- Bitcoin dominance drops to 60%, falling in need of a $93,000 retest.

- Altcoins like Dogecoin, Ripple, and Bonk acquire traction as Bitcoin stalls.

On fifteenth November, Bitcoin’s [BTC] dominance was on observe to achieve 65%, however a failure to retest the $93,000 mark has shifted the market’s focus.

With Bitcoin’s worth stalling, altcoins – lengthy overshadowed by BTC – are beginning to acquire momentum. The large query now could be whether or not Bitcoin dominance will proceed to say no as altcoins start to rally.

Altcoins rise as Bitcoin dominance falters

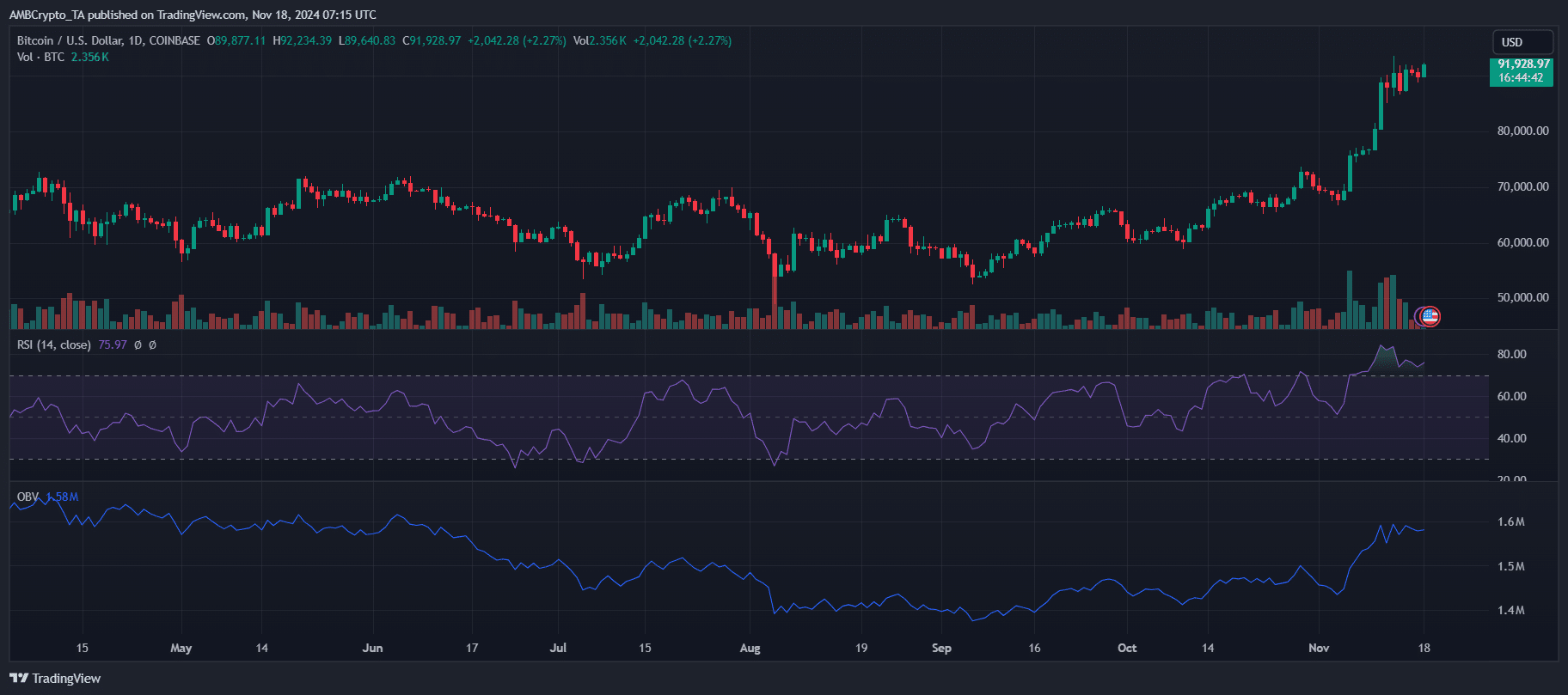

Bitcoin’s dominance has fallen to 60% at press time, casting doubt on bullish predictions of a near-term $100,000 breakout. The RSI of 76 signifies Bitcoin is in an overbought zone, doubtlessly signaling an upcoming correction.

In the meantime, altcoins are gaining traction, as evidenced by an increase within the Altcoin Season Index from 33 to 39, with prime performers like Ripple [XRP], Dogecoin [DOGE] and Bonk [BONK] driving market curiosity.

XRP, DOGE and BONK lead the cost

As Bitcoin’s dominance retreats to 60%, the altcoin market is witnessing a surge in momentum, indicating a possible shift towards an altcoin season.

