- Bitcoin’s worth has elevated by greater than 10% within the final seven days.

- BTC was testing resistance, and a breakout might begin one other bull rally.

Bitcoin [BTC] stunned buyers final week as its worth rallied by double digits. The pattern sparked pleasure available in the market as expectations of BTC reclaiming $70k elevated.

In truth, if the newest knowledge is to be thought-about, this chance doesn’t appear to be a protracted shot.

Bitcoin to repeat historical past?

CoinMarketCap’s knowledge revealed that BTC’s worth rallied by greater than 10% within the final seven days, permitting it to sit down above $67k.

On the time of writing, the king of cryptos was buying and selling at $67,115.81 with a market capitalization of over $1.32 trillion.

Whereas BTC’s worth motion favored the bulls, Titan of Crypto, a well-liked crypto analyst, lately posted a tweet highlighting an fascinating growth.

As per the tweet, BTC was focusing on the higher line of its realized worth. If this interprets into actuality, then buyers may witness BTC run above $100k within the coming weeks.

The potential of that taking place was probably, as comparable episodes occurred up to now. To be exact, Bitcoin has touched the higher line of its realized worth throughout every cycle up to now.

Issues by way of on-chain metrics additionally regarded fairly optimistic for Bitcoin.

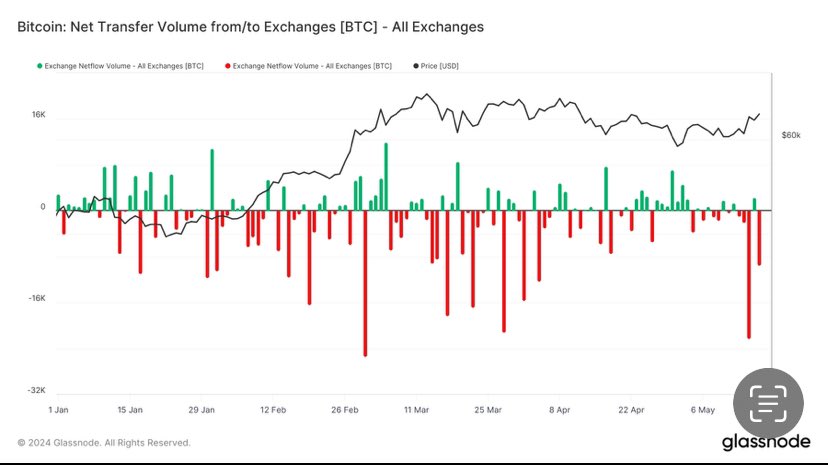

AMBCrypto’s evaluation of CryptoQuant’s knowledge revealed BTC’s internet deposit on exchanges was dropping, hinting at low promoting strain.

Its MPI was inexperienced, which means that miners had been promoting fewer holdings in comparison with its one-year common. Nevertheless, at press time, BTC’s aSORP was crimson, suggesting that extra buyers had been promoting at a revenue.

In the midst of a bull market, it may point out a market high.

What to anticipate within the quick time period?

Other than aSORP, just a few different metrics additionally raised crimson flags. As an example, AMBCrypto’s evaluation of Glassnode’s knowledge revealed that BTC’s accumulation pattern rating had a price of 0.0107.

The buildup pattern rating is an indicator that displays the relative measurement of entities which might be actively accumulating cash on-chain by way of their BTC holdings.

A worth nearer to 0 signifies that buyers are distributing or not accumulating BTC.

Other than this, BTC’s concern and greed index had a price of 72. This meant that the market was in a “greed” section, which regularly leads to worth corrections.

