- Bearish sentiment stays dominant throughout Bitcoin’s market

- A couple of metrics and whale actions may very well be key to a worth reversal

Bitcoin’s [BTC] worth has as soon as once more fallen beneath $64k, sparking concern a couple of additional decline on the charts. Now, although there are a number of components at play, a potential cause behind the aforementioned worth correction may very well be whales’ newest actions.

Bitcoin whales take revenue

Market bears stepped up their sport within the final 24 hours as BTC’s worth sank on the charts. In accordance with CoinMarketCap, BTC was down by over 2% at press time, with the crypto buying and selling at $63,042 with a market capitalization of over $1.24 trillion.

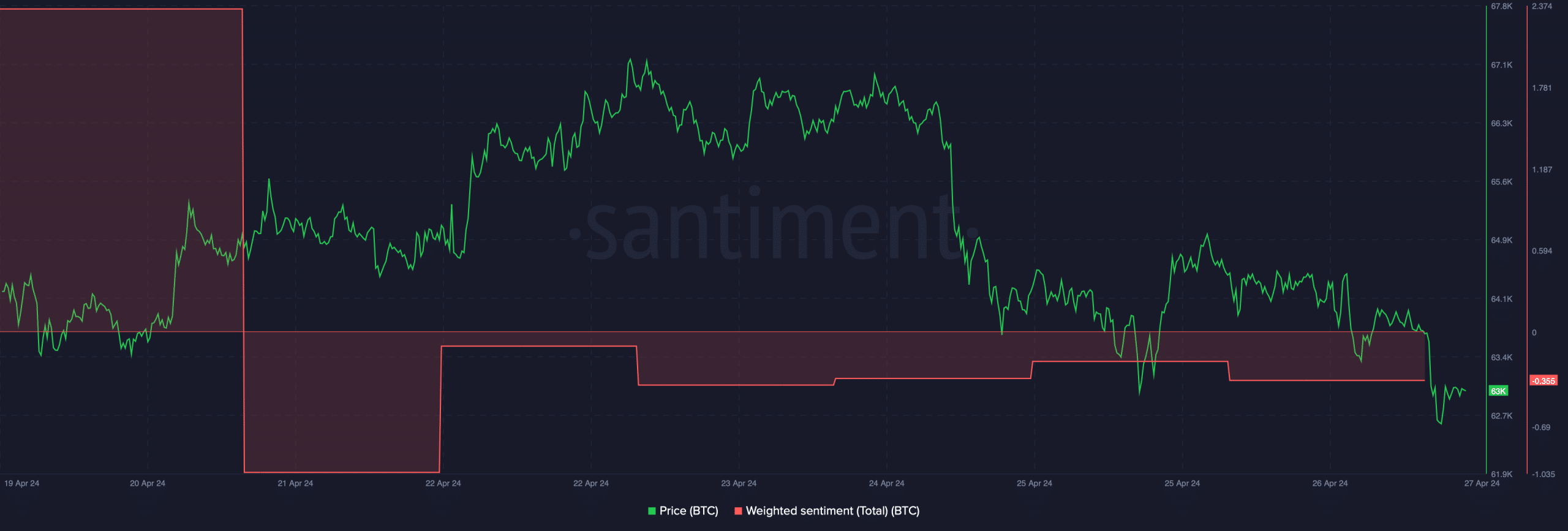

This decline additionally had an impression on the cryptocurrency’s social metrics. In actual fact, AMBCrypto’s evaluation of Santiment’s information revealed that BTC’s weighted sentiment went into the damaging zone – An indication that bearish sentiment retained dominance out there.

Moreover, Phi Deltalytics, an creator and analyst at CryptoQuant, not too long ago shared an evaluation highlighting an fascinating improvement, one which may have been the explanation behind BTC’s newest worth drop.

As per the evaluation, whale Bitcoin trade inflows recorded a notable surge.

The hike accounted for a considerable portion of total trade inflows, indicating vital profit-taking by whales amidst the 2024 Bitcoin bull run. If historic information is to be thought of, at any time when this metric has risen prior to now, it has been adopted by worth corrections on a number of events.

Will Bitcoin fall even additional?

Since BTC’s worth has already turned bearish, AMBCrypto checked its metrics to see whether or not an extra downtrend is certain to occur. As per CryptoQuant’s information, shopping for sentiment has been weak amongst U.S and Korean buyers, with Bitcoin’s Coinbase and Korea Premiums pink too.

