Coinspeaker

Bitcoin Bull Run Incoming? Key On-Chain Metrics Level to Market Shift

Latest information from CryptoQuant reveals that Bitcoin

BTC

$63 753

24h volatility:

0.6%

Market cap:

$1.26 T

Vol. 24h:

$25.85 B

is perhaps gearing up for a rally. In keeping with a CryptoQuant analyst below the pseudonym Darkfost, key on-chain metrics counsel a transfer towards a bullish section, with indicators that market sentiment is popping constructive.

Key On-Chain Metrics Indicating Restoration

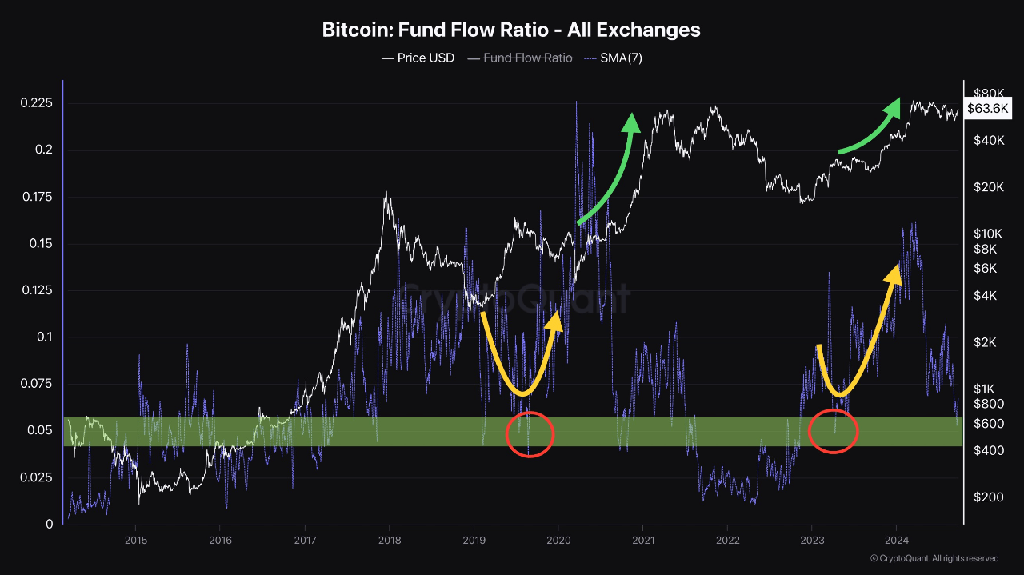

One of many major indicators highlighted by Darkfost is the 7-day Easy Transferring Common (SMA) of the Fund Circulate Ratio, which is at present at 0.05. Traditionally, this stage has marked the top of bear markets or the beginning of recent bullish phases. A current enhance within the Fund Circulate Ratio hints at rising investor exercise on the exchanges, an indication that normally precedes sharp value surges.

