Coinspeaker

Bitcoin Consolidates Close to $68K as Whales Trim Publicity

Since October 16, Bitcoin (BTC) has been consolidating close to $68K following an early-week pump pushed by sturdy spot market demand. Nevertheless, some holders seemed to be reserving revenue from the value rally, as famous by spikes in trade influx. The rise in trade influx meant extra BTC was moved into centralized exchanges to be offered. This might clarify the slight dip to $66K seen on Thursday.

Supply: CryptoQuant

Curiously, the slight pullback to $66.6K was additionally marked by whales trimming their lengthy positions. This was illustrated by the slight tapering of the Whale vs Retail Delta on Binance exchanges (inexperienced bars retreating). The metric tracks whale accumulation relative to retail merchants. Its decline is taken into account decreased whale-long positions, a pattern that coincides with BTC worth retracements.

Put otherwise; the current studying confirmed sensible cash on Binance derisked barely, maybe fearing that the plunge may lengthen past $66K.

Supply: Hyblock

Nevertheless, this week’s pump bolstered the bullish ‘Uptober’ outlook after a disappointing begin earlier within the month. The chance-on and bullish sentiment was additionally evident amongst US spot ETF merchandise, which have had a four-day successful streak since 11 October. On Thursday, the merchandise logged $470.48 million internet inflows.

Based on QCP Capital, a Singapore-based crypto buying and selling agency, the sturdy flows may push BTC in direction of its March all-time excessive.

“The strong and growing inflows may be a leading indicator of further rallies as BTC heads back to its all-time high of $73,790,” the agency wrote in its every day replace.

Supply: Soso Worth

The buying and selling agency additionally famous that its buying and selling desk noticed elevated shopping for for long-dated choices, particularly these expiring in March 2025.

“The desk noticed heavy shopping for on long-dated 28 Mar choices throughout US buying and selling hours, with 600 contracts at 120k strike. This signifies that optimistic, long-shot consumers are returning amid this rally,” added QCP Capital.

This meant the choices market merchants had been bullish on BTC worth prospects in This autumn 2024 and Q1 2025. Nevertheless, short-term market uncertainty remained amid incomes season and forward of the US elections.

Given BTC’s constructive correlation to US shares, the earnings season may influence asset worth motion, particularly MicroStrategy’s earnings, set for October thirtieth.

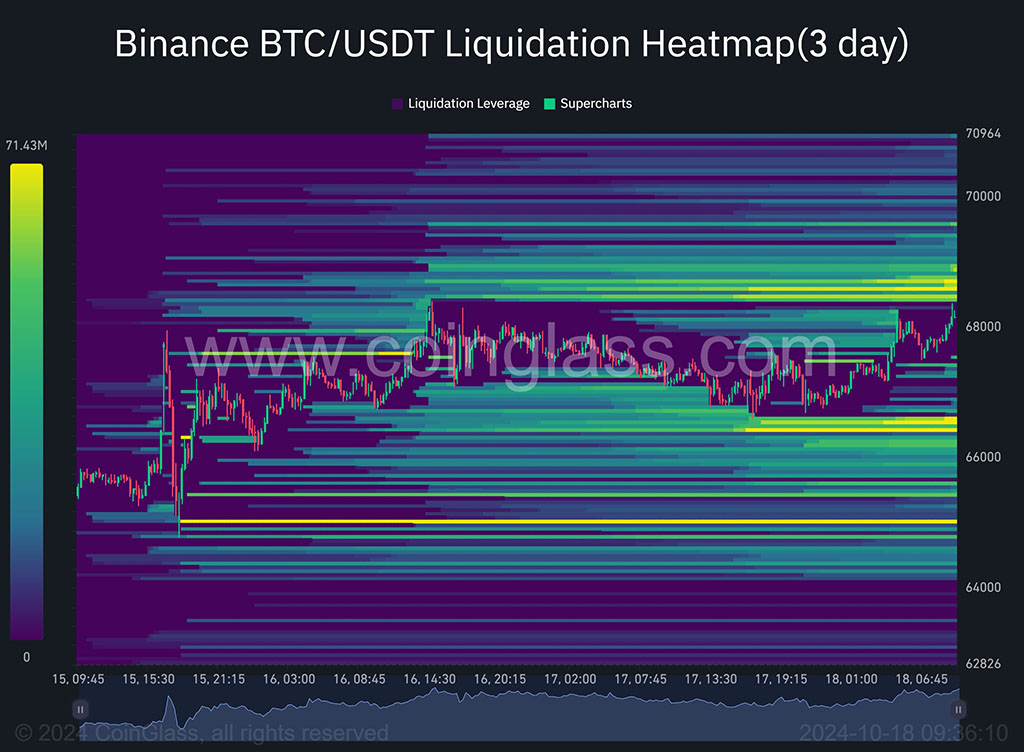

Supply: Coinglass

That mentioned, the liquidation heatmap confirmed appreciable brief positions had been constructing at round $68.6K and lengthy positions at $66.4K. Market makers sometimes use these liquidity clusters (brilliant yellow ranges) to control costs and have a tendency to affect BTC worth path in direction of them. Therefore, they might be key ranges to look at within the brief time period.