- Bitcoin DeFi TVL soared 600% in Q1 2024 and will climb larger in 2025

- Babylon leads with $5.5B of locked BTC as demand for BTC yield will increase

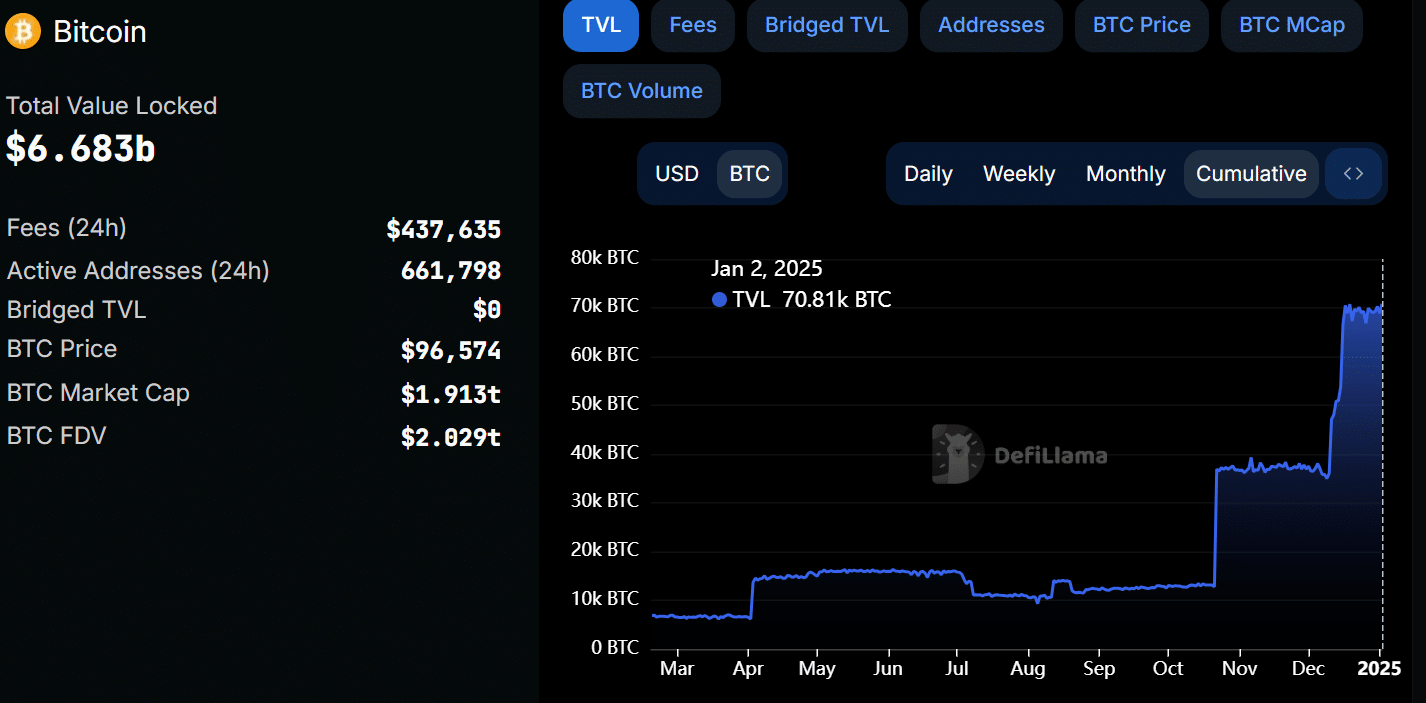

Bitcoin [BTC] DeFi TVL (whole worth locked) soared by practically 600% in Q1 2024, with specialists now projecting extra progress in 2025 forward of key L2 launches. In actual fact, recent DeFiLlama information indicated {that a} file excessive of over 70k BTC (Value $6.68 billion) has been locked throughout its DeFi ecosystem.

