Bitcoin broke previous $71,000 Tuesday morning to steer different main altcoins right into a bullish development per week earlier than the US elections. In accordance with CoinGecko’s monitoring, Bitcoin touched $71,075 after dipping final week resulting from rumors circulating over a potential investigation on Tether and the continued Center Jap battle.

Specialists and business watchers say the current Bitcoin breakout is linked to elevated inflows into Bitcoin ETFs and the joy over the November 4 US presidential elections favoring the crypto business. Regardless of Bitcoin’s erratic value actions in the previous couple of days, Bitcoin at present rides on a bullish sentiment.

Supply: Coingecko

Bullish Run Forward For Bitcoin?

Final week was a tough time for holders and the market as Bitcoin dipped beneath $66,000 however instantly bounced again and consolidated within the $67,0000 to $68,000 vary through the weekend.

Then, Bitcoin broke out and hit $71,075, its greatest efficiency during the last 4 months. In accordance with CoinGecko, Bitcoin’s newest value motion this Tuesday is backed by $51 billion in buying and selling quantity, double the quantity generated on Monday.

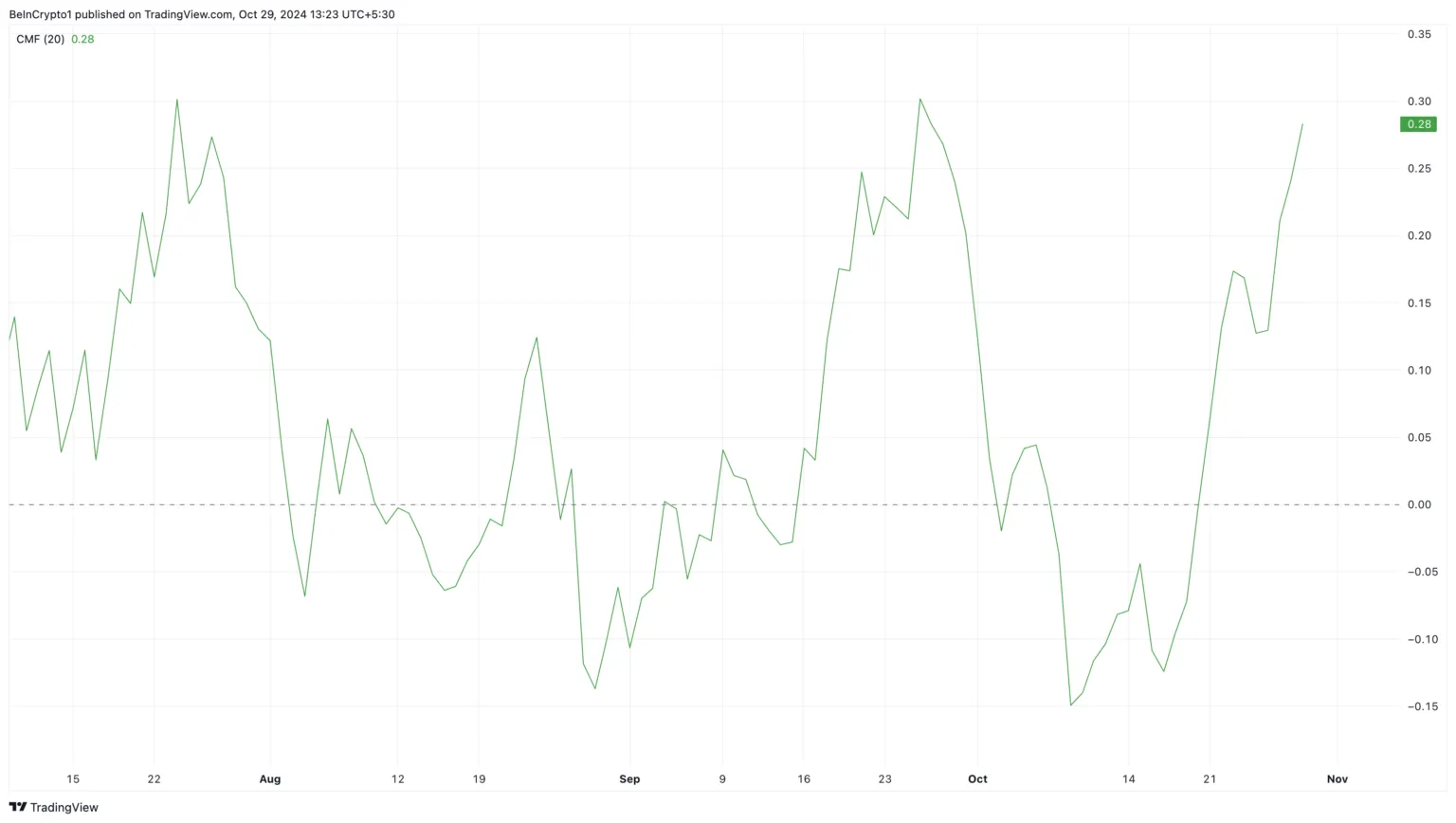

Bitcoin market cap at present at $1.4 trillion. Chart: TradingView.com

Observers like Peter Brandt stated that Bitcoin’s newest value motion displays a brand new bullish section post-halving. In a Twitter publish, the seasoned dealer shared Bitcoin has accomplished its “inverted expanding pyramid” and that the following follow-through is vital. Brandt additional defined that this could possibly be Bitcoin’s post-halving run.

Trades From BTC Whales And Inflows Into ETFs Increase The Market

Bitcoin’s current value surge is attributed to elevated trades from Bitcoin whales and inflows into ETFs. In accordance with CryptoQuant’s Mignolet, current shopping for could be attributed to whales on Binance, who seem like the web Bitcoin patrons through the Asian buying and selling hours.

Supply: Farside Traders

Additionally, buying and selling for the Bitcoin ETFs has primarily contributed to the higher-than-usual buying and selling quantity. These funds added a internet influx of over 47,000 Bitcoins over two weeks. Except for Bitcoin, different main altcoins additionally joined the surge. Dogecoin, for instance, elevated by 15% resulting from Trump’s reputation. Then, there’s Shiba Inu (SHIB), which jumped by 8%, Ether (ETH) by 4.9%, and Cardano’s ADA improved by 3%.

Picture: Zerocap

Larger Highs Subsequent?

For a lot of skilled merchants, Tuesday’s massive leap units the tone forward of November’s US elections. Merchants and crypto supporters anticipate Bitcoin to maintain its positive factors and even hit new highs whatever the end result of the presidential elections.

Merchants have lengthy favored and anticipated that Donald Trump will win the elections. For a lot of, a Trump win is a bullish catalyst for Bitcoin since he boasts a couple of pro-crypto insurance policies. It additionally helps that Trump will get the backing of Elon Musk, a vocal supporter of Bitcoin and blockchain know-how. The Democrats, however, haven’t made particular insurance policies however plans to introduce laws within the business.

Even monetary analysts contribute their opinions and projections forward of the US elections. In accordance with some analysts at Normal Chartered, Bitcoin might hit $73,000 by November fifth. If Trump wins, they predict the value to hit $80,000 and even as much as $125,000 earlier than the 12 months ends, particularly if the Republicans win Congress.

Featured picture from Dall-E, chart from TradingView