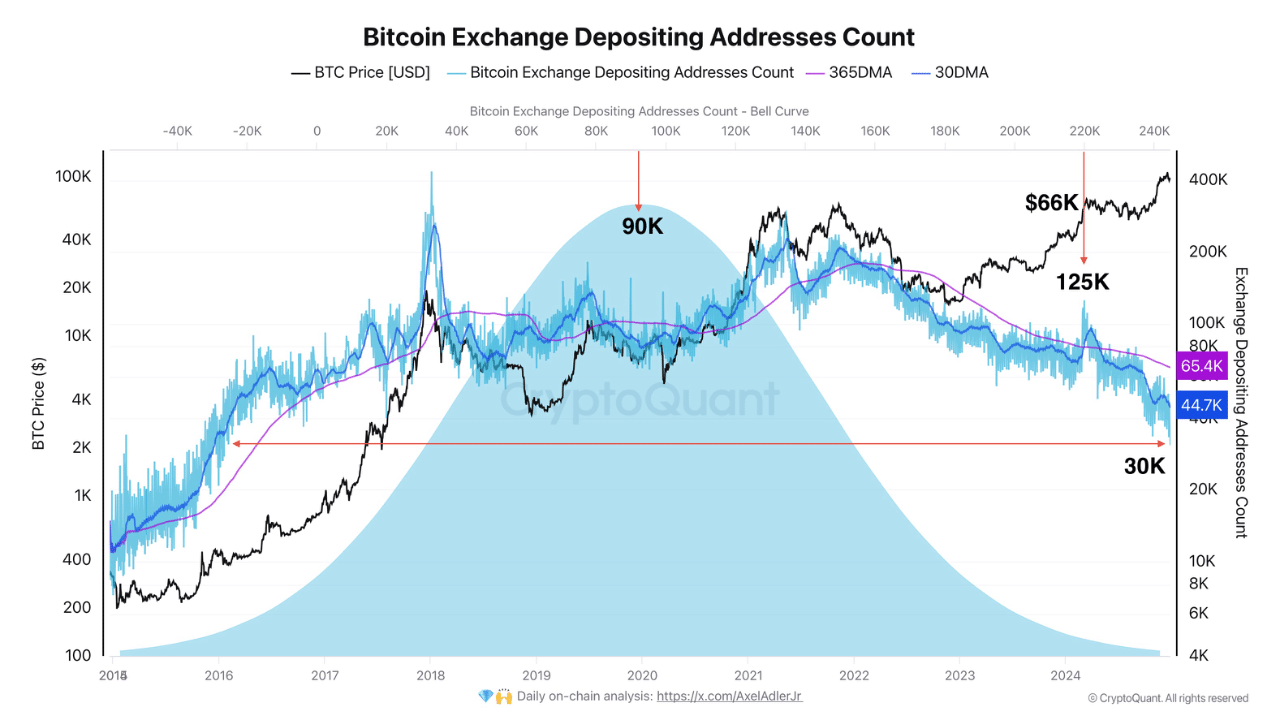

- BTC change deposits have shrunk to 2016 lows.

- CryptoQuant analyst deem this a sign for a serious rally for BTC in the long term.

Because the nineteenth of December, Bitcoin [BTC] has struggled beneath $100K, however the cryptocurrency’s long-term outlook stays optimistic.

In accordance with CryptoQuant analyst Axel Adler, the quantity of BTC being moved to exchanges has dropped to 2016 ranges. Adler added that the final time BTC deposits on exchanges dropped this low, a serious rally adopted.

“It typically suggests they prefer to keep their BTC in personal wallets rather than gearing up to sell.”

In comparison with early 2024, when BTC every day deposits peaked at over 125K cash, the present studying declined beneath 45K BTC, mirroring 2016 ranges.

