate optimism.

Resurgence in curiosity

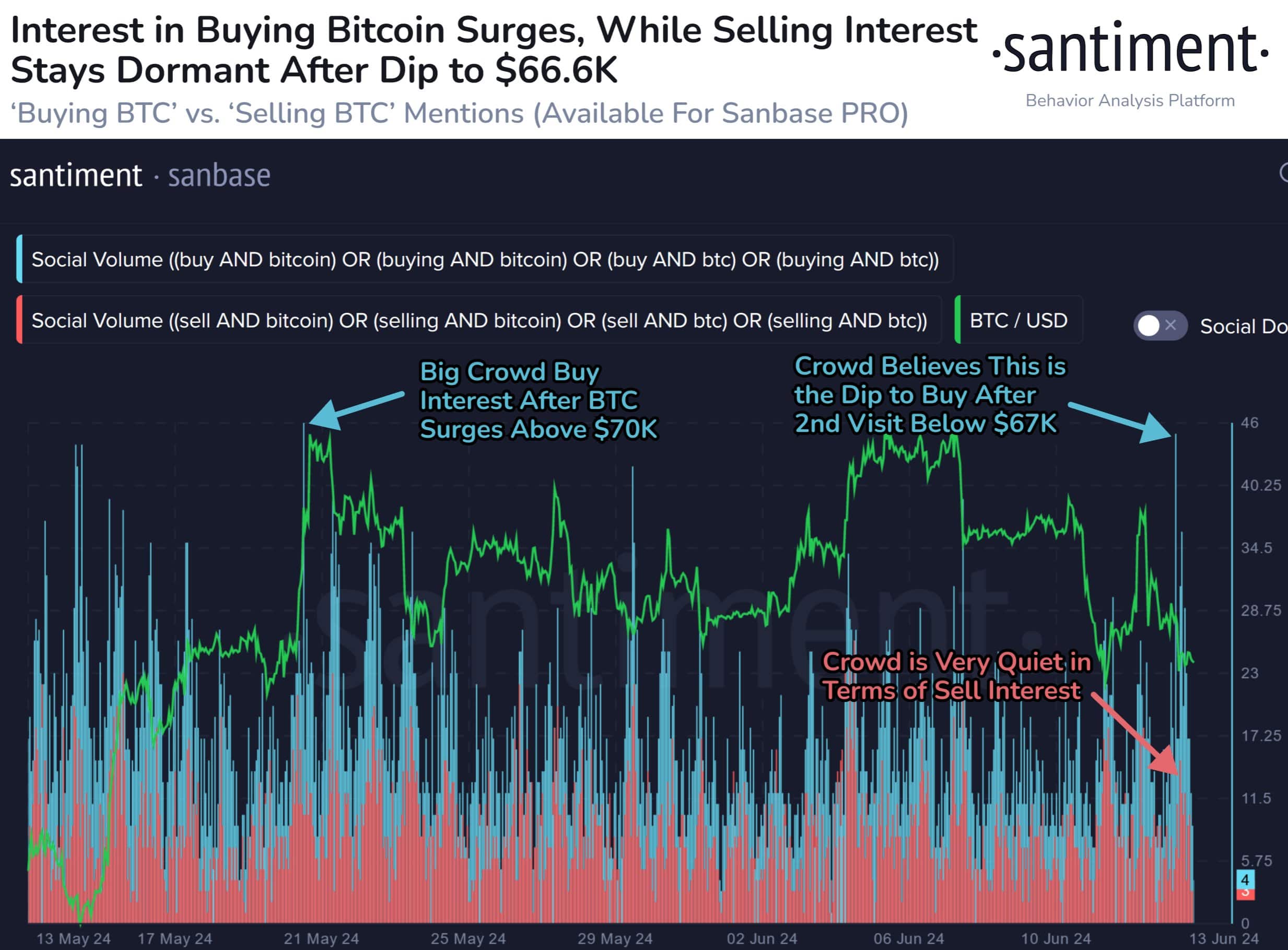

Based on Santiment’s knowledge, a latest dip in Bitcoin’s worth beneath $67,000 on thirteenth June, triggered a surge in shopping for exercise, marking the second-largest spike in investor curiosity for Bitcoin within the final two months.

The primary situation when this occurred, concerned a sudden worth enhance in Might 2024. One of these surge can entice merchants to leap in, anticipating additional worth hikes and potential earnings.

They could be pushed by the idea that they’re lacking out on a profitable alternative in the event that they don’t take part within the rally.

Conversely, a worth drop, just like the one witnessed on June thirteenth, also can set off a shopping for frenzy. On this situation, some merchants may imagine the worth decline is unwarranted and represents a shopping for alternative.

They anticipate a fast restoration and an opportunity to capitalize on a brief dip.

Bitcoin merchants step again

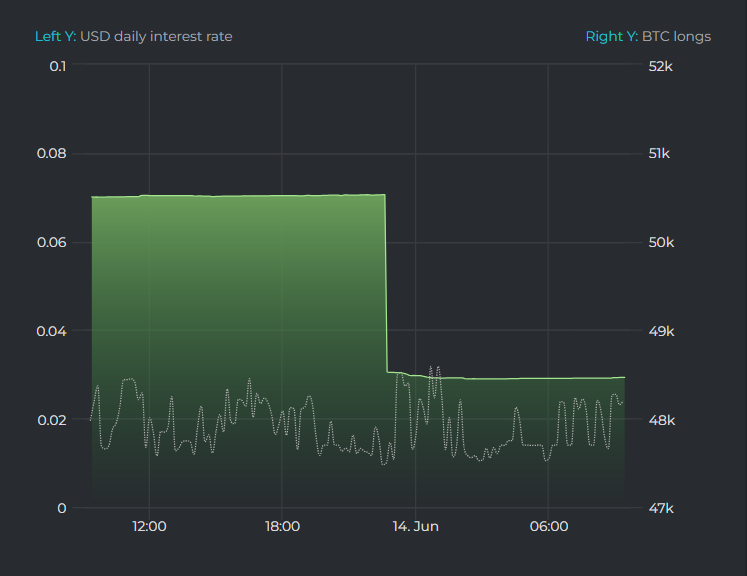

On the flipside, merchants had been changing into increasingly more cautious. Knowledge from Datamish revealed a major motion by Bitfinex whales between 22:35 and 22:41 UTC+8 on June thirteenth.

Throughout this temporary window, these large-scale traders reportedly lowered their lengthy positions by roughly 2,000 BTC, bringing their present holdings right down to 48,464 BTC.

This coincides with a broader pattern of lengthy place liquidation on Bitfinex since June eleventh, totaling roughly 76.4 BTC.

This sell-off by whales means that regardless of the surge in retail shopping for, some bigger traders are adopting a extra cautious method, probably anticipating additional worth fluctuations or searching for to lock in earnings.

Learn Bitcoin (BTC) Worth Prediction 2024-2025

At press time, BTC was buying and selling at $66,918.83, its worth had declined by 0.18% within the final 24 hours. The amount at which it was being traded at had fallen by 24.99% as properly.

The MVRV ratio for BTC remained excessive indicating most holders had been worthwhile on the time of writing.