- Germany offered a considerable amount of their seized BTC holdings, inflicting a dip in value.

- The profitability of holders declined whereas variety of long-term holders decreased.

Bitcoin [BTC] slipped beneath the $65,000 degree over the previous few days inflicting a dip in sentiment across the king coin.

What’s Germany as much as?

Germany’s crypto holdings are within the highlight after a current hearth sale. Over the previous two days, the German authorities has shed practically 1,700 Bitcoins, value a cool $110 million, throughout main exchanges like Kraken, Coinbase, and Bitstamp.

Whereas this may appear to be a major transfer, it’s a mere drop within the bucket in comparison with their large $43 billion Bitcoin stash.

This on-chain exercise suggests a deliberate technique of offloading a small portion of their Bitcoin holdings.

It’s value noting that Germany has been accumulating Bitcoin by means of seizures, with a complete of fifty,000 confiscated over the previous few years.

In accordance with CryptoQuant CEO Ki Younger Ju, regardless of this current sale of three,000 BTC, Germany remains to be sitting on a hefty pile of unrealized income.

The current surge in BTC’s value has considerably inflated the worth of Germany’s holdings. Their present stash is estimated to be value a staggering $3.24 billion, with a whopping $1.1 billion of that being unrealized revenue.

This places them firmly within the place of the world’s fourth-largest Bitcoin holder, trailing behind the US, China, and the UK.

Curiously, the US holds a considerably bigger quantity at 213,246 Bitcoins, valued at $13.7 billion. China, regardless of a ban on Bitcoin transactions and a big sell-off in 2019, nonetheless surprisingly holds onto a large stash of 190,000 Bitcoins.

This current German sell-off, coupled with outflows from spot Bitcoin ETFs, is being blamed for the present promoting stress on Bitcoin.

Bitcoin begins to endure

At press time, BTC was buying and selling at $64,562.51 and its value had declined by 1.29% within the final 24 hours.

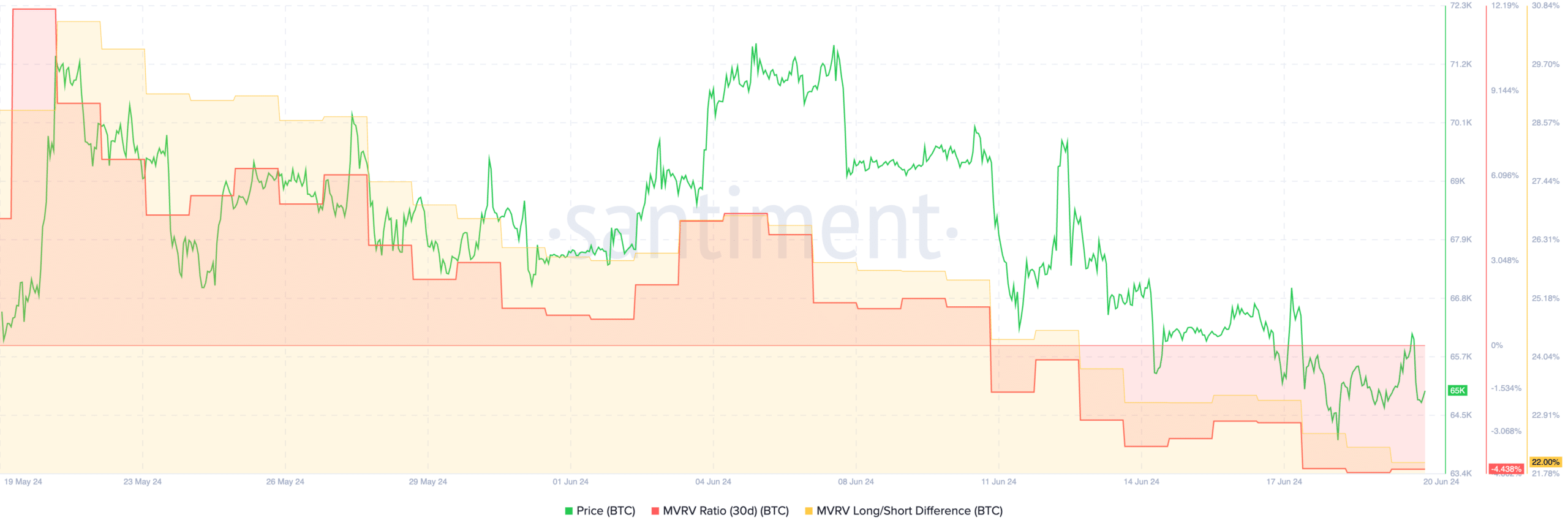

The MVRV ratio for BTC had additionally declined indicating that almost all holders on the time of writing weren’t worthwhile. This might additional impression sentiment round BTC negatively.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Nonetheless, low profitability additionally implies that most maintain must wait earlier than promoting to make a revenue.

Coupled with that, the lengthy/brief distinction round BTC had additionally decreased indicating that the variety of long run addresses holding BTC had declined.