Credit score: CryptoQuant

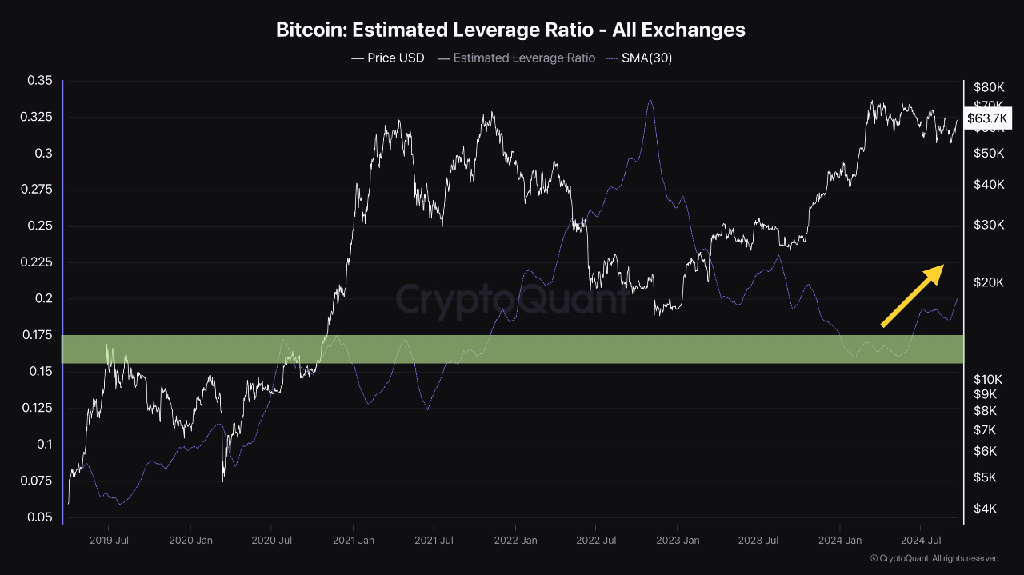

One other crucial metric pointing towards restoration is the 30-day SMA of the Estimated Leverage Ratio. This metric tracks leverage use in Bitcoin buying and selling. At present, the ratio is trending upward inside a help vary of 0.15 and 0.175. This displays elevated confidence by market individuals. Rising leverage is additional confirmed by rising curiosity in futures ETFs and Bitcoin choices buying and selling.

Credit score: CryptoQuant

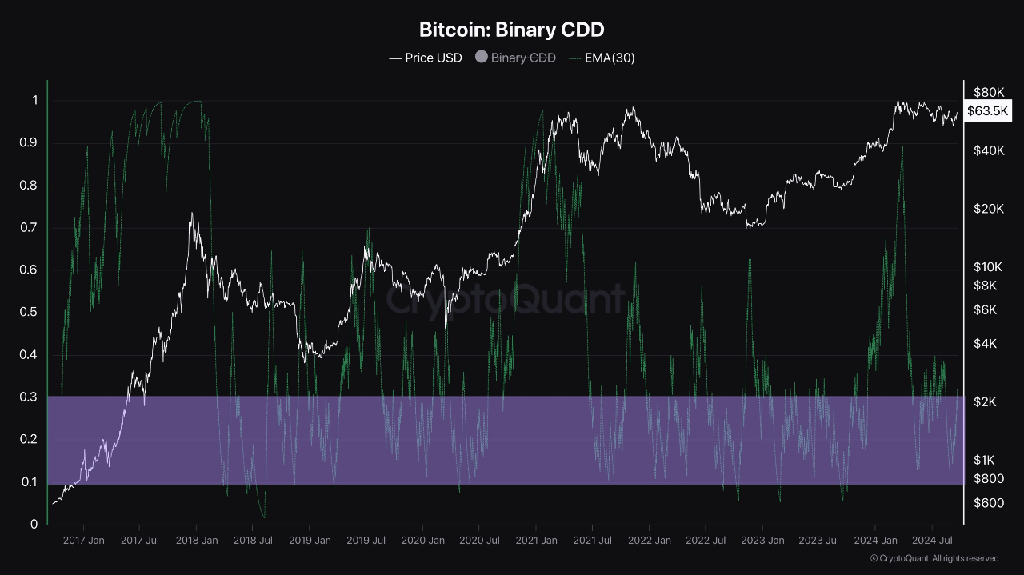

Darkfost additionally attracts consideration to the 30-day Exponential Transferring Common (EMA) of Binary Coin Days Destroyed (CDD). This indicator displays the exercise of long-term Bitcoin holders. A pointy rise on this metric typically indicators the top of a bear market section. For now, the long-term holders appear to be positioning themselves for future beneficial properties, which might present additional help for Bitcoin’s value within the months forward.

Credit score: CryptoQuant

Historic Tendencies Counsel a Bullish Breakout

Alongside on-chain information, historic cycle patterns additionally counsel Bitcoin could also be on the verge of a breakout. In an X put up, pseudonymous analyst Rekt Capital famous that Bitcoin tends to interrupt out from its reaccumulation section round 154-161 days after a halving occasion. If this argument stands, a breakout is perhaps close to since 157 days have handed because the newest halving.

Whereas historic developments are not any assure of future value actions, Bitcoin additionally behaved equally in 2016 and 2020. Moreover, the normally bearish month of September stunned many this yr with the month 9% in inexperienced. This marks the second-best September efficiency for Bitcoin since 2016.

Lengthy-Time period Outlook Stays Optimistic

The long-term outlook for Bitcoin stays constructive. It’s unclear precisely when or how huge the subsequent value soar will probably be, however current information reveals Bitcoin may very well be near a powerful rally. Bitcoin is now simply 14.6% under its earlier peak of $73,738. The following few days may very well be essential in deciding Bitcoin’s value trajectory.

Within the coming months, the upcoming U.S. elections are anticipated to affect market sentiment, although specialists consider the impression could also be minimal. Each candidates have expressed curiosity in crypto, with Trump being extra vocal and displaying sturdy help.

Bitcoin Bull Run Incoming? Key On-Chain Metrics Level to Market Shift