Coinspeaker

Bitcoin (BTC) Worth Eyes $83,000 after This Breakout, Choices Expiry Knowledge Bullish

The world’s largest cryptocurrency Bitcoin (BTC) has been holding onto $71,000 for fairly some time with some on-chain indicators hinting at a possible surge forward. All eyes are at present on subsequent week’s Fed assembly as central banks in Europe and Canada have already pivoted by slicing rates of interest.

As per the most recent report from 10x analysis, Bitcoin (BTC) value may surge all the best way to $83,000 with a bullish value sample on the every day chart. A transfer above $72,000 would validate a breakout from an inverted head-and-shoulders sample, marked by three value troughs, with the center one being probably the most pronounced.

Courtesy: 10x Analysis

In its latest notice, Markus Thielen, founding father of 10x Analysis, stated: “It is only a matter of time until bitcoin makes a new all-time high. The head-and-shoulders formation suggests a rally towards 83,000 soon, with the resistance line likely broken within the next few days. The ideal time for this resistance to break is either today, Friday, June 7, or next week, Wednesday, June 12”.

Bitcoin Derivates Knowledge

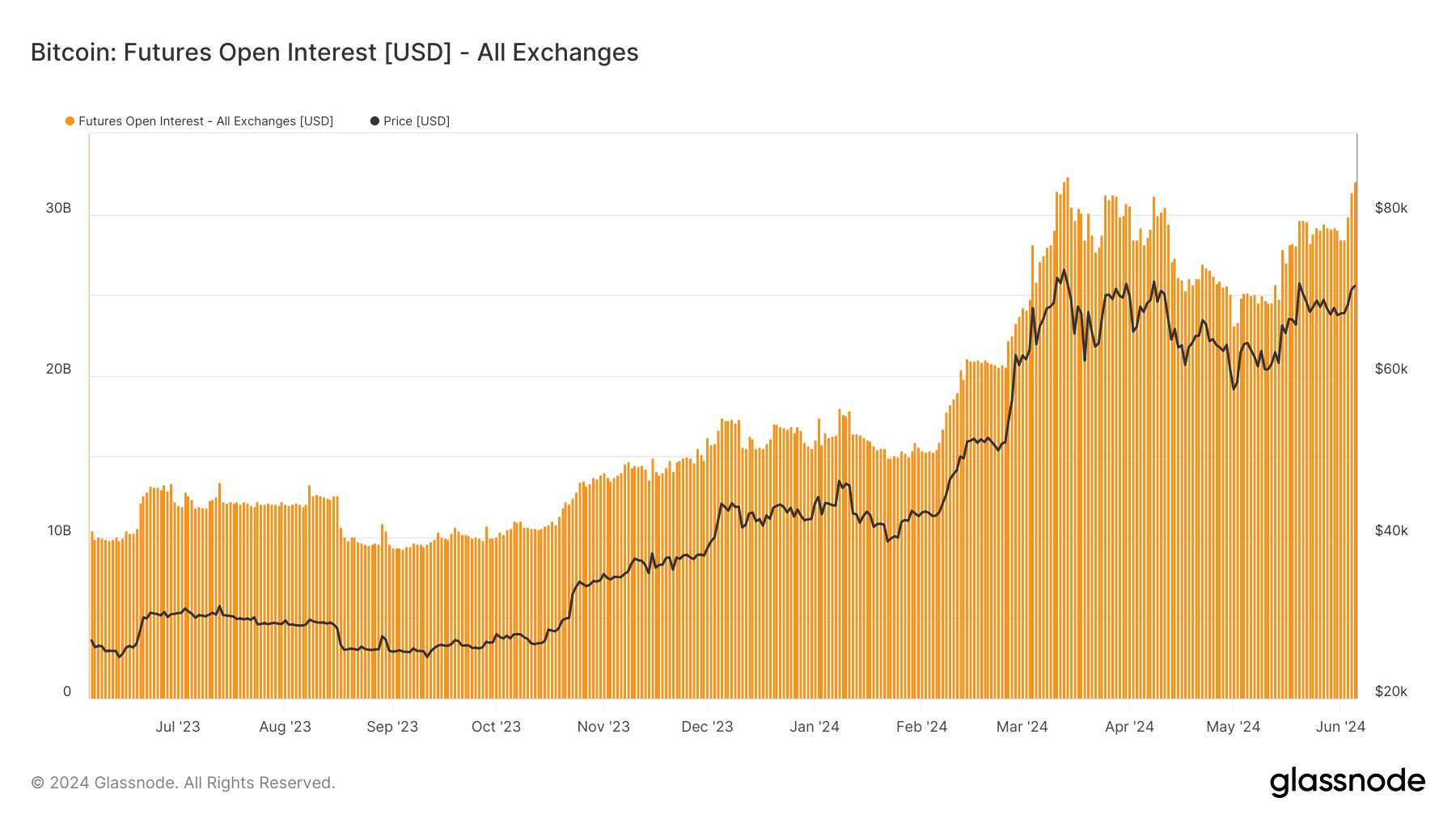

Bitcoin (BTC) merchants have set a brand new milestone as open curiosity in BTC-tracked futures surged to an all-time excessive, surpassing $37.7 billion late on Thursday. This achievement eclipses the earlier peak of practically $37 billion noticed in mid-March, coinciding with Bitcoin’s recent highs of $73,700.

In response to information from CoinGlass, over $5 billion in open curiosity has been added since Monday, with BTC costs climbing from round $68,500 to $71,000 throughout this era. Among the many contributors to the document open curiosity, the Chicago Mercantile Trade (CME) leads with bets totaling $11 billion, adopted intently by crypto change Binance at $8 billion.

The substantial long-short ratio signifies a prevailing bullish sentiment amongst merchants, reflecting confidence in Bitcoin’s upward trajectory.

BTC Choices Expiry

Greeks.Stay supplied an outline of the June 7 Choices Knowledge, revealing that 18,000 BTC choices expired with a Put Name Ratio of 0.67, a Maxpain level of $70,000, and a notional worth of $1.25 billion.

Presently, BTC’s main time period implied volatility (IV) stands round 50%, whereas ETH’s main time period IV hovers round 55%, each of which have decreased to cheap ranges.

Trying forward, the chance of this month’s BTC market is predicted to be strongly correlated with macro information, notably concerning the Federal Reserve’s rate of interest minimize.

Bitcoin (BTC) Worth Eyes $83,000 after This Breakout, Choices Expiry Knowledge Bullish