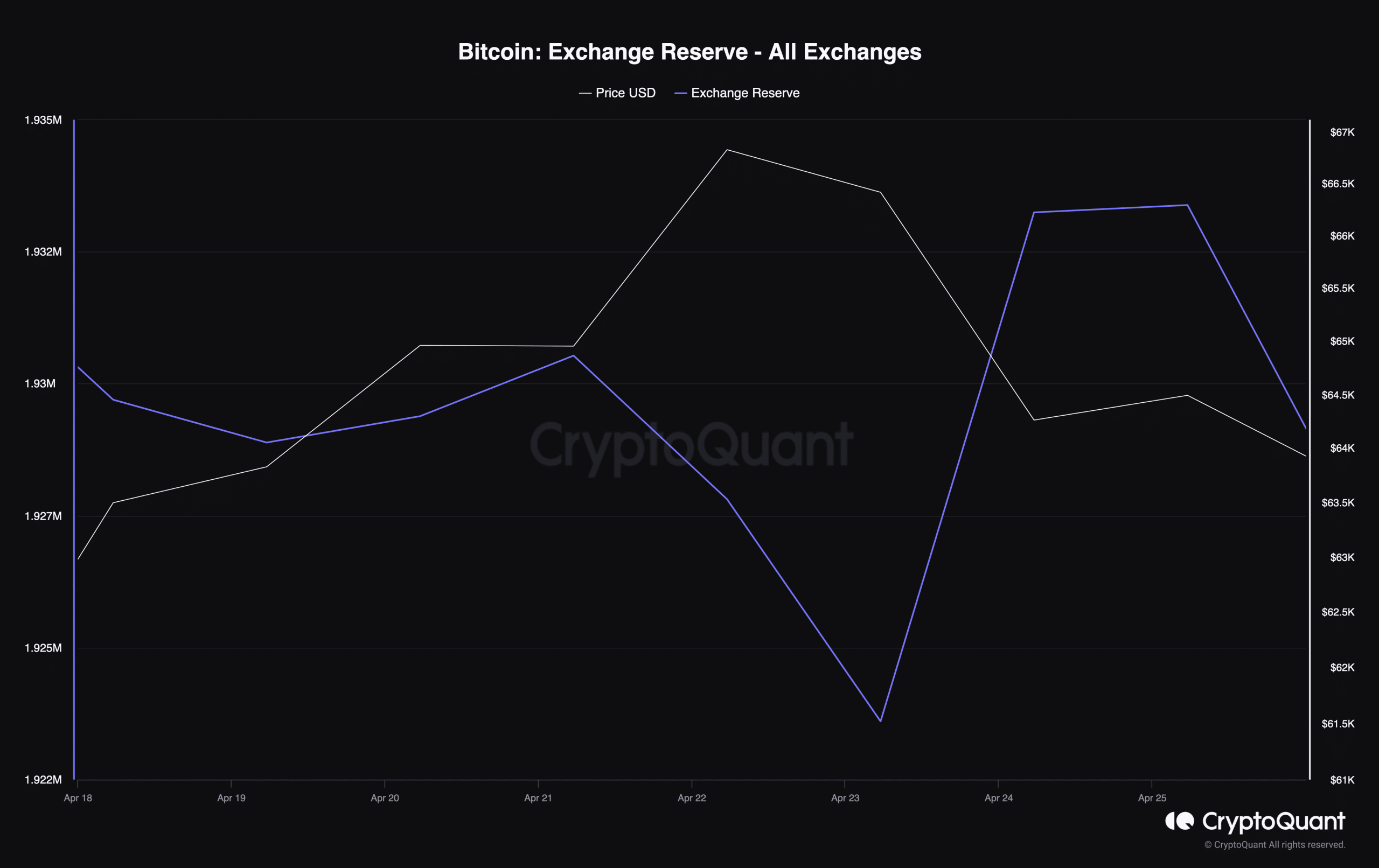

Right here, the excellent news is that after a spike on 24 April, BTC’s trade reserves began to say no – An indication that promoting stress on the king of cryptos was declining.