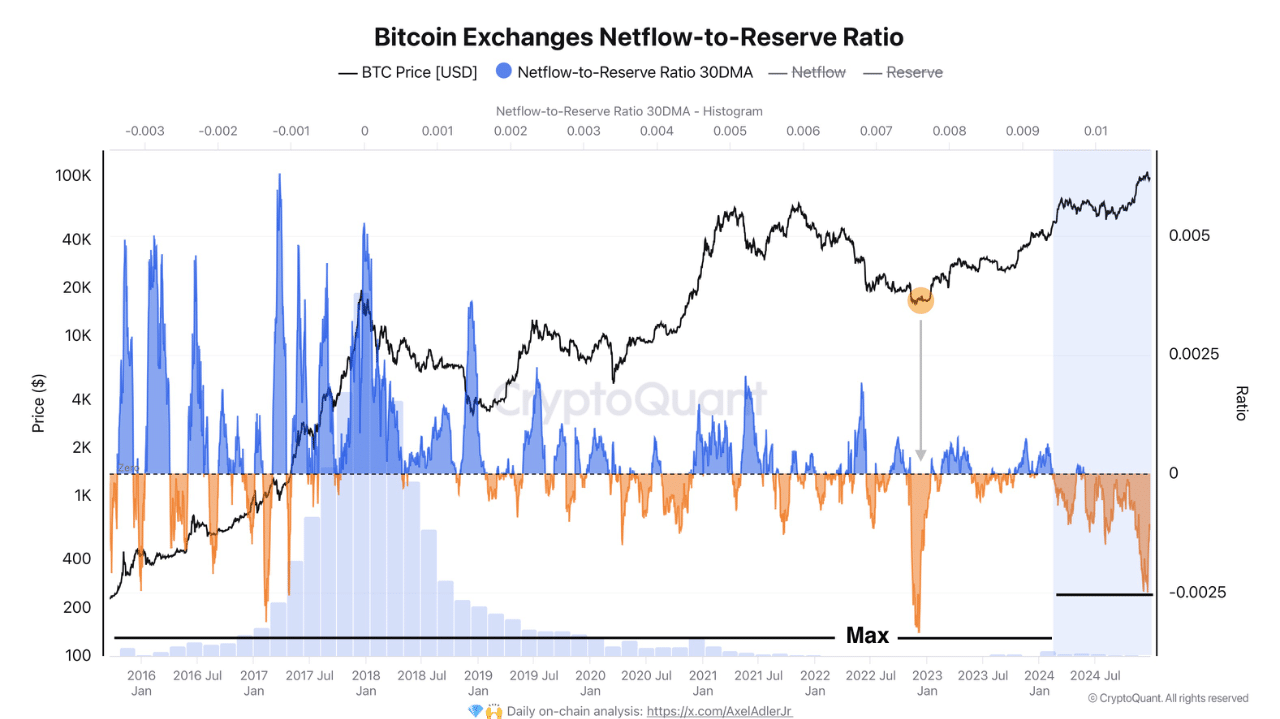

Extra BTC leaving exchanges

Curiously, the above optimistic outlook was additionally strengthened by extra BTC being moved from the exchanges.

Utilizing the BTC netflow-to-reserve ratio, Addler famous that the metric was unfavourable, underscoring dominance in change outflows.

The ratio gauges the correlation between internet inflows/outflows relative to change BTC reserves.

The unfavourable studying urged that, on common, extra BTC left exchanges than recorded deposits. This can be a typical bullish sign.

Briefly, BTC’s long-term prospect was nonetheless optimistic regardless of the current spike in promote stress that has stored the asset beneath $100K.

