- With the crypto greed index at elevated ranges, asset costs may turn out to be inflated, and market volatility could enhance.

- Nonetheless, present key metrics sign a possible BTC short-squeeze to $85K.

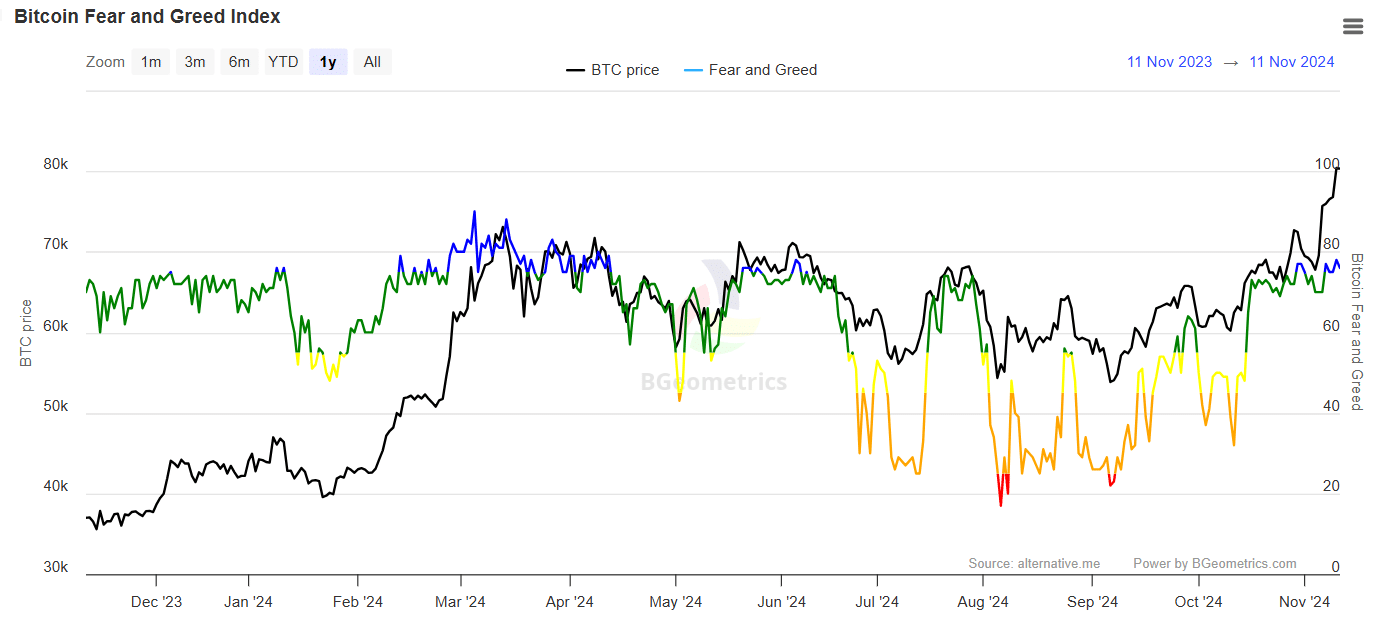

With almost all Bitcoin [BTC] holders in revenue, market sentiment teeters between greed and concern. As BTC breaks information with a brand new ATH of $81K, the crypto greed index has reached a 7-month excessive.

This case is fragile, as heightened greed may push costs increased, however a sudden shift in sentiment would possibly set off a swift sell-off.

Crypto greed index exhibits indicators of overvaluation

For context, the crypto greed index helps buyers gauge market feelings, which might closely affect shopping for and promoting selections. Information from CoinMarketCap exhibits the market steadily edging towards excessive greed.

Earlier than Bitcoin hit $80K, the market was in a greed place. Whereas excessive greed suggests buyers are nonetheless aiming for extra upside, excessive greed may sign overconfidence, growing the chance of a market correction, as seen in the course of the March rally.

In March, as BTC reached the $73K benchmark, the crypto greed index peaked at 90. Because the index signaled excessive greed, many buyers determined to exit the market after securing huge positive factors from the rally. Subsequently, the worth retraced again to $67K in lower than every week.

Now, with the crypto greed index reaching a 7-month excessive and reflecting the same market sentiment, the query arises : Does this sign that BTC is due for a correction, particularly with 100% of holders at present in revenue?

Bulls are betting on additional upside

With BTC leaping over 2% from the day prior to this’s shut, regardless of coming into a high-risk section, it’s clear that buyers are optimistic about Bitcoin’s long-term potential.

This optimism is mirrored within the excessive crypto greed index, which at present signifies a stronger-than-usual risk-taking conduct out there.

