U.Right now – didn’t quit on the $68,000-$70,000 value vary and is perhaps gaining some momentum for a breakthrough try. The digital gold is at the moment buying and selling at round $69,000, bouncing off of the 26 EMA. Nonetheless, $69,400 is a big resistance threshold which will trigger some severe hassle if BTC doesn’t achieve sufficient momentum.

As Bitcoin makes an attempt to interrupt by way of the vital $70,000 barrier as soon as extra, the chart exhibits a bullish sentiment. The value has demonstrated resilience and the potential for upward motion by just lately rebounding off the 26-day Exponential Shifting Common.

This rebound implies that consumers are intervening and giving the market the assist it wants to stay above $68,000. Presently Bitcoin is battling the $69,400 resistance degree, a vital level that has traditionally been difficult to surpass. If this degree just isn’t damaged, there could possibly be a reversal towards $70,000 and decrease.

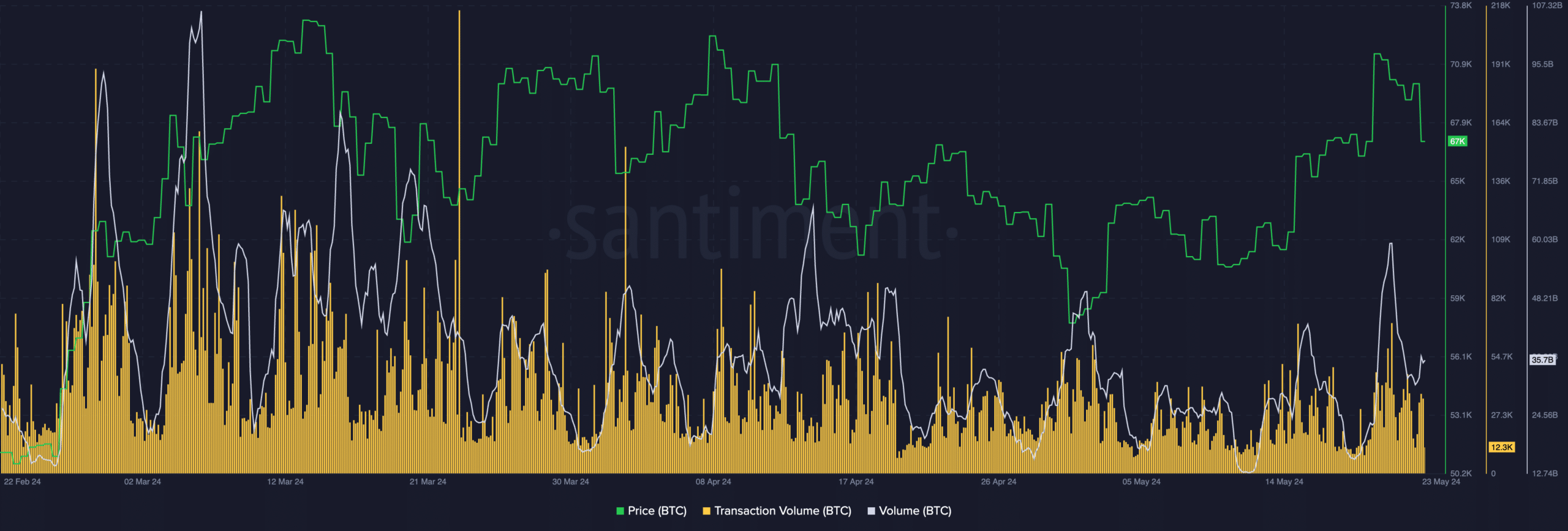

A correction could discover extra assist on the 50-day EMA and the 100-day EMA, that are each positioned under the present value. The buying and selling quantity has elevated considerably, suggesting that merchants have gotten extra and concerned. Any significant value motion should be sustained by this quantity spike.

‘s questionable state

XRP is at the moment in a combined state: on the one hand, the asset remains to be closely suppressed; on the opposite, it’s gaining some energy and doubtlessly even gaining some energy for a bounce. A technique or one other, it’s nonetheless transferring underneath the 50 EMA and positively has to interrupt by way of with a purpose to be thought of a bounce contender.

On condition that XRP has not but been capable of decisively break by way of the 50-day EMA it’s particularly vital. If the value continues to rise above this barrier, it might be an indication that consumers are taking cost and driving up the value. However the bearish angle may nonetheless be prevalent so long as XRP stays under this mark.

The low buying and selling quantity could point out a insecurity amongst merchants. XRP would require extra buying and selling quantity to maintain the value motion with a purpose to create a profitable restoration. Robust participation is normally indicated by excessive quantity, which may additionally affirm the course of the value development. The RSI is in a impartial zone, at round 50 and doesn’t present any substantial perception.

‘s concern

Ethereum is clearly dealing with some struggles because the asset has stayed in the identical buying and selling vary for the previous few weeks. Contemplating the buying and selling quantity, it’s not the difficulty, since bears usually are not actually able to push it downwards. However there’s additionally an vital issue to contemplate: the exhaustion of bulls.

The Ethereum/USD chart signifies that the cryptocurrency has been settling right into a small vary, roughly starting from $3,750 to $3,850. The value has not damaged out significantly greater regardless of prior bullish momentum suggesting a doable plateau. Though sellers usually are not actively bringing costs down this stagnation could also be the results of bullish exhaustion, wherein consumers lack the facility to drive costs greater.

Extra context is given by the chart’s transferring averages. However failing to interrupt above the current resistance degree round $3,850 may point out a consolidation section or perhaps a doable retreat. The present vary must be damaged, and quantity evaluation signifies that buying and selling exercise has not elevated considerably.

Elevated market participation can be indicated by a spike in quantity, which could encourage a breakout. The low however constant quantity in the intervening time signifies that merchants are ready to see what’s going to occur earlier than making an enormous transfer. Ethereum is getting near overbought situations, as indicated by the RSI, which is at the moment buying and selling between 60 and 70. Even when it’s not a drastic situation, it implies that the upside potential is perhaps constrained within the absence of a market correction or consolidation interval.