Supply: DeFiLlama

This was a pointy hike from about 13k BTC locked as of October, underscoring a vibrant DeFi ecosystem. Therefore, the query – What’s driving the BTC renaissance and what’s subsequent in 2025?

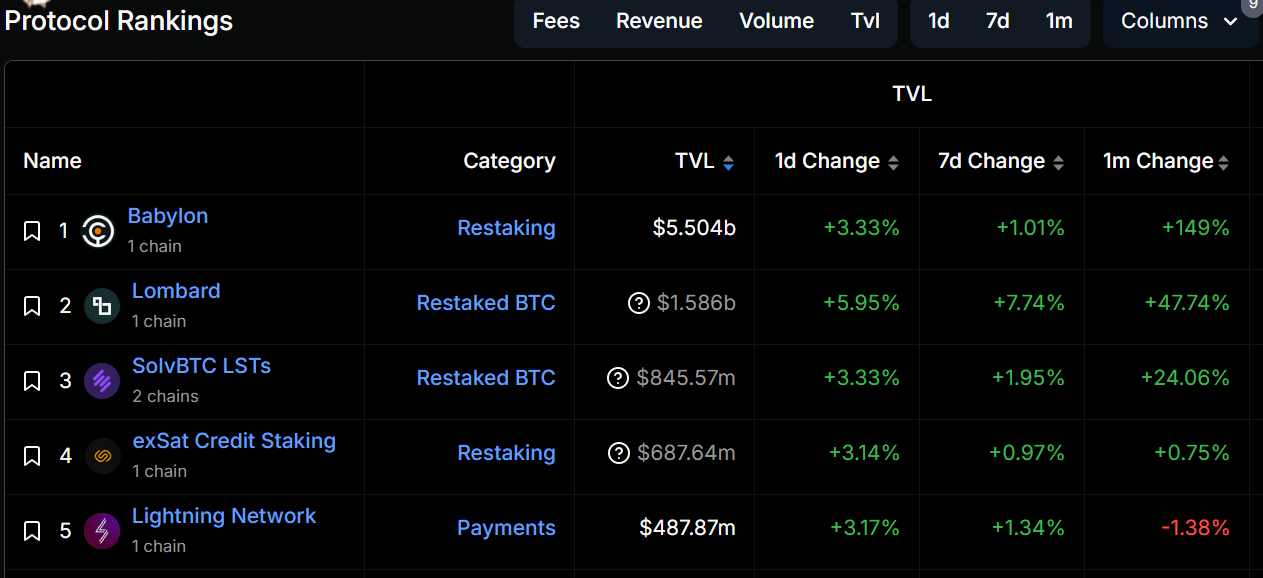

Babylon leads BTC DeFi

From a protocol rating perspective, Babylon, the most recent restaking platform on the community, dominated with over 90% of the BTC DeFi TVL. It had $5.5 billion of TVL, underscoring immense investor belief within the protocol.

In actual fact, Babylon’s TVL soared by practically 150% over the previous month, as buyers rushed to stake their BTC for yield.

Lombard and SolvBTC ranked second and third, respectively, and have been all staking protocols. This illustrates that the favored restaking narrative in Ethereum has unfold to the Bitcoin ecosystem.

Nonetheless, prime executives throughout the DeFi area count on extra progress in 2025.

