- Bitcoin’s worth surged by greater than 4% within the final seven days.

- Indicators prompt that BTC would possibly attain $87k quickly.

Bitcoin [BTC] bulls labored arduous this week because the king of cryptos’ worth surpassed $70k. This sparked pleasure in the neighborhood, and a number of other anticipated the coin’s worth to rise additional.

Nonetheless, a promote sign flashed on BTC’s chart, which might have impacted its worth.

Bitcoin holds above $70k

CoinMarketCap’s knowledge revealed that BTC gained bullish momentum on the third of June as its worth began to rise. The coin’s worth spiked by greater than 4% within the final seven days.

On the time of writing, BTC was buying and selling at $71,091.06 with a market capitalization of over $1.4 trillion.

Within the meantime, Ali, a well-liked crypto analyst, posted a tweet highlighting a promote sign. This hinted at a worth decline.

Nonetheless, the sign didn’t have a lot affect on Bitcoin’s worth motion because the coin continued to commerce above $71k.

AMBCrypto’s evaluation of CryptoQuant’s knowledge revealed that traders didn’t promote BTC both. The coin’s trade reserve was dropping, signaling excessive shopping for strain.

Moreover, shopping for sentiment remained dominant amongst US traders as BTC’s Coinbase premium was inexperienced.

Will BTC proceed to rise?

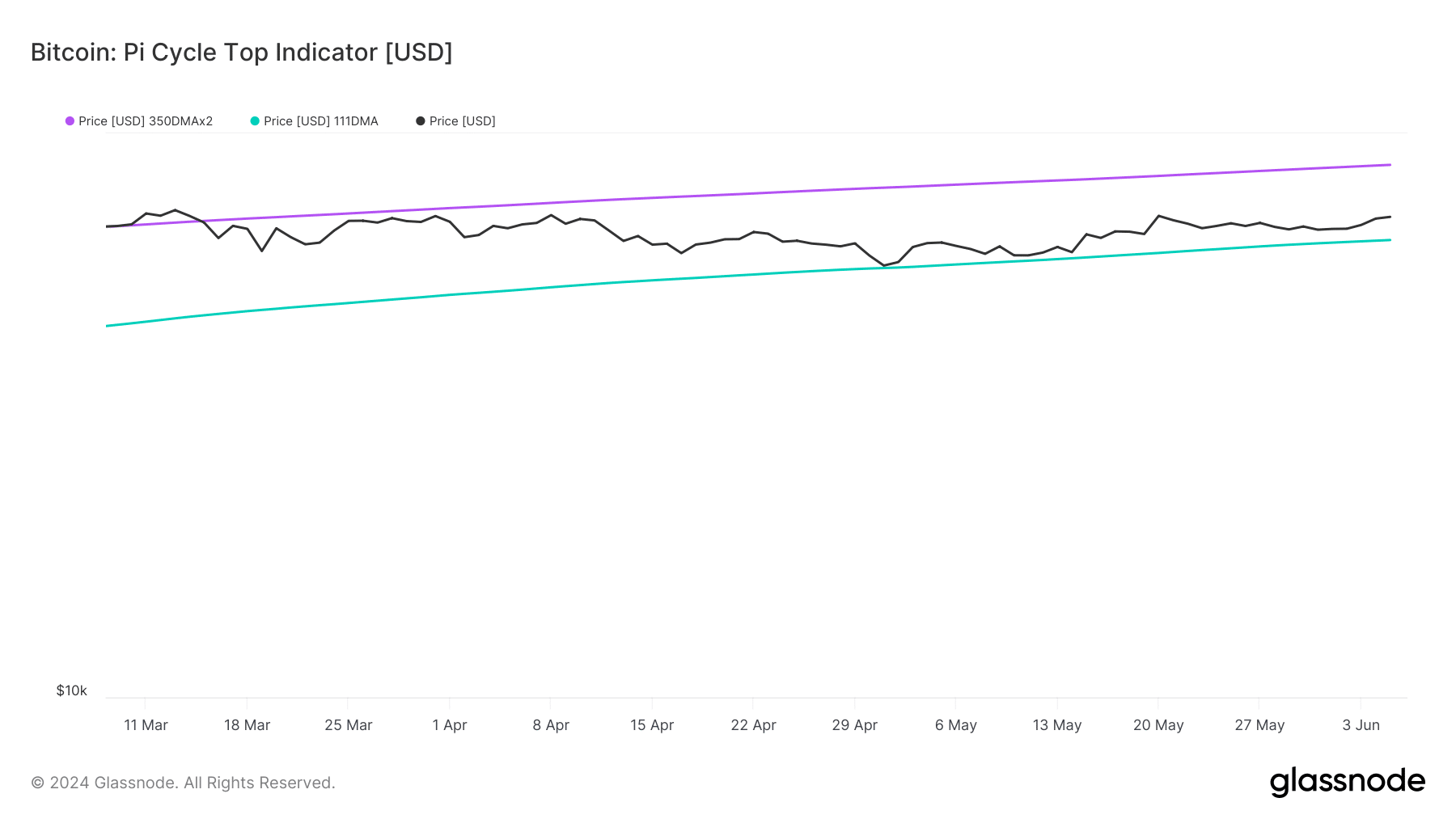

AMBCrypto’s evaluation of Glassnode’s knowledge revealed that BTC would possibly proceed its bull rally. As per the coin’s Pi Cycle Prime indicator, BTC was but to succeed in its market high.