Put merely, buyers could also be overlooking potential dangers to chase outsized returns, suggesting a willingness to remain invested regardless of indicators of overvaluation.

This confidence, nonetheless, wants to carry regular within the coming days to forestall BTC from slipping beneath the essential $80K stage.

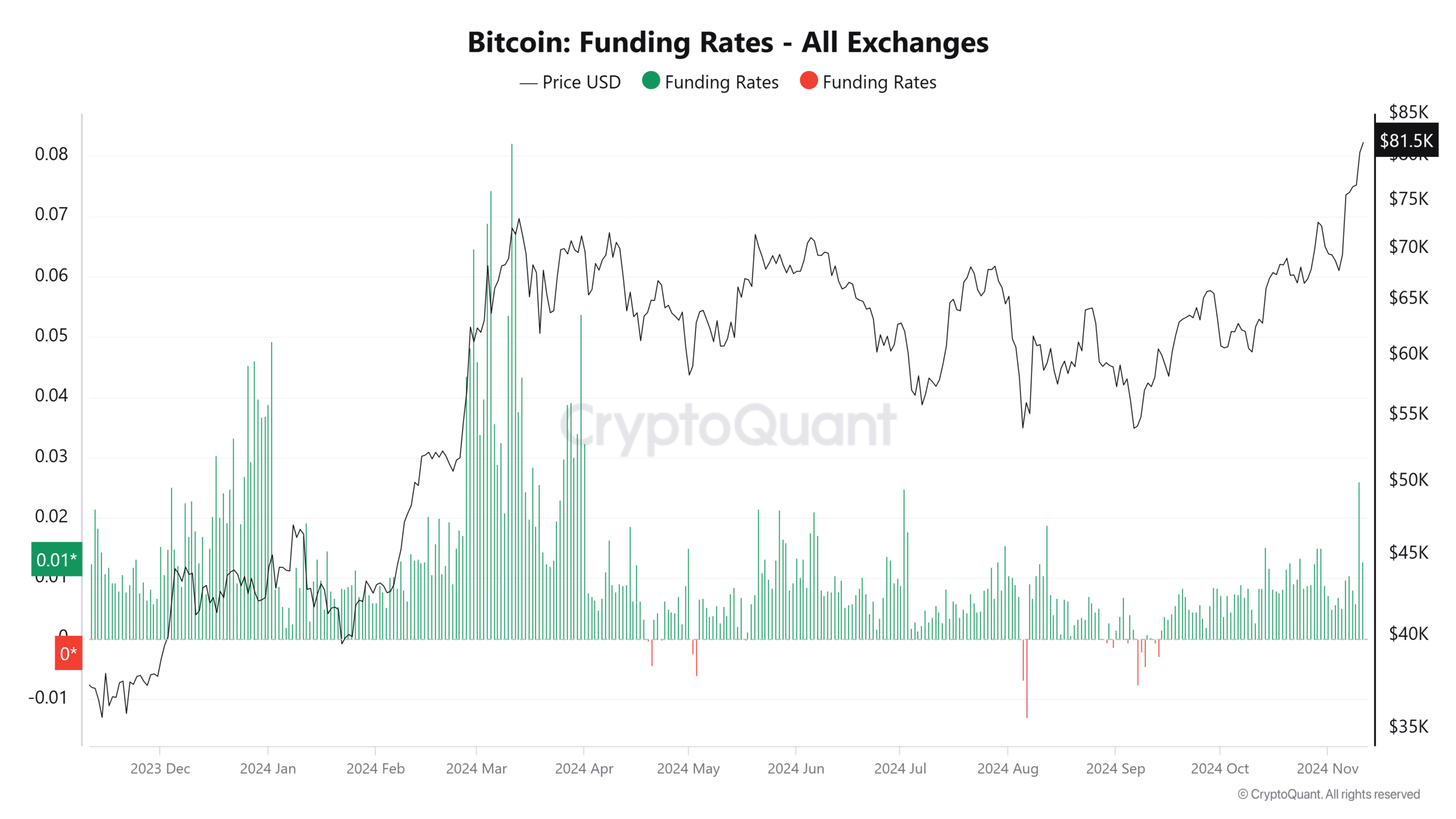

Within the derivatives market, bulls are at present dominating short-sellers, reinforcing the crypto greed index. Whereas bullish exercise stays sturdy, it nonetheless falls in need of the depth seen in the course of the rally in March.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Nonetheless, the mix of sturdy whale accumulation, new bulls coming into the market, a derivatives panorama dominated by longs, and a excessive greed index suggests {that a} high should still be distant.

This creates a positive setup for a possible brief squeeze, the place BTC may surge to $85K earlier than month’s finish as investor optimism and risk-taking conduct attain unusually excessive ranges.