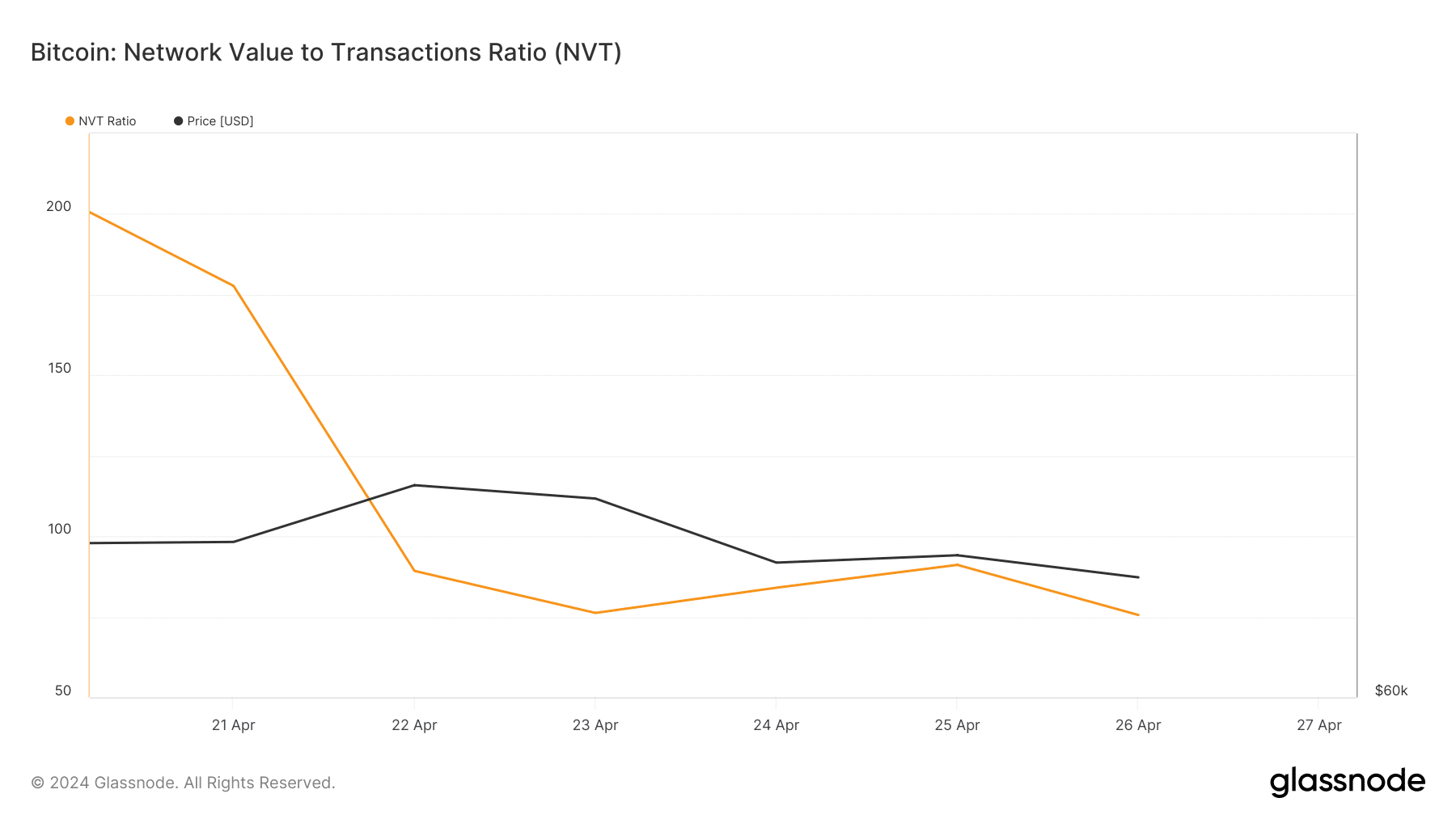

AMBCrypto’s statement of Glassnode’s information identified yet one more bullish sign.

BTC’s Community To Worth (NVT) ratio registered a pointy downtick. For starters, the NVT ratio is computed by dividing the market cap by the transferred on-chain quantity measured in USD.

Each time the metric drops, it means that an asset is undervalued. On this event, it indicated that the possibilities of BTC’s worth going up have been excessive.

In actual fact, AMBCrypto not too long ago reported {that a} well-trained AI mannequin predicted BTC’s worth to the touch $77K throughout the subsequent 30 days.