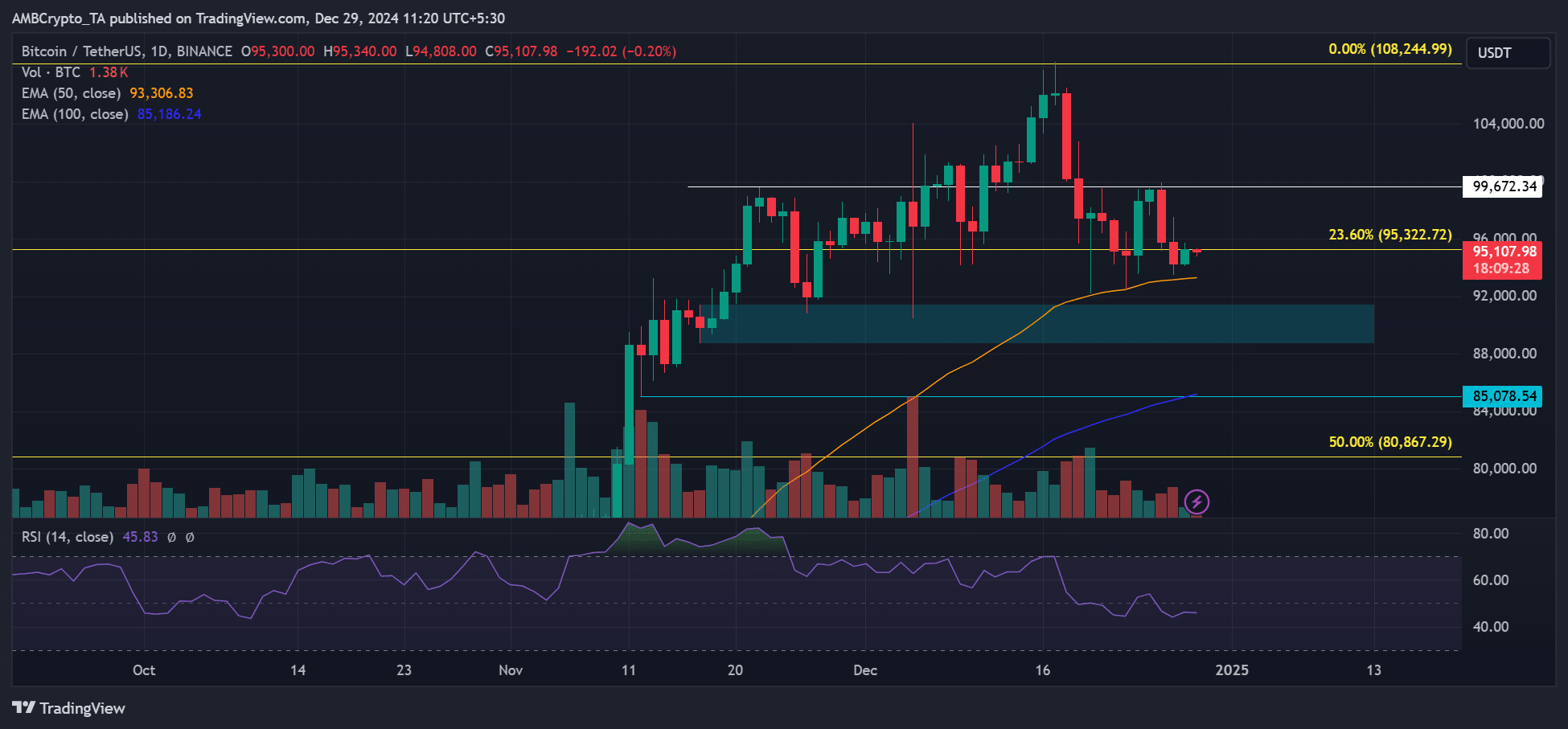

Within the meantime, BTC value remained range-bound throughout the vacation season, consolidating between $100K and the 50-day EMA (Exponential Transferring Common).

Moreover, the every day RSI slipped beneath 50, indicating a short-term weakening in demand.

Learn Bitcoin [BTC] Value Prediction 2025-2026

Ought to bearish stress persist within the brief time period, a drop to $90K or $85K may very well be on the playing cards.

Nonetheless, holding above the dynamic help of a 50-day EMA may improve the chances of retesting $100K or a bullish breakout.