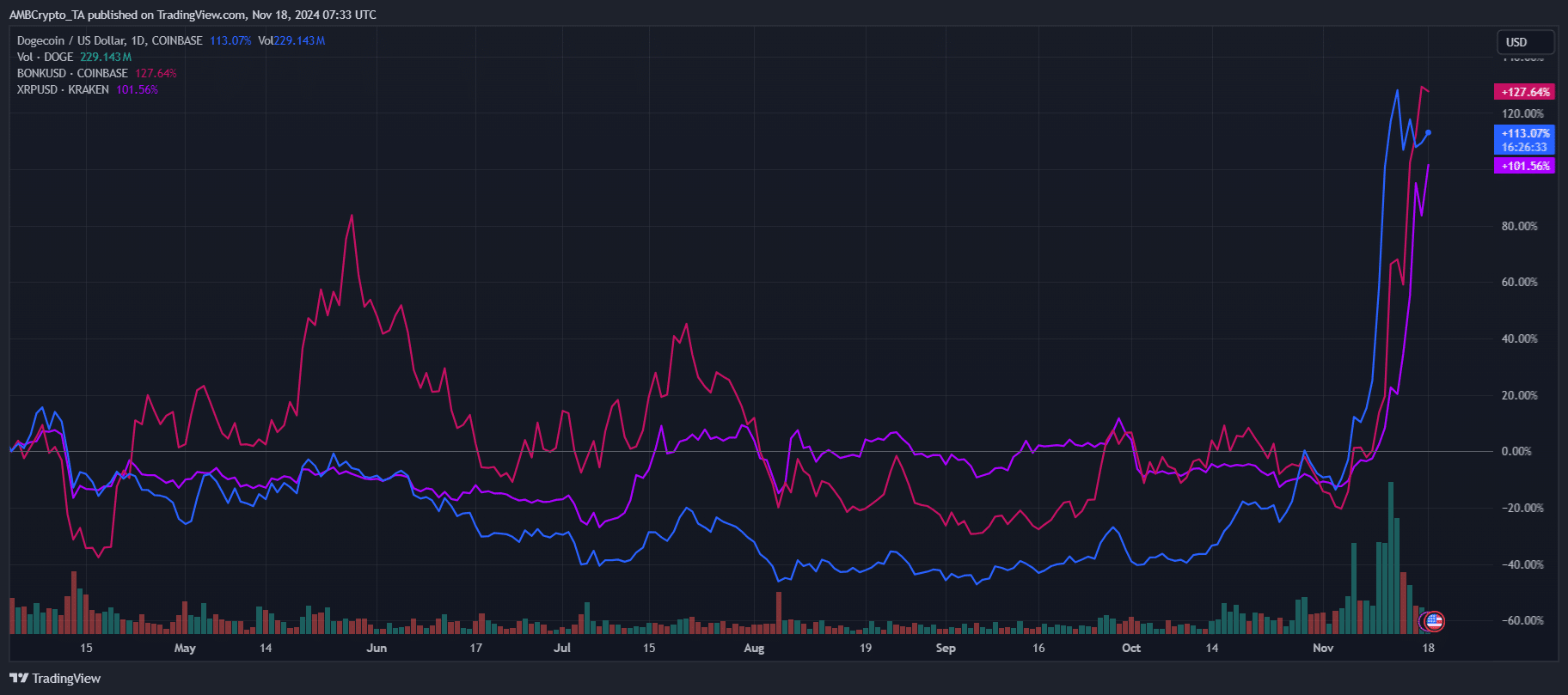

Tokens like Dogecoin, XRP and Bonk have posted important good points, as seen within the comparative efficiency chart.

Dogecoin has climbed over 114.5%, buoyed by elevated buying and selling volumes and renewed neighborhood enthusiasm. Ripple’s 100.6% rally displays its sustained momentum post-legal readability, positioning it as a prime performer within the altcoin house.

In the meantime, Bonk, a rising memecoin, has outpaced each with a 127.3% surge, showcasing the facility of speculative property in driving market curiosity.

This rally throughout widespread memecoins suggests rising confidence in altcoins as Bitcoin faces potential correction dangers.

If this development persists, altcoin lovers may see a full-fledged rally, echoing previous cycles the place Bitcoin corrections triggered a capital rotation into high-performing altcoins.

The position of worry and greed

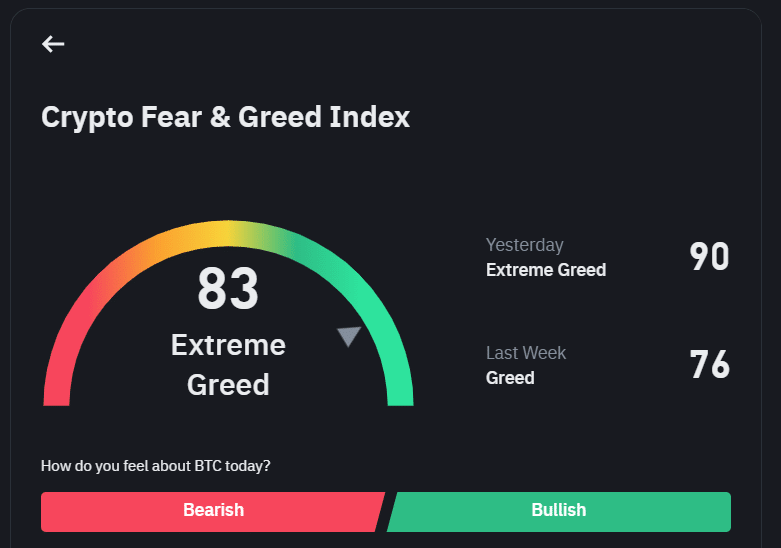

The Crypto Worry & Greed Index, at the moment at 83 (Excessive Greed), displays heightened optimism available in the market. Traditionally, such ranges of utmost greed typically precede corrections, as exuberant sentiment can result in overbought circumstances.

With Bitcoin’s RSI additionally suggesting potential overextension, the convergence of those alerts signifies that the short-term worth motion would possibly lean in direction of a pullback.

On this atmosphere, altcoins may additional profit as merchants rotate capital away from Bitcoin to hunt good points in property exhibiting relative undervaluation.

Learn Bitcoin [BTC] Value Prediction 2024-2025

If Bitcoin struggles to reclaim its dominance, the present market dynamic might gas an early-stage altcoin season, setting the stage for broader diversification in crypto portfolios.

Navigating these market circumstances would require a cautious steadiness of optimism and warning, notably for Bitcoin bulls anticipating a $100,000 breakout.