This meant that BTC’s worth would possibly proceed to rise to $87k earlier than it witnesses any main worth correction.

For starters, the Pi Cycle indicator consists of the 111-day shifting common and a 2x a number of of the 350-day shifting common of Bitcoin’s worth.

BTC’s binary CDD was inexperienced, which means that long-term holders’ actions within the final 7 days had been decrease than common. They’ve a motive to carry their cash.

Moreover, its funding price additionally elevated. This meant that long-position merchants are dominant and are keen to pay short-position merchants. These metrics prompt that the possibilities of BTC persevering with to rise had been excessive.

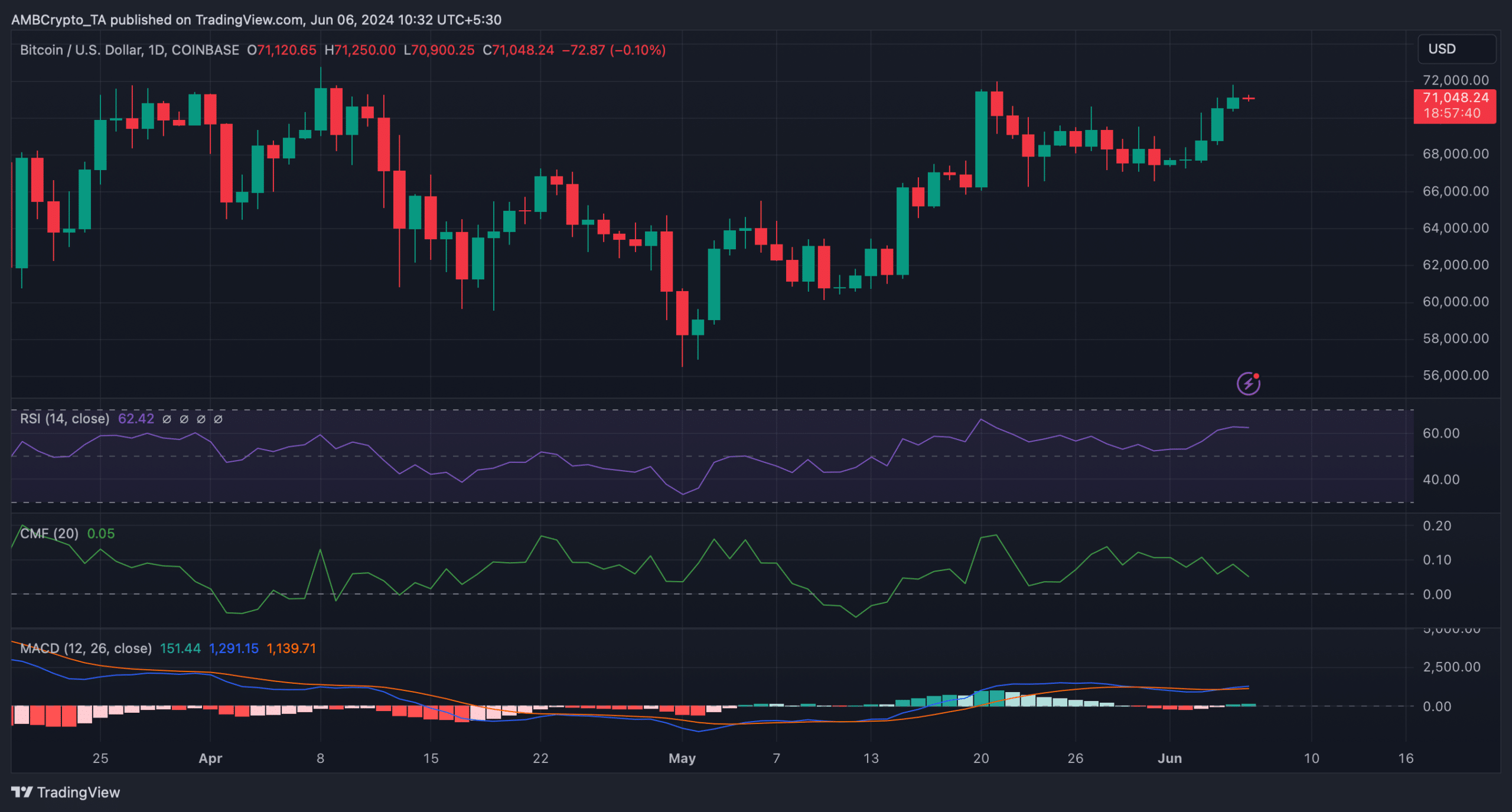

AMBCrypto then analyzed BTC’s day by day chart to higher perceive which route its worth was headed. The technical indicator MACD displayed a bullish crossover.

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

On high of that, BTC’s Relative Power Index (RSI) remained effectively above the impartial mark, suggesting an additional worth hike within the coming days.

Nonetheless, whereas the aforementioned indicators supported the bulls, BTC’s Chaikin Cash Move (CMF) favored the bears. This gave the impression to be the case, because the indicator registered a downtick within the current previous.