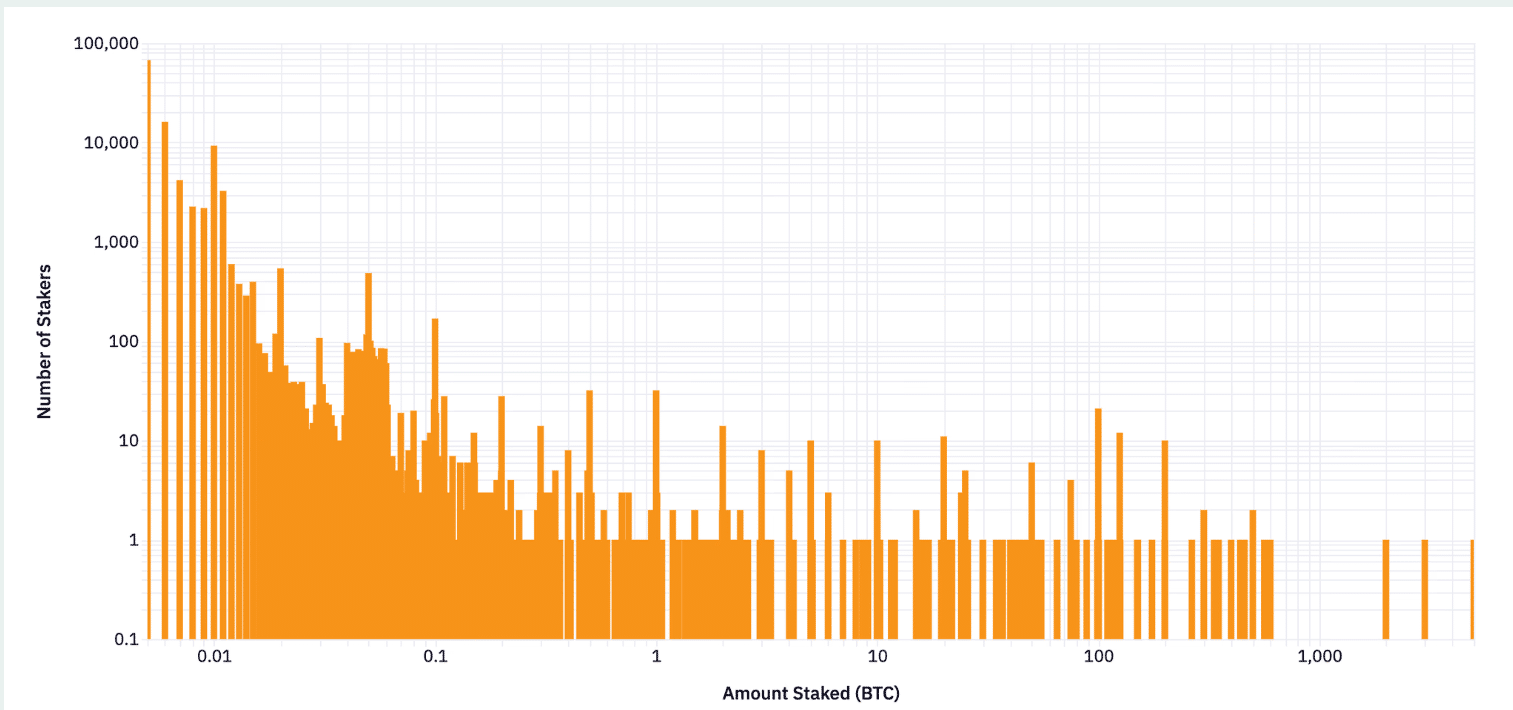

Based on Fisher Yu, CTO of Babylon, the protocol plans to merge BTC and the altcoin universe to take pleasure in the advantages of liquidity and safety by way of the upcoming Babylon L2 launch. He mentioned,

“Our Phase-1 launch signalled that the Bitcoin universe and the mainstream universe is ready to embrace the altcoin universe. They comprise both retailer stakers and institutional stakers. This indicates a potential consensus in entering the altcoin universe.”

In actual fact, extra institutional DeFi lending corporations are gearing as much as provide BTC derivatives as collateral this 12 months.

Sidney Powell, CEO of DeFi lending agency Maple Finance, not too long ago informed the media that BTC might grow to be the ‘premier collateral asset’ for DeFi programs. He mentioned,

“With Bitcoin increasingly incorporated into institutional DeFi lending markets, it is poised to establish itself as a premier collateral asset within decentralized financial ecosystems.”

On the time, Powell cited BTC’s excessive liquidity and low counterparty threat for his projections.

That being mentioned, many scaling options such because the Lightning Community and Stacks have already got deliberate upgrades to drive this BTC DeFi renaissance.