- Brief-term holders offloaded important volumes over the previous 24 hours, whereas giant buyers, together with whales, remained on the sidelines, ready for extra favorable entry factors.

- The shopping for ratio peaks at a brand new excessive final reached in April, opening shopping for alternatives.

Bitcoin’s [BTC] has slipped right into a corrective part, dropping 4.43% previously 24 hours to commerce beneath $100,000. This pullback has trimmed its month-to-month positive aspects to 4.94%.

If bullish momentum takes maintain, Bitcoin might surpass its earlier all-time excessive and transfer towards $108,500 earlier than trending increased. In line with AMBCrypto’s evaluation, restoration could rely upon giant holders stepping in at key worth ranges regardless of ongoing bearish market circumstances.

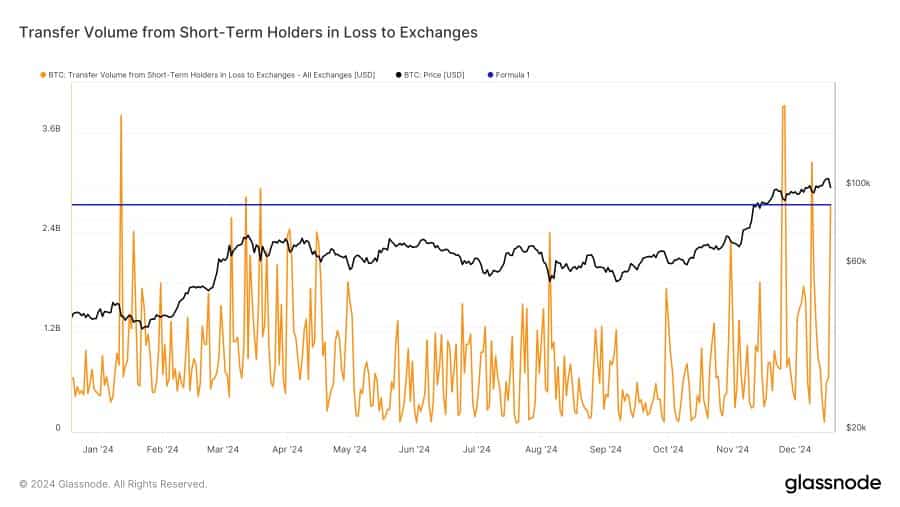

Brief-term holders gas Bitcoin’s latest decline

Analyst Jam Van Straten attributes Bitcoin’s latest downturn primarily to short-term holders who continuously commerce the cryptocurrency. This group has collectively offloaded about 26,000 BTC, valued at $2.7 billion.

These sell-offs embrace trades made at each losses and earnings, reflecting the volatility of their buying and selling exercise.

Van Straten famous that enormous buyers, or whales, stay on the sidelines, holding important liquidity as they await an excellent entry level.

He defined:

“Big players are waiting for the price and not chasing it.”

This means that these influential merchants are unlikely to behave till market circumstances align with their methods. As soon as whales re-enter the market, their shopping for exercise might drive Bitcoin to get better and doubtlessly commerce increased.

Shopping for momentum might quickly resume

Santiment experiences that discussions about shopping for Bitcoin’s latest dip have reached record-high ranges, a sentiment that was final seen on the twelfth of April 2024, eight months in the past.

Since then, Bitcoin has surged by over 81%. If historical past repeats itself, the present sentiment might gas an analogous rally, pushing BTC into increased worth areas past its present ranges.

With this potential upside in view, whales are more likely to resume purchases. If shopping for momentum stays robust, Bitcoin might development even increased.

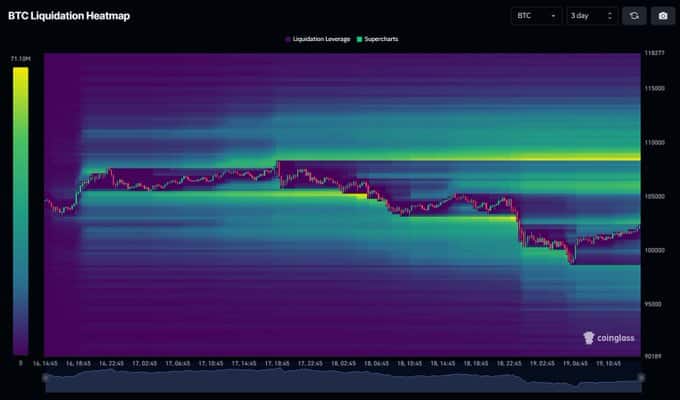

Additional evaluation reveals that BTC is able to commerce above its earlier highs, pushed by the formation of a big liquidity cluster across the $108,500 degree, as identified by analyst Mister Crypto.

Liquidity clusters act as magnets for worth actions, as property usually gravitate towards these areas to filter pending orders earlier than persevering with their trajectory.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

This setup means that Bitcoin has a robust chance of regaining purchaser curiosity, particularly as bullish conversations proceed to dominate the market.