Learn Bitcoin [BTC] Value Prediction 2024 -2025

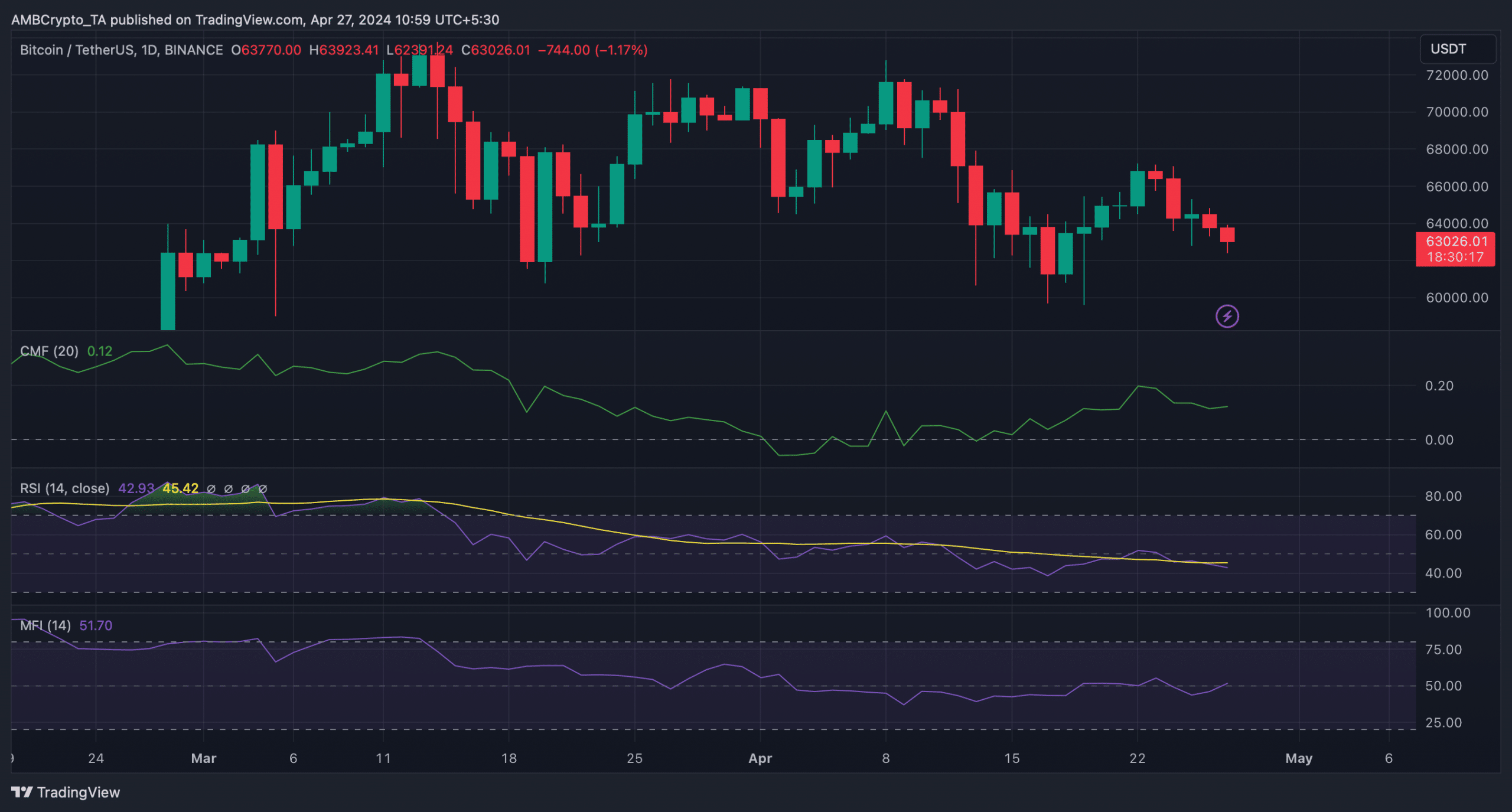

AMBCrypto then analyzed Bitcoin’s every day chart to raised perceive whether or not an uptrend is prone to occur. BTC’s Cash Circulate Index (MFI) registered an uptick and was headed additional above the impartial mark. Its Chaikin Cash Circulate (CMF) was additionally resting properly above the impartial mark of 0.

These indicators instructed that BTC’s worth chart would possibly quickly flip inexperienced once more. Nonetheless, the Relative Energy Index (RSI) regarded bearish because it went south.