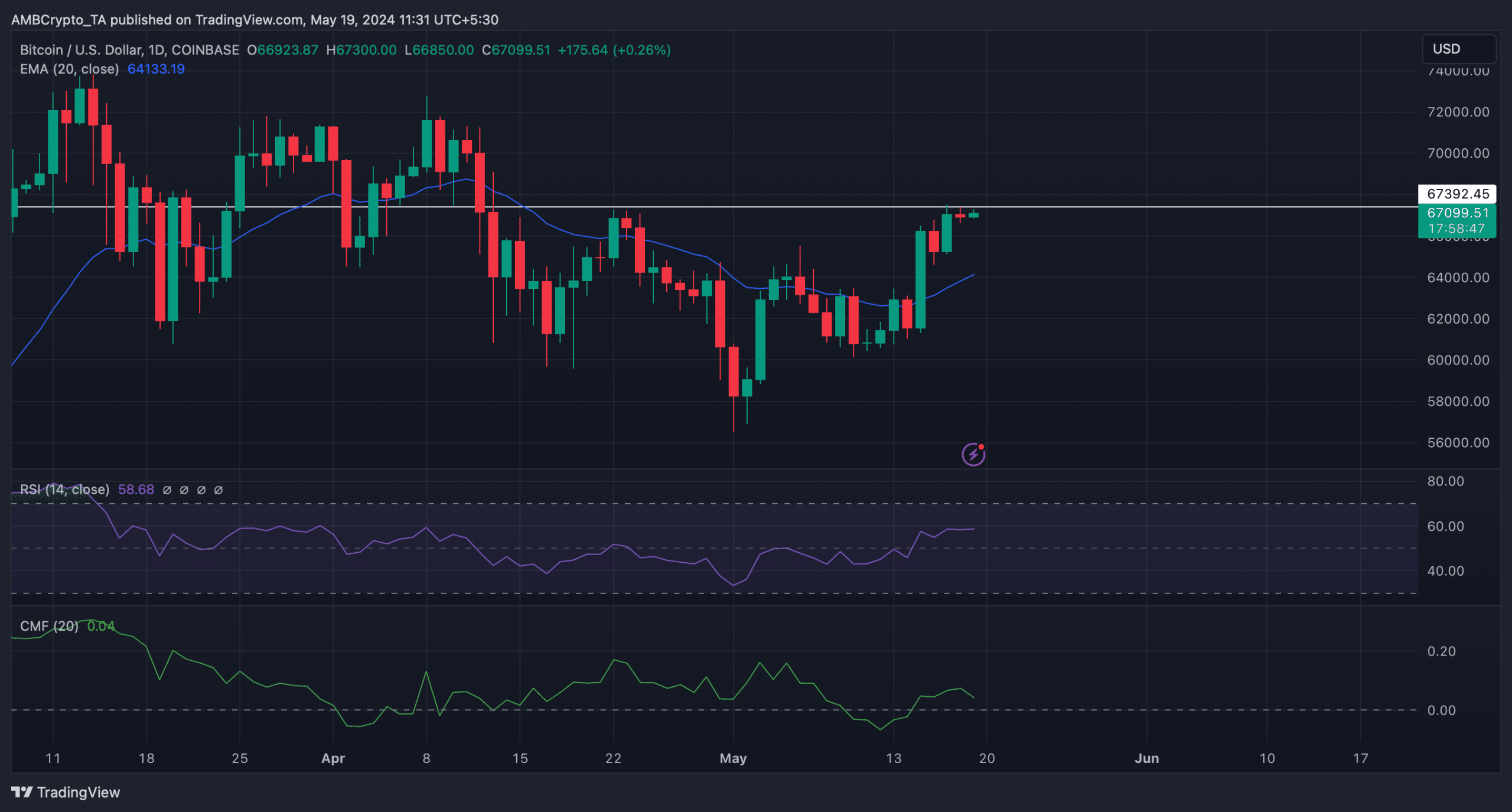

So, AMBCrypto analyzed BTC’s every day chart to see which route it was headed within the short-term. We discovered that BTC was testing its resistance on the $67.3k mark at press time.

Likewise, its worth remained above its 20-day Exponential Transferring Common (EMA).

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Moreover, its Relative Energy Index (RSI) additionally registered an uptick, suggesting that BTC may flip its resistance into its assist. If that occurs, then issues will stay bullish within the close to time period.

Nonetheless, the Chaikin Cash Movement (CMF) went southward, hinting at a worth correction quickly.